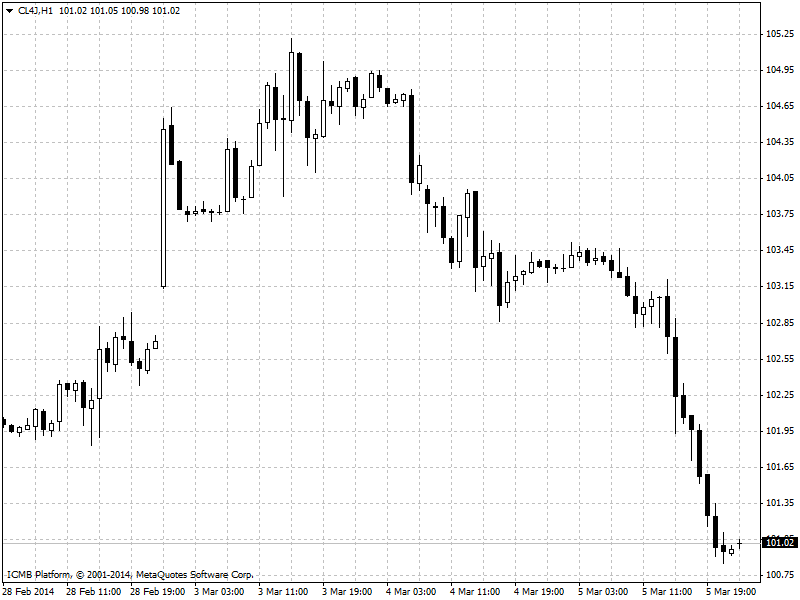

CL

Crude prices fell on Wednesday after weekly supply data missed investor expectations, while waning fears of a Russian invasion into Ukraine that could threaten global supply pressured prices lower as well. The U.S. Energy Information Administration said in its weekly report that U.S. crude oil inventories rose by 1.4 million barrels in the week ended Feb. 28, surpassing expectations for an increase of 1.3 million barrels, which sent prices falling on concerns the country is awash in crude. Total U.S. crude oil inventories stood at 363.8 million barrels as of last week. The report also showed that total motor gasoline inventories decreased by 1.6 million barrels, compared to forecasts for a drop of 1.2 million barrels, while distillate stockpiles increased by 1.4 million barrels, confounding expectations for a withdrawal of 1.2 million barrels. Soft U.S. service-sector data weakened oil prices as well. Meanwhile, the Institute of Supply Management said its services purchasing managers' index fell to a 43-month low of 51.6 last month from 54.0 in January. Analysts had expected the index to tick down to 53.5 in February.

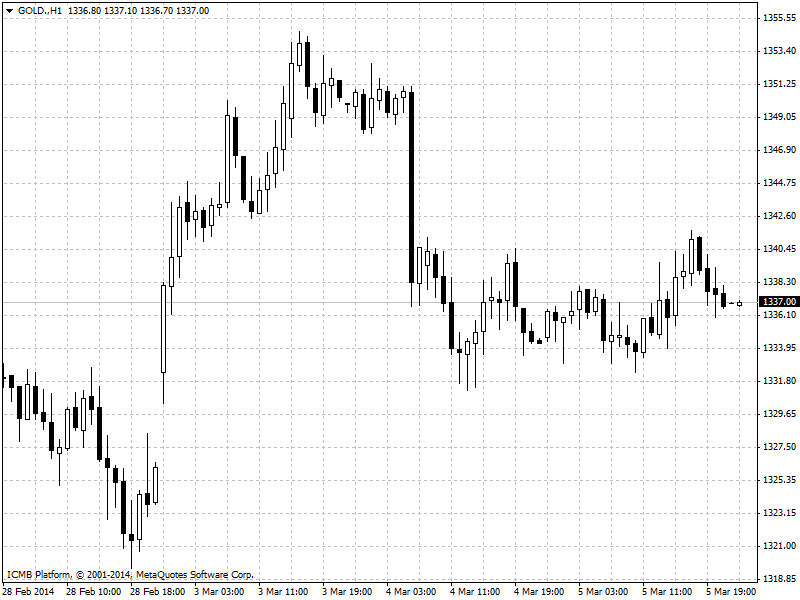

GOLD

Gold prices rose on Wednesday after a widely-watched gauge of the U.S. service sector missed expectations and weakened the dollar, though profit taking sent the yellow metal back into negative territory later in the session. The U.S. dollar weakened after the Institute of Supply Management said its services purchasing managers' index fell to a 43-month low of 51.6 last month from 54.0 in January. Analysts had expected the index to tick down to 53.5 in February. The soft showing sent investors rethinking the pace at which the Federal Reserve will taper its monthly bond-buying stimulus program, which weakens the dollar and bolsters gold's appeal as a hedge by suppressing interest rates. Investors shrugged off payroll processor ADP's nonfarm payrolls report, which revealed that the U.S. private sector added 139,000 jobs in February, below expectations for an increase of 160,000.