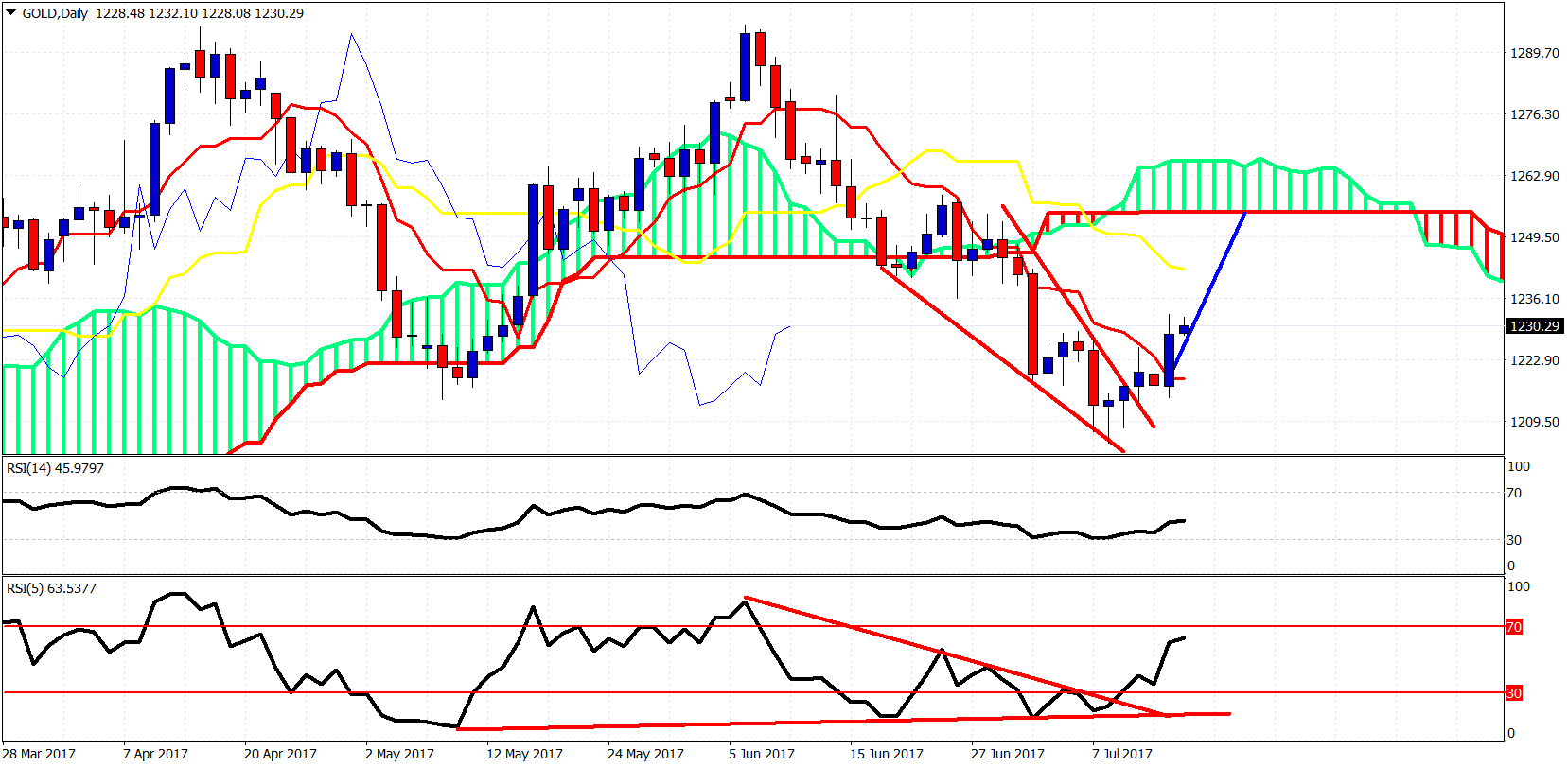

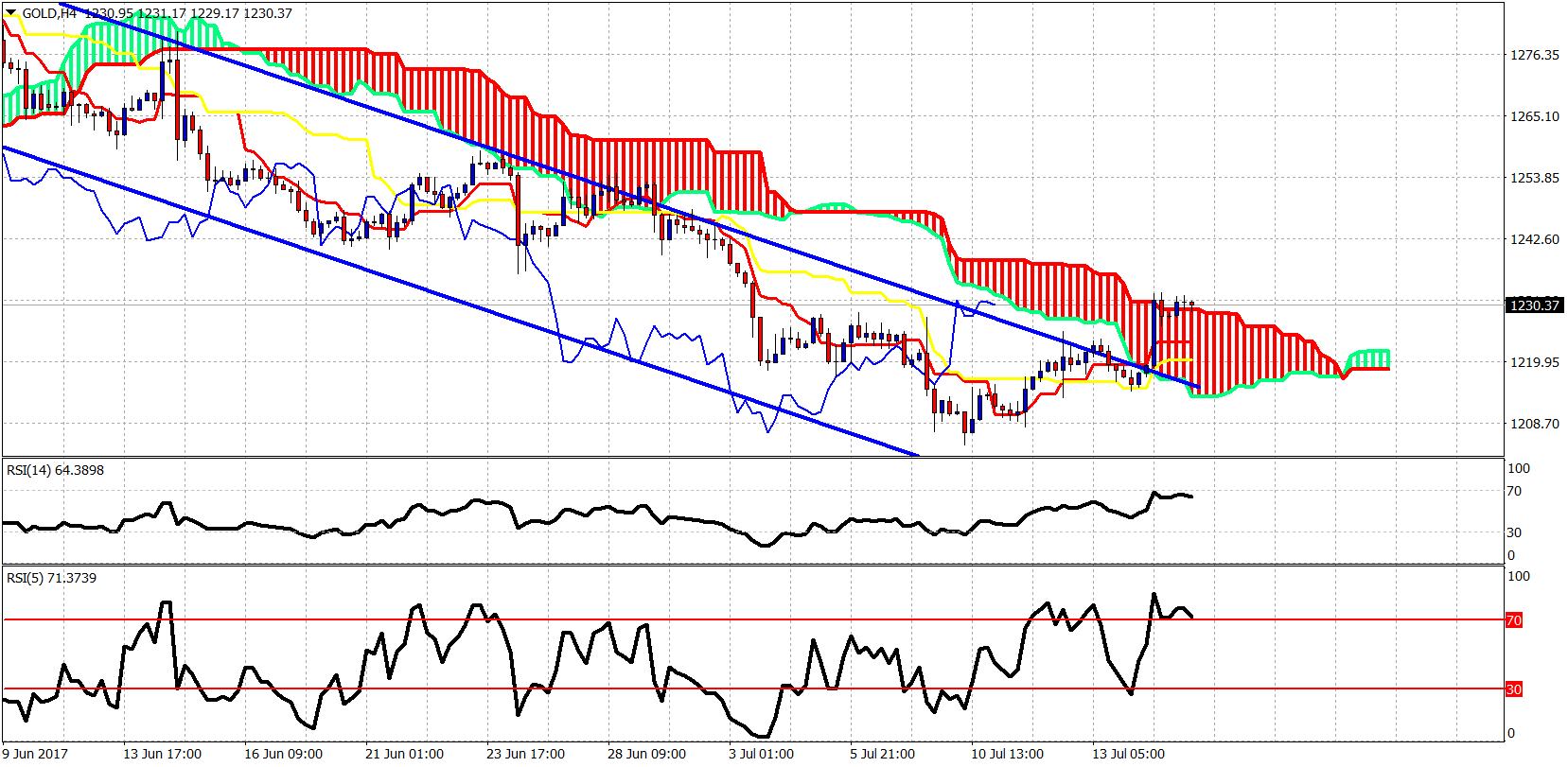

Gold and silver prices have reached important long-term buying interest areas last week and we have the first reversal signs. If you have been reading my daily analysis in gold through my partnership with InstaForex you know I remain longer-term bullish and you were notified promptly by the wedge pattern breakout and the warning signs we were given before the upside reversal.

My minimum bounce target is at $1,260 but overall I believe there are a lot of chances that an important low is in and that a new upward move has started, that eventually will break the long-term downward sloping trend line we have hit so many times and got rejected.

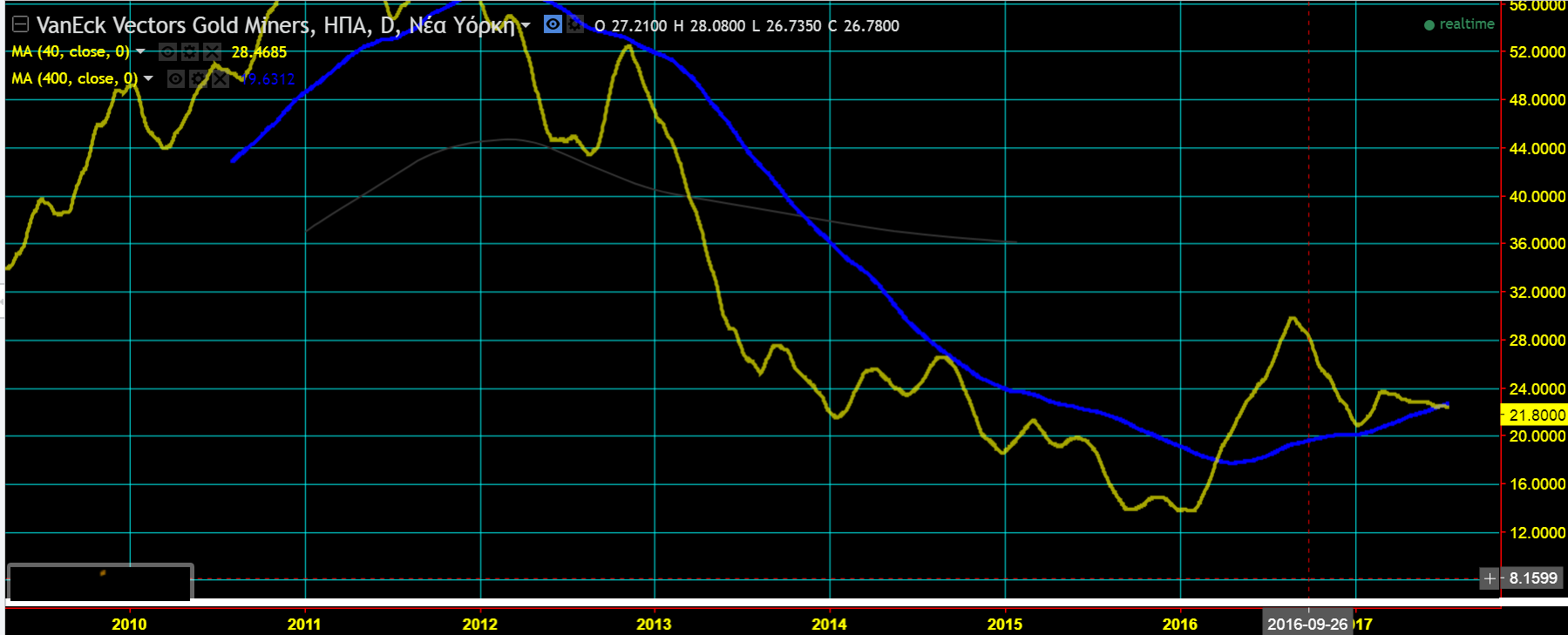

Some interesting miner charts:

I have long positions in ABX (NYSE:ABX), AG, GDX (NYSE:GDX), WPM, XME, and in future contracts.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.