- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Micron (MU) Tests LPDDR5-Set UMCP Product For 5G Handsets

Micron Technology (NASDAQ:MU) recently started testing its universal flash storage multichip package (uMCP) DRAM with low-power DDR5 (LPDDR5) for 5G smartphones.

The company’s uMCPs could reduce chip space in a smartphone by 40%, by combining low-power DRAM with NAND and an onboard controller. The flash storage would also save power and reduce memory footprint, thereby enabling mobile phone manufacturers to design smaller smartphones.

The latest uMCP LPDRAM packaging solution’s ability to increase memory and storage density by 50% at minimal power consumption makes it suitable for slim, midrange smartphone designs. It leverages 1y nm DRAM process technology and 512Gb 96L 3D NAND die.

Notably, 5G networks are expected to start rolling out globally this year. Micron’s next-generation LPDDR5 memory caters to the need of 5G networks for higher memory performance and lowers energy consumption. The LPDRAM enables data up to 6.4Gbps to be processed efficiently by 5G smartphones.

Recovery in DRAM Demand Drives Micron

Micron is benefiting from a resurgence in DRAM demand, backed by progress in customer inventory adjustments in the cloud, graphics and PC markets. Adoption of 5G smartphones, which require more memory, is likely to be a key driver in this regard.

Notably, the company’s first-quarter fiscal 2020 results gained from a recovery in demand in the memory market.

Cowen analyst, Kerl Ackerman, recently noted that aided by a modest server upgrade cycle and the 5G smartphone uptake, the DRAM market is likely to rebound in the second half of 2020. Notably, 5G is driving more than 50% content growth in premium-tier handsets. Further, given these positives, both DRAM demand and ASP are expected to witness an upswing.

Micron believes that rapid 5G adoption, the advent of foldable phones and upcoming innovation in AR/VR will shore up sustained content growth and augment smartphone unit sales this year.

Per IDC, 5G smartphone shipments will surge to more than 100 million units by the end of this year, fueled by deployments of 5G networks and reduction in premium prices of handsets. The firm also mentioned that 5G handsets could contribute 10% to global volumes in 2021.

Further, 5G adoption beyond mobile is likely to foster demand for memory and storage, particularly in IoT devices, wireless infrastructure and data centers.

Zacks Rank & Other Key Picks

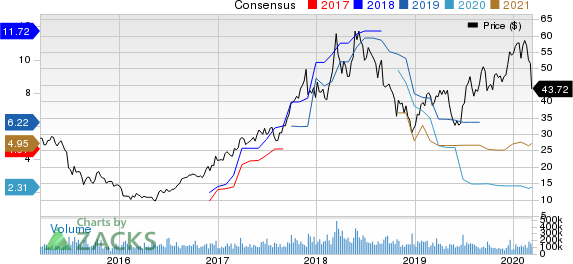

Micron currently carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader technology sector are HP Inc. (NYSE:HPQ) , Cirrus Logic, Inc. (NASDAQ:CRUS) and Mellanox Technologies, Ltd. (NASDAQ:MLNX) , each sporting a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for HP, Cirrus and Mellanox is currently pegged at 2%, 15.27% and 18.25%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

HP Inc. (HPQ): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Mellanox Technologies, Ltd. (MLNX): Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS): Free Stock Analysis Report

Original post

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Pretty rough day out there—S&P 500 down about 1.8%, Nasdaq down around 2.2%, and small caps hit even harder, dropping 2.7%. However, the S&P 500 is approaching a crucial...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.