Microsoft Corp. (NASDAQ:MSFT) recently launched its long awaited employee performance analysis software called Workplace Analytics. The solution will be currently available as an add-on for any Office 365 enterprise plan.

The software analyses data gathered by Microsoft Graph, which collects data about employees by using their online tools. Workplace Analytics aims at providing behavioral patterns that help to improve employee productivity and effectiveness.

The analytical tool can be used to improve sales productivity, managerial effectiveness and build a data-based enterprise, which will ultimately lead to the betterment of an organization. It will give a clear idea about how the employees work and what they spend their time on.

Growth of the Office 365 Segment

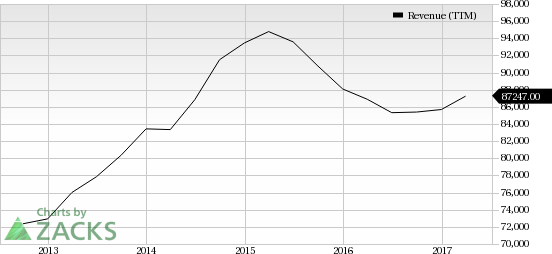

We believe that this new addition to the Office 365 will eventually add to Microsoft’s customer base, thereby boosting top-line growth. Notably, the company has outperformed the S&P 500 on a year-to-date basis. While the index gained 9%, the stock returned 11.6% over the same time frame.

In the last reported third-quarter 2017 results, the company announced that it has been winning new customers like H&R Block (NYSE:HRB) , Johnson & Johnson (NYSE:JNJ) based on improved features of Office 365. Its consumer subscriptions were 26.2 million, up from 24.9 million in the previous quarter. The company is working on increasing the appeal of Office 365 to a diverse customer base.

Office 365 crossed a major milestone with more than 100 million monthly active users in the past quarter. The revenue contribution increased 35% from the year-ago quarter, mainly attributed to growth in subscription rate.

Microsoft recently announced that it will add certain features in Outlook, which is one of the solutions of Office 365. The company will introduce the option to add and edit contacts from Outlook on Apple’s (NASDAQ:AAPL) iOS platform.

We note that the with the introduction of features and solutions to Office 365 coupled with the large scale adoption of the products, Microsoft is well poised to enjoy steady growth in the segment going forward.

Zacks Rank

Currently, Microsoft has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Johnson & Johnson (JNJ): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

H&R Block, Inc. (HRB): Free Stock Analysis Report

Original post

Zacks Investment Research