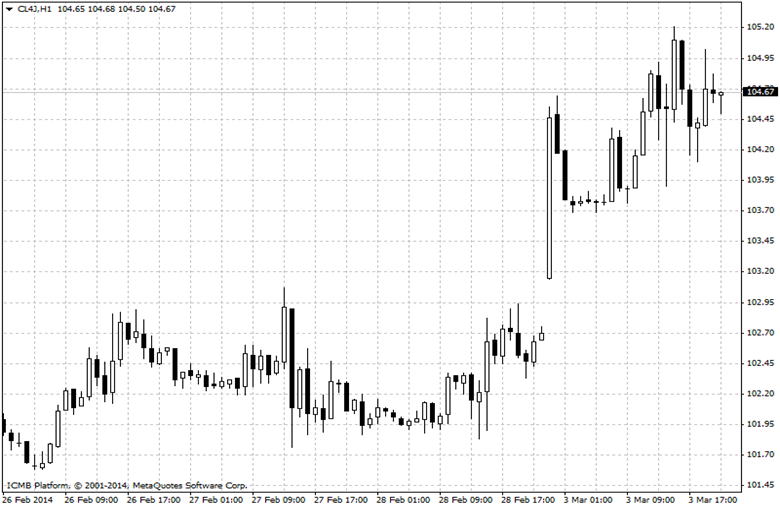

CL

Crude prices shot up on Monday after upbeat U.S. manufacturing and personal-spending reports painted a picture of a U.S. economy that is gaining steam and will demand more fuel and energy going forward. The Commerce Department reported earlier that personal spending rose 0.4% in January, above expectations for an increase of 0.1%. Personal spending for December was revised down to a 0.1% gain from a previously reported increase of 0.4%. The report added that personal income rose 0.3%, beating expectations for a 0.2% increase, after a flat reading in December. Meanwhile, the core PCE price index, which is stripped of food and energy items, inched up by a seasonally adjusted 0.1% in January, in line with expectations, after rising 0.1% in December. The core PCE price index rose at an annualized rate of 1.2%, above forecasts for a 1.1% increase, after rising at a rate of 1.1% in December. Consumer spending is the single biggest source of U.S. economic growth, accounting for as much as two-thirds of economic activity. Oil also saw support after the Institute for Supply Management revealed that its manufacturing purchasing managers’ index rose to 53.2 last month from 51.3 in January, beating forecasts for a reading of 52.0.

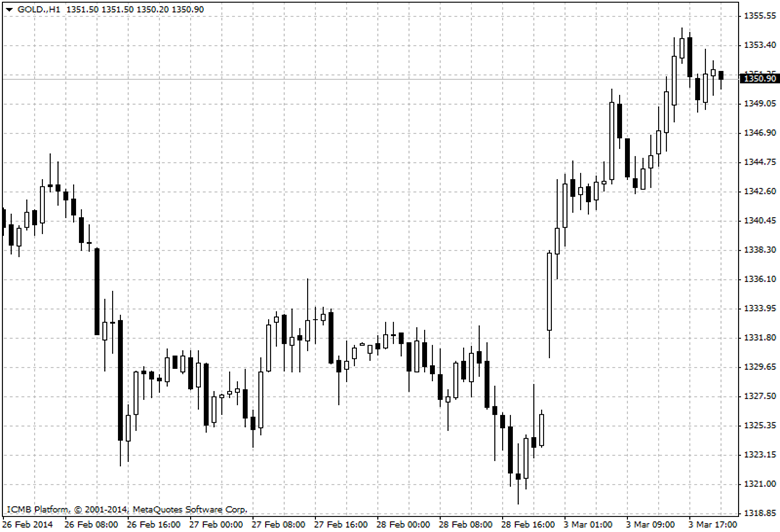

GOLD

Gold prices shot up on Monday amid safe-harbor demand from investors fleeing paper currencies due to the Ukraine crisis. Gold shoots up on safe-haven appeal from Ukraine crisis Russian President Vladimir Putin over the weekend sent troops into the Crimea region. The move sparked fears that the West will impose sanctions on Russia. Russia’s central bank hiked interest rates from 5.5% to 7% on Monday after the rouble fell to record lows against the euro and dollar, and fears of contagion sparked demand for safe-haven gold positions. Gold is often viewed as an attractive hedge to softening paper currencies. Elsewhere, the yellow metal shrugged off strong U.S. data. The Commerce Department reported earlier that personal spending rose 0.4% in January, above expectations for an increase of 0.1%. Personal spending for December was revised down to a 0.1% gain from a previously reported increase of 0.4%. The report added that personal income rose 0.3%, beating expectations for a 0.2% increase, after a flat reading in December. Meanwhile, the core PCE price index inched up by a seasonally adjusted 0.1% in January, in line with expectations, after rising 0.1% in December. The core PCE price index rose at an annualized rate of 1.2%, above forecasts for a 1.1% increase, after rising at a rate of 1.1% in December.