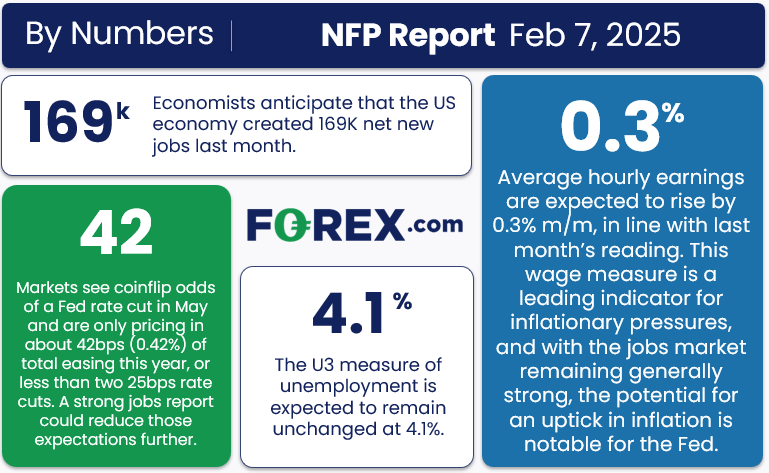

- NFP report expectations: +169K jobs, +0.3% m/m earnings, unemployment at 4.1%

- Leading indicators point to a potentially above-expected reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 175-225K range.

- With the greenback at support and the US economy still outperforming all of its major rivals, the risks are tilted to an upside reaction in the US Dollar Index if the jobs report is at or above expectations.

The January NFP report will be released today at 8:30 ET.

Traders and economists expect the NFP report to show that the US created 169K net new jobs, with average hourly earnings rising 0.3% m/m (3.8% y/y) and the U3 unemployment rate holding steady at 4.1%.

NFP Overview

Perhaps to the chagrin of a Federal Reserve that would prefer to cut interest rates, all else equal, last month’s jobs report handily beat expectations, showing a stellar 256K net new jobs in December vs. only 164K expected with the unemployment rate falling to 4.1%.

Despite last month’s stellar reading on the jobs market, expectations for this month’s report are essentially unchanged from last month with economists expecting 169K net new jobs and the unemployment rate to hold steady at 4.1%.

One key area to watch will be the average hourly earnings measure, which has generally held steady in the 3.9-4.0% range for the past five months; any deviation from that zone could have downstream implications for inflation and Fed policy:

Source: StoneX

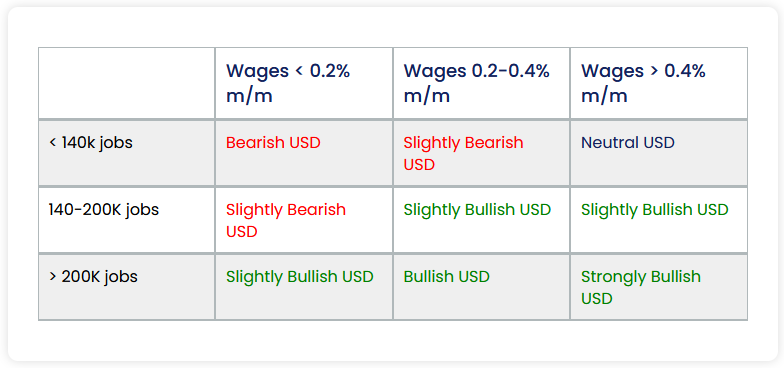

As the lower left box below suggests, traders don’t believe that the Fed will deliver much in the way of additional interest rate cuts this year, with only one 25bps reduction expected in the first half of the year (May/June) and only about a 2-in-3 chance of a second cut in the latter half of 2025.

With a handful of jobs and inflation reports still to come before the proverbial “rubber meets the road” for the US central bank in late Q2, this week’s jobs report may not be as market-moving as other, more immediately impactful releases.

NFP Forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The ISM Manufacturing PMI Employment component rose to 50.3 from 45.4 last month.

- The ISM Services PMI Employment component ticked up to 52.3 from 51.3 last month.

- The ADP Employment report showed 183K net new jobs, in-line with last month’s upwardly revised 176K reading.

- Finally, the 4-week moving average of initial unemployment claims rose to 217K from 213K last month, remaining near historical lows.

Weighing the data and our internal models, the leading indicators point to a potentially above-expected reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 175-225K range, albeit with a big band of uncertainty given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which came in at 0.4% m/m in the most recent NFP report.

Potential NFP Market Reaction

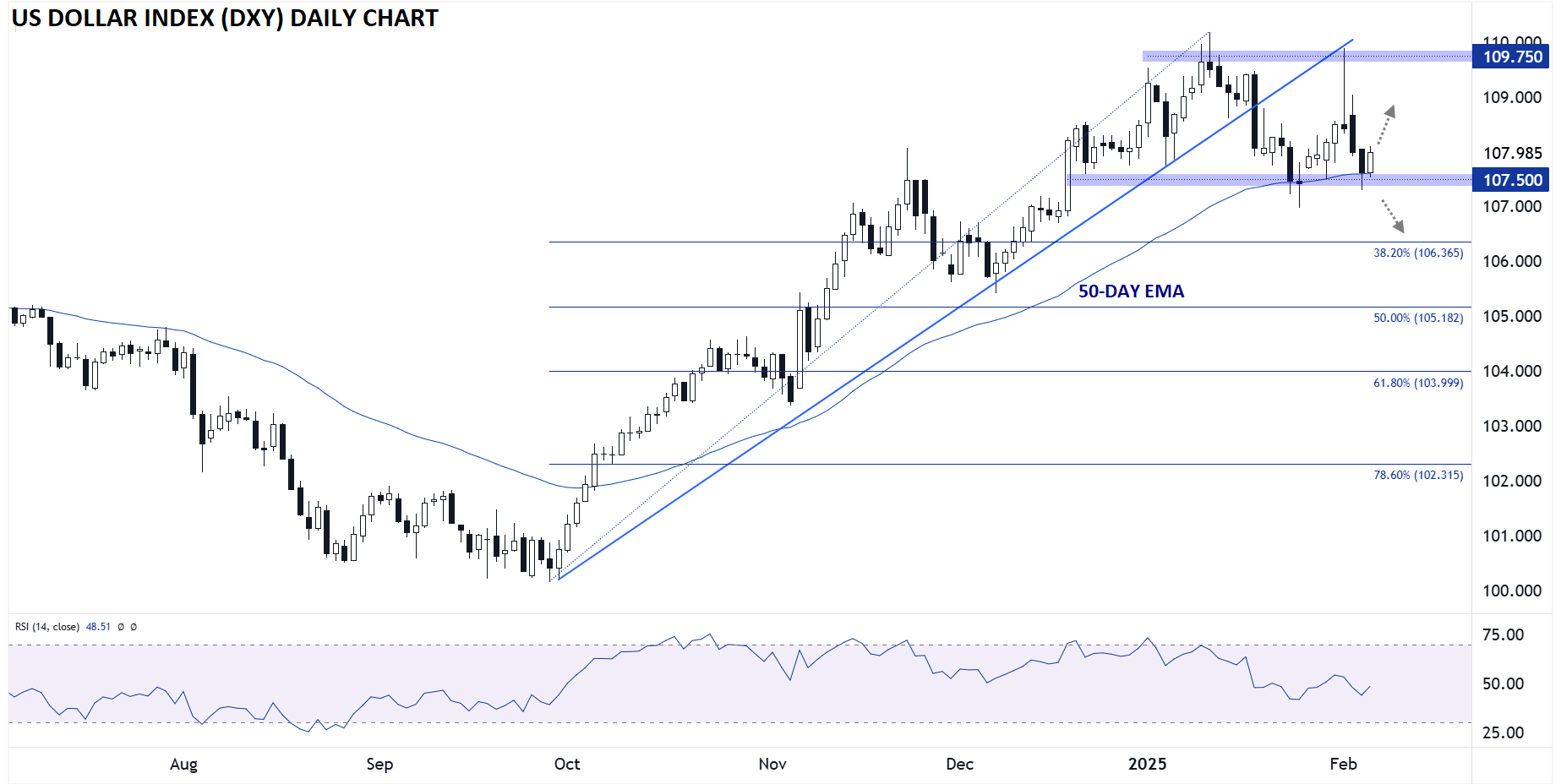

As we outline below, the US dollar has fallen to test support at a 7-week low near 107.50, potentially skewing the odds slightly in favor of a bullish reaction if the jobs report is decent.

US Dollar Technical Analysis – DXY Daily Chart

Source: TradingView, StoneX

The US Dollar Index (DXY) has had a volatile month, but as of writing, is sitting just above horizontal support near its 7-week lows around 107.50, as well as the 50-day EMA in the 107.60 area. With the greenback at support and the US economy still outperforming all of its major rivals, the risks are tilted to an upside reaction in the US Dollar Index if the jobs report is at or above expectations.

To the topside, there’s little in the way of intra-range resistance until the highs closer to 109.75. Meanwhile, a particularly weak jobs report could set the stage for more aggressive Fed rate cuts this year; in that scenario, a confirmed break below 107.50 would open the door for more weakness toward the 38.2% Fibonacci retracement near 106.40 next.