Newmont Corporation (NYSE:) announced that it received aggregate net proceeds of around $985 million, after deducting underwriting discounts (before expenses), post closure of its registered public offering of $1 billion aggregate principal amount of 2.250% senior notes due 2030.

Per management, the company plans to use the low-cost capital raised to partly refinance outstanding notes slated to mature in 2022 and 2023, lowering its effective interest rate and extending its maturity profile.

The notes are treated as senior unsecured obligations of Newmont, and rank equally with its current and future unsecured senior debt. Further, the notes are senior to the future subordinated debt of the company. Notably, the notes are guaranteed by the company’s subsidiary, Newmont USA Limited, on a senior unsecured basis.

Newmont plans to use the net proceeds from the senior notes offering along with cash from its balance sheet (as required) for the repurchase of its outstanding 3.500% senior notes slated to mature in 2022 and outstanding 3.700% senior notes slated to mature in 2023.

It also involves the repurchase of Goldcorp Inc.’s (Newmont’s fully-owned subsidiary) outstanding 3.700% senior notes (slated to mature in 2023) for up to certain aggregate maximum principal tender amounts set out in the relevant purchase offer accepted for purchase. Moreover, it involves the payment of all unpaid and accrued interest thereon as well as any remaining part for working capital and other general corporate purposes.

BMO Capital Markets Corp., Goldman Sachs & Co (NYSE:). LLC and J.P. Morgan Securities LLC served as the joint book-running managers for the senior notes offering.

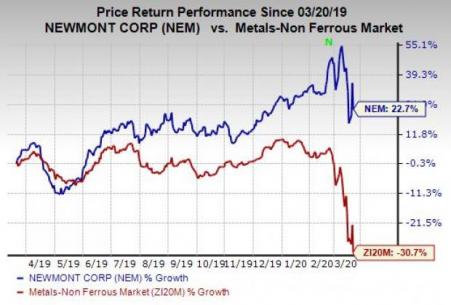

Newmont’s shares have gained 22.7% in the past year against the

industry’s decline of 30.7%.

On the fourth-quarter earnings call, the company expected attributable gold production of 6.4 million ounces for 2020. For the year, the all-in sustaining cost for gold is projected at $975 per ounce and the cost applicable to sales expectation for gold was pegged at $750 per ounce.

Newmont Goldcorp Corporation Price and Consensus

Zacks Rank & Other Stocks to Consider

The company currently carries a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the basic materials space are Franco-Nevada Corporation (TSX:) , Barrick Gold Corporation (NYSE:) and NovaGold Resources Inc. (NYSE:) .

Barrick Gold currently has a Zacks Rank #2 (Buy) and a projected earnings growth rate of 43.1% for 2020. The company’s shares have rallied 21% in a year.

NovaGold has a projected earnings growth rate of 11.1% for 2020. It currently carries a Zacks Rank #2. The company’s shares have gained 86% in a year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

Newmont Goldcorp Corporation (NEM): Free Stock Analysis ReportFranco-Nevada Corporation (FNV): Free Stock Analysis ReportBarrick Gold Corporation (GOLD): Free Stock Analysis ReportNovagold Resources Inc. (NG): Free Stock Analysis ReportOriginal postZacks Investment Research

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.