- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Merrimack (MACK) Incurs Narrower-Than-Expected Loss In Q4

Merrimack Pharmaceuticals, Inc. (NASDAQ:MACK) reported a loss of 89 cents per share in the fourth quarter of 2017, narrower than the Zacks Consensus Estimate of a loss of $1.27. The company reported a loss of $2.93 in the year-ago quarter.

Merrimack sold Onivyde and a generic version of Doxil to Ipsen in April 2017. Merrimack did not generate any revenues in the quarter as there was no marketed product.

Merrimack’s shares lost 10.3% following the release of fourth-quarter results. Shares of Merrimack have underperformed the industry so far this year. The stock tumbled 25.7% in the last six months while the industry declined 7.7%.

In the quarter, research and development expenses were down 51.6% year over year to $12.4 million due to Merrimack's refocused clinical and preclinical pipeline.

General and administrative expenses were down 57.3% year over year to $4.7 million due to reduced headcount levels and stock-based compensation

2017 Results

Loss per share for 2017 came in at $5.66 compared with $12.33 in 2016.

Pipeline Updates

With the sale of its only marketed product, the company can now focus its resources on the development of its three pipeline candidates — MM-121/seribantumab (heregulin-positive, locally advanced or metastatic non-small cell lung cancer ("NSCLC"), MM-141/istiratumab (pancreatic cancer) and MM-310 (solid tumor).

Data from the phase II CARRIE study, evaluating MM-141 in pancreatic cancer, is expected in the first half of 2018. MM-310 is being evaluated in a phase I study in solid tumors. Safety data and maximum tolerated dose is expected to be announced in the second half of 2018.

The company is conducting a phase II study, SHERLOC on MM-121 in non-small cell lung cancer. Enrollment in the study has been expanded to 100 from 80. Top-line data from the study is expected in the second half of 2018. In November 2017, the FDA granted orphan drug designation to the candidate for the treatment of heregulin-positive non-small cell lung cancer.

Merrimack announced that the first patient has been also dosed in phase II study, SHERBOC, for evaluating MM-121 in HER2 negative metastatic breast cancer.

Outlook

Per the company, cash and cash equivalents of $93.4 million as of Dec 31, 2017 and potential net milestone payments anticipated from Shire (NASDAQ:SHPG) will be sufficient to fund its planned operations into the second half of 2019.

Our Take

The narrower-than-expected loss in the fourth quarter was due to lower expenses. We expect investor focus on pipeline updates from the company.

Zacks Rank & Stocks to Consider

Merrimack carries a Zacks Rank #3 (Hold).

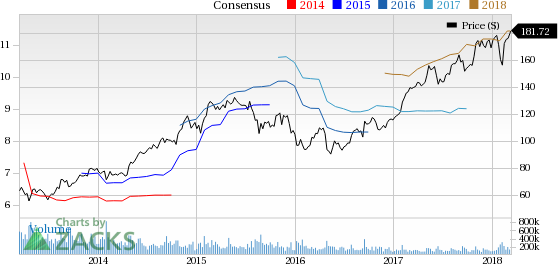

Investors interested in the health care space can consider some better-ranked stocks are Regeneron Pharmaceuticals (NASDAQ:REGN) and Ligand Pharmaceuticals (NASDAQ:LGND) . While Regeneron sports a Zacks Rank #1 (Strong Buy), Ligand carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here..

Regeneron’s earnings per share estimates have moved up from $17.13 to $18.65 and from $20.37 to $21.56 for 2018 and 2019, respectively in the last 30 days. The company pulled off a positive earnings surprise in three of the last four quarters, with an average beat of 9.15%.

Ligand’s earnings per share estimates have moved up $3.54 to $4.15 from $4.75 to $5.75 for 2018 and 2019 respectively over the last 30 days. The company delivered positive earnings surprises in three of the trailing four quarters, with an average beat of 24.88%. The company’s shares have rallied 57.2% over a year.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Merrimack Pharmaceuticals, Inc. (MACK): Free Stock Analysis Report

Shire plc (SHPG): Free Stock Analysis Report

Original post

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.