- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Modest Market Movements Due To Independence Day Holiday In US

- With US markets closed for Independence Day yesterday there have been only modest market movements since market close in Europe. The sentiment in the stock market is moderately negative ahead of today’s ECB meeting and the important labour market report in the US tomorrow. Asian stock markets are slightly lower this morning with Nikkei and Hang Seng both down 0.3%.

- The FX market has been largely range trading since market close in Europe yesterday. Both EUR/USD and USD/JPY are this morning trading largely unchanged at 1.253 and 79.81 respectively. In the commodity market Brent crude oil is also trading largely unchanged, slightly below USD 100 after the recent surge.

- There has been no major market-moving news overnight. According to a press report in today’s Wall Street Journal it will be very difficult to create a common euro bank supervisor by the end of the year as targeted by the EU-leaders at the summit last week, see Wall Street Journal.

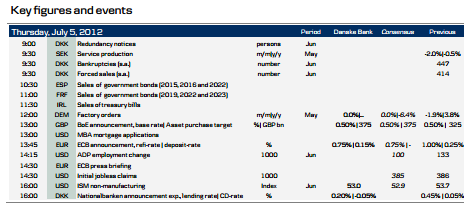

- The main event today is the ECB-meeting, where we expect ECB to cut the refi rate by 25bp to 0.75%, see ECB preview: Time for ECB to deliver rate cut, 3 July. We also expect it to lower the deposit rate by 10bp to 0.15% but here there is a broad range of possible outcomes, which could leave the deposit rate anywhere between unchanged and a 25bp cut. We do not expect ECB to announce non-standard easing measures in connection with today’s meeting, albeit another long LTRO is still possible in the coming months. In line with the consensus view we expect Bank of England (BoE) to keep the base rate unchanged at 0.5% but to expand the target for its asset purchases by GBP50bn to GBP375bn in connection with today’s BoE meeting. However, in BoE there has been some frustration about the effectiveness of its asset purchases, so new non-standard easing measures cannot be ruled out.

- In the data calendar focus will mainly be on the ADP report in the US that will give us an early indication of tomorrow’s very important nonfarm payrolls. In the US ISM non-manufacturing will also be released today. In Europe both Spain and France will attempt to tap the bond market. Ireland will today sell Treasury bills in its first attempt to tap the market since September 2010.

In Denmark the central bank’s certificate of deposit rate (CD rate) could end up in negative territory if the ECB cuts its deposit rate today, see DKK strategy: Central Bank Preview. After recent independent interest rate cuts to stem the FX inflow the CD rate is only 0.05%. With continued FX inflow there will be pressure on the Danish central bank to maintain the spread to the eurozone and for that reason we expect the CD rate to be cut by 10bp to -0.05% if the ECB cuts the deposit rate by 10bp. However, a 5bp cut in the CD rate or even unchanged CD rate cannot be ruled out. If ECB cuts the deposit rate by 25bp the CD rate could be cut by more than 10bp.

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank")

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research analyst’s personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation by the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of the Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. Employees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over-all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate finance or debt capital transactions.

Financial models and/or methodology used in this research report

Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis of relevant assumptions, are stated throughout the text.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors”.

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.

Related Articles

At age 94, Warren Buffett can still formulate a shareholder letter like no other. His humility, candor, and wisdom is special. I always make it a point to read these because you...

The EU’s most costly budgets, bitcoin’s market swings, and rising US bankruptcies. Each week, the Syz investment team takes you through the last seven days in seven charts. 1. The...

The central bank’s job is never easier, but in the current climate, it’s unusually tricky. In addition to the usual challenges that complicate real-time monetary policy decisions,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.