- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

MongoDB (MDB) Q4 Earnings Miss, Coronavirus To Hurt Top Line

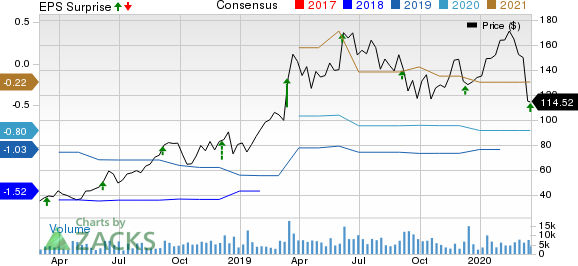

MongoDB (NASDAQ:MDB) incurred fourth-quarter fiscal 2020 adjusted loss of 25 cents per share, wider than the Zacks Consensus Estimate by 10.7% as well as the year-ago loss of 17 cents.

Revenues of $123.5 million surged 44.5% year over year and also comfortably surpassed the consensus mark of $110 million.

MongoDB added 1,100 customers sequentially to reach 17K at the end of fourth-quarter fiscal 2020.

The company’s Atlas revenues soared 80% year over year, accounting for 41% of the company’s top line. Atlas had more than 15,400 customers at the end of the reported quarter compared with more than 14,200 at the end of third-quarter fiscal 2020.

Quarterly Details

Year-over-year growth in revenues was driven by a 46.2% jump in subscription revenues (95.4% of revenues) that totaled $117.8 million. Moreover, services revenues (4.6% of revenues) increased 16.9% year over year to $5.7 million.

Net AR expansion rate remained above 120%. The company had 751 customers in the quarter with at least $100,000 in ARR and annualized MRR, up from 557 reported in the year-ago quarter.

During the reported quarter, the company launched the MongoDB Modernization Toolkit in partnership with Informatica and Hitachi Vantara Pentaho to enable enterprises’ smooth shift from legacy databases like Oracle (NYSE:ORCL).

In the reported quarter, gross margin expanded 250 basis points (bps) to 73.8%. Year-over-year growth benefited from revenues related to one large multiyear Enterprise Advanced deal with a Fortune 50 customer.

While research and development (R&D) expenses climbed 43.7% to $29.1 million, sales and marketing (S&M) expenses ascended 50.7% to $57.6 million. Moreover, general and administrative (G&A) expenses augmented 35.9% to $16.6 million.

Moreover, as percentage of revenues, S&M increased 190 bps on a year-over-year basis to 46.6%. However, as percentage of revenues, R&D expenses decreased 10 bps to 23.6%. G&A expenses declined 80 bps to 13.4%.

Loss from operations widened to $12 million from the year-ago loss of $9.7 million.

Balance Sheet & Cash Flow

As of Jan 31, 2020, MongoDB had $987 million in cash, cash equivalents and short-term investments compared with $426.4 million as of Oct 31, 2019.

In the reported quarter, the company used $8.6 million of cash on operations and $1.2 million on capital expenditures. Free cash outflow was $10.9 million.

Other Developments

MongoDB announced that co-founder Eliot Horowitz has decided to step down as CTO and as a director of the company effective July 10, 2020.

Guidance

For first-quarter fiscal 2021, MongoDB expects revenues between $119 million and $121 million. Higher percentage of Atlas in revenue mix is expected to erode gross margin, at least in the near term.

Coronavirus or COVID 19 outbreak is expected to affect first-quarter revenues by $1-$2 million.

Non-GAAP loss from operations is anticipated to be $12-$14 million. Non-GAAP net loss is predicted between 22 cents and 25 cents per share.

For fiscal 2021, MongoDB expects revenues between $510 million and $530 million. Coronavirus outbreak is expected to adversely impact full-fiscal revenues by $15-$25 million due to anticipated weaker bookings in the first half.

Non-GAAP loss from operations is expected to be $68-$78 million. Non-GAAP net loss is expected between $1.23 and $1.40 per share.

Zacks Rank & Stocks to Consider

Currently, MongoDB carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector are Microsoft (NASDAQ:MSFT) , Intel (NASDAQ:INTC) and Garmin (NASDAQ:GRMN) , all three sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Microsoft, Intel and Garmin is currently pegged at 13.2%, 7.5% and 7.4% each.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Microsoft Corporation (MSFT): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

MongoDB, Inc. (MDB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.