- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Merger Of Online & Offline Retail: 4 Stocks To Watch Out For

As technology becomes more accessible to shoppers and they rapidly shift their choices, both online and offline retailers are looking for strategies to adapt to the change. The result, notwithstanding store closures, is the fusion of online and offline shopping that combines confidence with convenience and delivers a better consumer experience.

Let’s find out how this evolving concept is helping retailers.

Data Usage and Inventory Management

Striking the right balance between online and offline channels helps fetch customer data. This data is helping retailers to get rid of the older model of stocking up on inadequate quantities of a broader selection to target more shoppers. Instead, they are focusing on selling fewer items that are always in stock and cater to customers more.

This is especially true in case of commodity-type products or food. The purchase intention wanes if consumers have to wait too long for fulfillment or are required to pay for shipment. So, by uniting online and offline features, retailers are trying to track inventories, focus on availability and further simplify the transaction.

In-Store Experience Always Important

There are many aspects to the shopping experience that retailers are spending time and resources on. Apart from adding merchandise and increasing selection, retailers are using technology to track customers and push promotions to them at suitable times, reduce waiting time at billing counters, enable more variety and security in payment options while also adding a personal touch.

On the other hand, routine functions such as locating and fetching products or tracking shelf space for replenishing are increasingly being automated. IoT is bringing technology to them in other ways. All these are helping retailers to enhance shopping experience, which helps to maintain customer loyalty.

The broader objective is to tap a large number of customers who still prefer to shop offline.

Here are four companies that are already working to get there.

Wal-Mart Stores (NYSE:WMT)

Wal-Mart is one of the first companies to offer the ‘order online pickup at store’ facility. It also has the technology to detect when a customer is coming for the pickup, which enables it to start the packaging process even before he/she arrives. This reduces delivery time to about 3.5 minutes, lower than the company’s promised five minutes.

In June last year, Wal-Mart inked a deal with JD.com to sell its Chinese e-commerce business, Yihaodian to JD.com in exchange for a 5% equity stake in the company. In October, Wal-Mart increased its stake in Chinese e-commerce website, JD.com to 10.8% from 5.9%, aiming to grab more market share and expand its reach in China, where the company has been struggling of late.

In July this year, the duo extended their partnership on inventory, customer and store/platform integration.

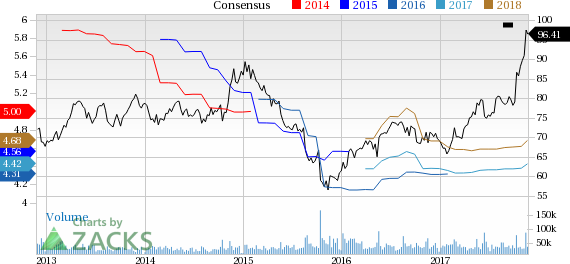

Wal-Mart currently carries a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wal-Mart Stores, Inc. Price and Consensus

Alibaba (NYSE:BABA)

Increased competition and market saturation have forced Alibaba to move beyond hawking goods online. The company is trying to build its business as an ecosystem of retail, cloud and artificial intelligence (AI). It is working on the development of what it calls “New Retail” to bridge the gap between online and offline shopping using its big data capacity; acquiring new ways to evolve across marketing, inventory and distribution networks.

To implement this strategy, it has been making investments in offline stores for quite some time now. It acquired department store operator, InTime and purchased a 20% stake in retail giant Suning. It also purchased a stake in grocery chain Sanjiang Shopping Club Co Ltd.

The company entered into a strategic partnership with Bailian Group to leverage on its big data capacities and to explore new retail opportunities across outlet design, technology research and development, customer relationship management, supply chain management, payment and logistics.

Perhaps the most exciting way its effort is paying off is Hema convenience stores. These stores allow customers to enter by scanning a QR code, shop, eat and order items, and pay automatically through Alipay at the checkout.

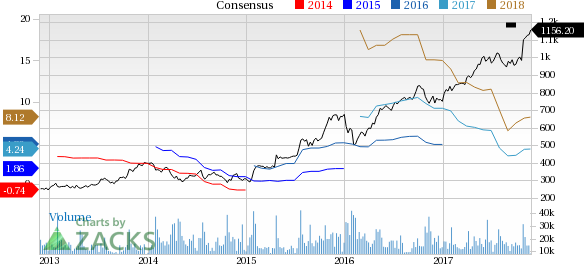

Alibaba carries a Zacks Rank #3 (Hold).

Alibaba Group Holding Limited Price and Consensus

Amazon (NASDAQ:AMZN)

Amazon is the first major retailer to transform the line-free store concept to reality. The company’s, Amazon Go “Just Walk Out” grocery stores are devoid of cashiers and check outs. Thus, there are no long customer queues.

Customers will have to download an app and get their smartphones scanned at the store entrance. As they start shopping, the app will add every item they put in their virtual carts and delete the ones that are put back. As customers exit, the technology will enable the calculation of the total bill, generate a digital receipt and charge customers from their Amazon account.

The company’s drive-in-grocery delivery service called AmazonFresh Pickup allows customers to order groceries online and collect them from a store at a convenient time.

It has also added online and offline features to its bookstores. There, books don’t have a price tag and customers need to download the Amazon app to know the prices. Customers can check out like a regular bookstore or with the Amazon app.

Amazon might add those features to Whole Foods’ stores in the future. For now, select Whole Foods Market (NASDAQ:WFM) stores have Amazon Lockers to allow customers to get products shipped from Amazon.com to local Whole Foods Market stores where they can pick up or return them to Amazon.

Amazon carries a Zacks Rank #3.

Amazon.com, Inc. Price and Consensus

JD.com (NASDAQ:JD)

To expand its role in the online-offline merger and drive sales, JD is engaging brands with several tech-driven services such as location-based inventory management, facial recognition-based payment systems and precision marketing.

Like Amazon and Alibaba, the company is testing waters with the unstaffed store concept at its Beijing headquarters that deploys RFID tags and facial recognition to facilitate cashier-less experience. Cameras on the ceiling help track products selected or preferred by customers through heat maps. A combination of cameras and weight sensors helps track products picked up from racks.

JD.com currently carries a Zacks Rank #3.

JD.com, Inc. Price and Consensus

Last Words

Offline stores are and will remain extremely important to most customers. It isn’t just about the price and product but also the personalized experience and social element of shopping at stores that count. The truth is shopping online can be convenient but shopping at a store, other than for essentials, is also a way to relax and unwind for some.

Moreover, the amount of choice available online can at times be confusing, so it’s comforting to be able to simply go where one has always gone. After all, you can always pull out your phone and compare prices.

Another thing to keep in mind is that the combination of online and offline operations is such that the two complement and leverage each other. This is a trend that is likely to continue for years to come. The companies that can best utilize the resources at their disposal and increase efficiency will emerge winners and so will the investors betting on the model.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

JD.com, Inc. (JD): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Pretty rough day out there—S&P 500 down about 1.8%, Nasdaq down around 2.2%, and small caps hit even harder, dropping 2.7%. However, the S&P 500 is approaching a crucial...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.