- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Gold And Silver Are On The Rise

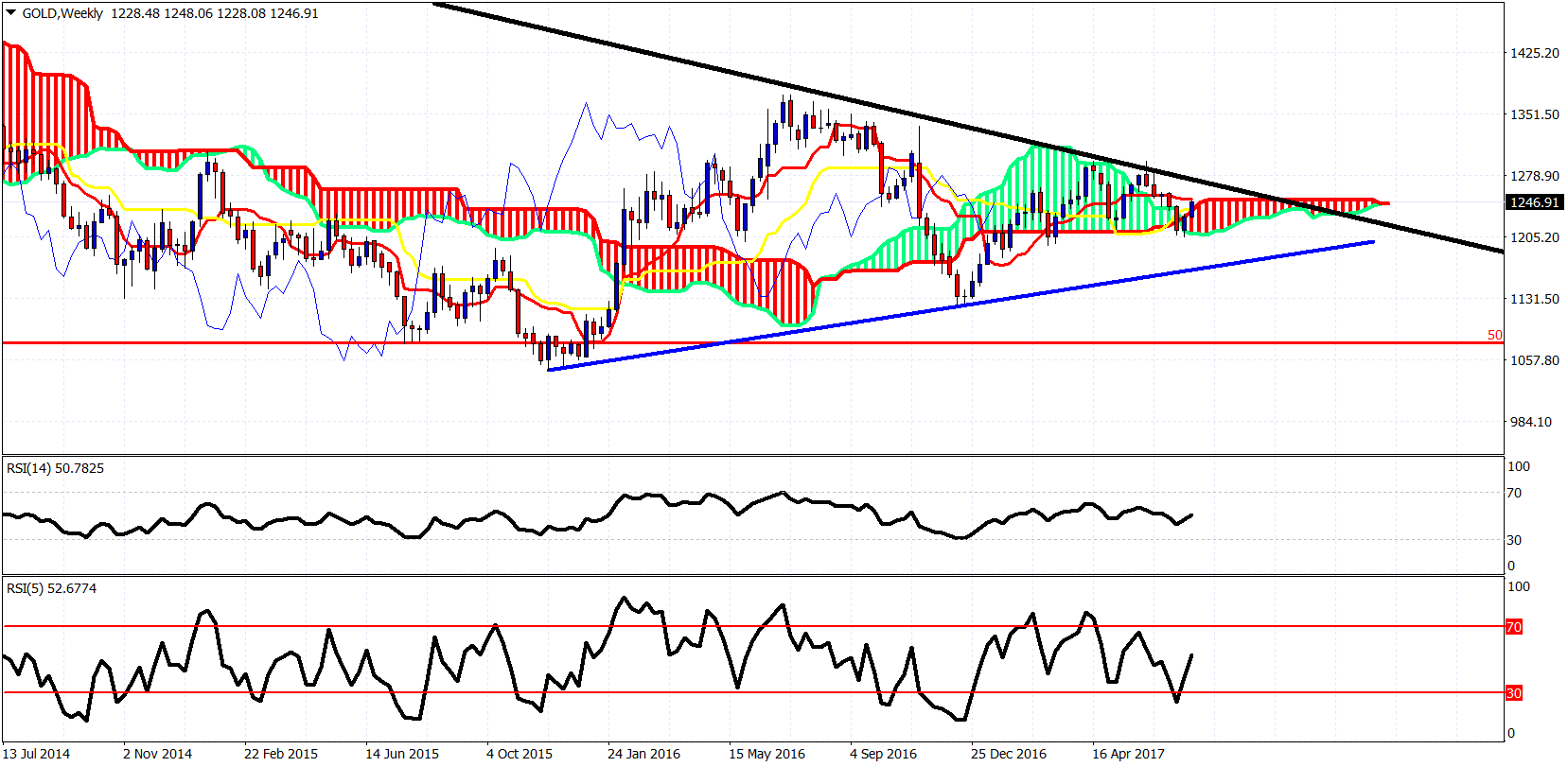

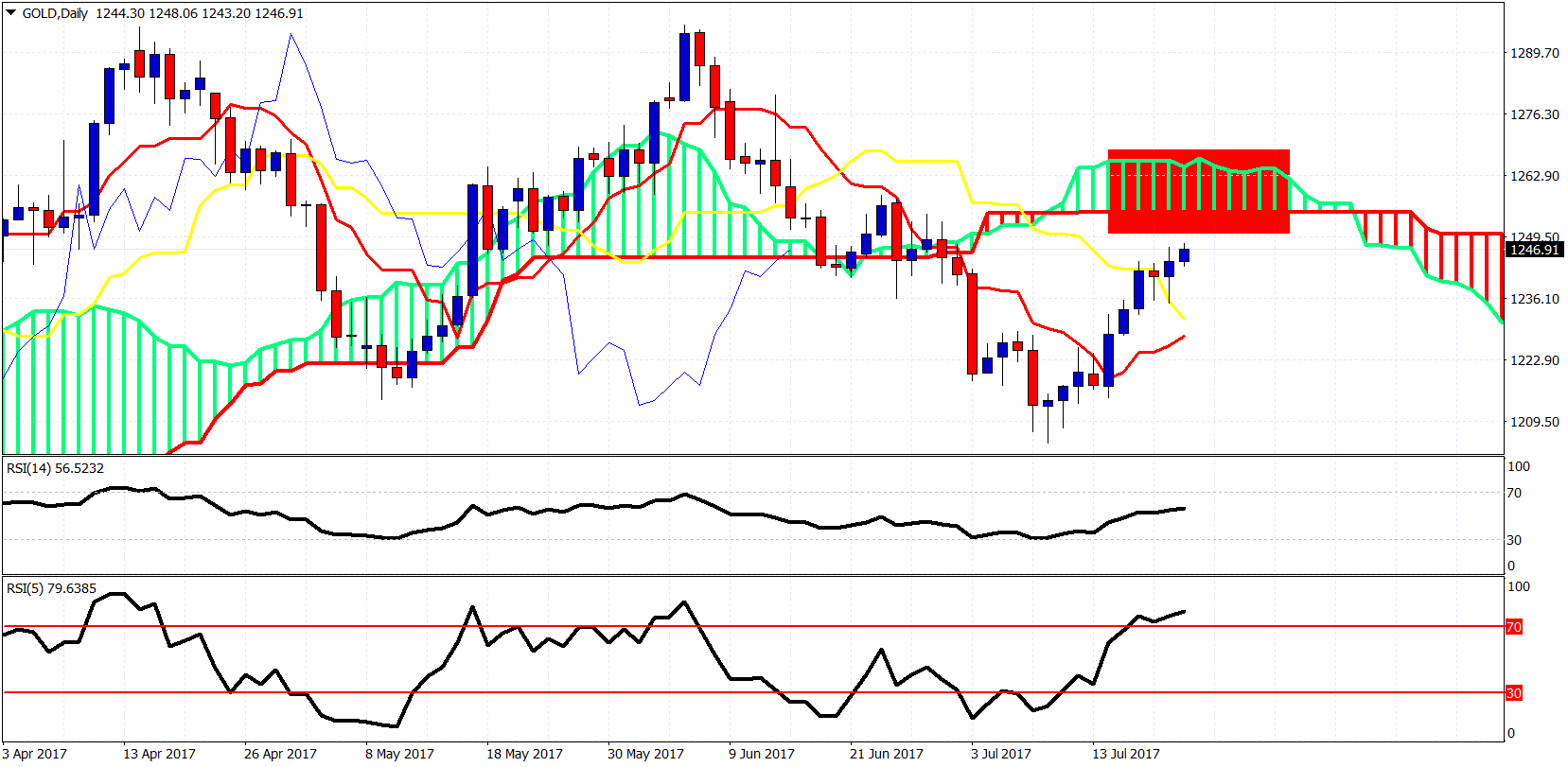

Last time I posted an analysis for gold and silver I said that I was bullish looking for higher levels. I’ve been bullish gold since early July when prices entered the $1220-1200 price range. I was expecting a bounce at least towards $1,260 while there are also many chances for a move much higher. Gold price was forming a wedge pattern and I timely noted when it was broken and a bullish signal was given.

Below you can find the charts I’m looking at where I see $1,260 as the first pause to this upward move.

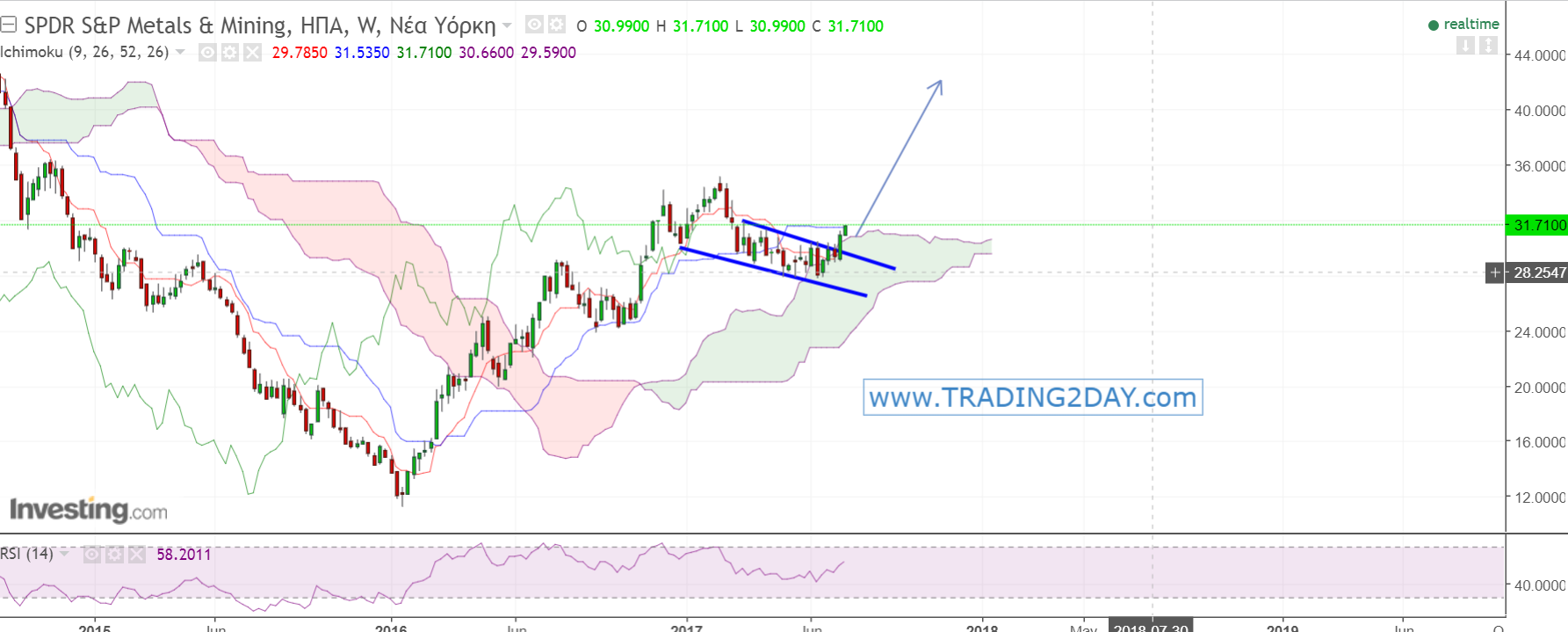

I remain long gold and silver futures, and long some miners and SPDR S&P Metals & Mining (NYSE:XME).

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

Related Articles

Gold prices continue to move swiftly higher as gold nears $3000/ounce. Feels like a big rally already. But gold may be in the early innings of a longer-term run… especially if...

If the whispers of revaluing the US XAU/USD reserves prove true, it could be an instant boon to the people’s (currently debt-addled) asset base. This article is written by someone...

The major gold stocks are on the verge of a momentous technical event, a dozen-year secular breakout. With their leading index just single-digit percentages away, that could...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.