- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

NVR's Q2 Earnings Surpass Expectations, New Orders Increase

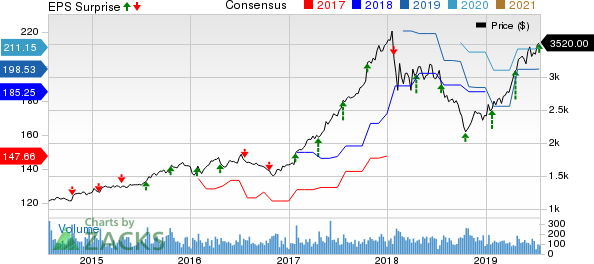

NVR, Inc. (NYSE:NVR) reported second-quarter 2019 results, wherein earnings surpassed the Zacks Consensus Estimate. The stock — which was up by just 0.4% on Jul 19 — has rallied 44.4% year to date compared with the SPDR S&P Homebuilders (NYSE:XHB) ETF XHB and S&P 500’s gain of 29.1% and 17.2%, respectively.

The country’s one of the leading homebuilding and mortgage banking companies reported earnings of $53.09 per share, beating the consensus mark of $45.15 by 17.6%. Also, the reported figure increased 8.2% from the prior-year quarter.

Total revenues (Homebuilding & Mortgage Banking fees combined) were $1.8 billion in the quarter, up 1% year over year on higher deliveries and prices.

Segment Details

Homebuilding: Revenues from the homebuilding segment were almost flat year over year at $1.76 billion. Settlements increased 2% from the year-ago quarter to 4,720 units. Average settlement price was $372.3k, reflecting an increase of 1.9% year over year.

New orders also increased 6% from the prior-year quarter to 5,239 units. Average sales price of new orders during the reported quarter was $358,600, reflecting a 5% year-over-year decline, mainly due to a continued shift to smaller and lower-priced products. A shift to markets with lower average sales prices added to the woes.

Gross margin in the quarter contracted 20 basis points to 18.9%. Also, income before tax dropped 2% from the year-ago quarter. Selling, general and administrative expenses were $112.2 million, up 5.3% from the prior-year quarter.

Backlog (homes sold but not settled) as of Jun 30, 2019 declined 6% from the year-ago period to 9,530 units and 9% (on a dollar basis) to $3.52 billion.

At the end of the reported quarter, average community count was 470, down from the prior-year level of 480 units.

Mortgage Banking: In the reported quarter, Mortgage banking fees rose 16% year over year to $42.7 million. Moreover, mortgage closed loan production totaled $1.23 billion, increasing 1% year over year.

Financials

As of Jun 30, 2019, NVR’s cash and cash equivalents for Homebuilding and Mortgage Banking were $861 million and $21.4 million compared with $688.8 million and $23.1 million, respectively, at 2018-end.

Zacks Rank

Currently, NVR carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Lennar Corporation (NYSE:LEN) reported better-than-expected results in second-quarter fiscal 2019 (ended May 31, 2019), after missing estimates in the preceding quarter. Earnings and revenues increased on a year-over-year basis during the quarter.

KB Home’s (NYSE:KBH) earnings and revenues beat expectations in second-quarter fiscal 2019. However, earnings and revenues decreased 10.5% and 7.2% year over year, respectively, in the quarter.

Upcoming Peer Release

PulteGroup, Inc. (NYSE:PHM) is scheduled to report second-quarter results on Jul 23. The company’s second-quarter earnings are projected at 82 cents, indicating a 7.9% year-over-year decline.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Lennar Corporation (LEN): Free Stock Analysis Report

PulteGroup, Inc. (PHM): Free Stock Analysis Report

NVR, Inc. (NVR): Free Stock Analysis Report

KB Home (KBH): Free Stock Analysis Report

SPDR S&P Homebuilders ETF (XHB): ETF Research Reports

Original post

Zacks Investment Research

Related Articles

Investing in cheap wallet-friendly stocks priced under $10 can offer potential growth without the need for significant capital. As such, I used the 'Under $10/Share' stock...

Genius remains a bull market so far in 2025. All the main sectors in the US equities market are posting year-to-date gains, led by financials and health care, based on a set of...

Worried about the next round of tariffs? Tech disruption from DeepSeek? The geopolitical landscape? All of the above? Fret not my contrarian friend—here are seven...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.