- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Navient Corporation (NAVI) Jumps: Stock Rises 8%

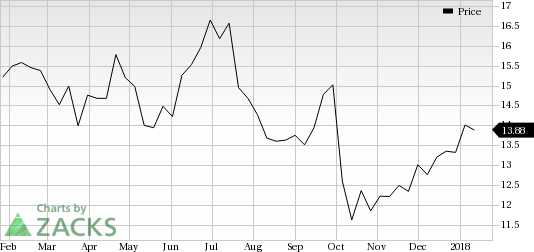

Navient Corporation (NASDAQ:NAVI) was a big mover last session, as the company saw its shares rise 8% on the day. The move came on solid volume too with far more shares changing hands than in a normal session. This stock, which remained volatile and traded within the range of $13.21–$14.51 in the past one-month time frame, witnessed a sharp increase yesterday.

The move came after the company reported its fourth quarter 2017 results.

The company has seen one positive estimate revision in the past few weeks, while its Zacks Consensus Estimate for the current quarter has also moved higher over the past few weeks, suggesting that more solid trading could be ahead for Navient. So make sure to keep an eye on this stock going forward to see if this recent jump can turn into more strength down the road.

Navient currently has a Zacks Rank #2 (Buy) while its Earnings ESP is 0.00%.

Navient Corporation Price

A better-ranked stock in the Finance sector is Credit Acceptance Corporation (NASDAQ:CACC) , which currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Is NAVI going up? Or down? Predict to see what others think: Up or Down.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Credit Acceptance Corporation (CACC): Free Stock Analysis Report

Navient Corporation (NAVI): Free Stock Analysis Report

Original post

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.