- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Medtronic (MDT) Down 1.5% Since Earnings Report: Can It Rebound?

It has been about a month since the last earnings report for Medtronic plc (NYSE:MDT) . Shares have lost about 1.5% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Recent Earnings

Medtronic reported second-quarter fiscal 2018 adjusted earnings per share (EPS) of $1.07, beating the Zacks Consensus Estimate by 8.1%. Earnings however declined 4.5% year over year.

Adjustments in the quarter primarily included the impact of restructuring charges, intangible asset amortization, divestiture-related items, adverse effects of Hurricane Maria and acquisition-related items. After adjusting for unfavorable foreign exchange impact of $0.01, adjusted EPS was $1.06.

Without these adjustments, the company’s reported EPS was $1.48, up 85% year over year.

Total Revenues

Worldwide revenues in the reported quarter grossed $7.05 billion, up 3.5% on a constant exchange rate or CER basis (down 4.1% on a reported basis). The top line missed the Zacks Consensus Estimate of $7.07 billion. Foreign currency fluctuation affected Medtronic’s second-quarter revenues by $35 million.

In the quarter under review, U.S. sales (52.9% of total revenues) declined 10.1% year over year to $3.73 billion. Non-U.S. developed market revenues totaled $2.24 billion (31.8% of total revenues), reflecting a 4.7% increase at CER (up 1.4% as reported). Emerging market revenues (15.3% of total revenues) amounted to $1.08 billion, up 12.4% at CER (up 9.8% as reported).

Segment Details

The company currently generates revenues from four major groups, viz. Cardiac & Vascular Group (CVG), Minimally Invasive Therapies Group (MITG), Restorative Therapies Group (RTG) and Diabetes Group.

CVG comprises Cardiac Rhythm & Heart Failure (CRHF), Coronary & Structural Heart (CSH) and Aortic & Peripheral Vascular divisions (APV). MITG now includes the Surgical Innovations (SI) and the Respiratory, Gastrointestinal & Renal (RGR) divisions after the divestiture of Patient Care, Deep Vein Thrombosis (Compression), and Nutritional Insufficiency (Enteral Feeding) businesses. RTG comprises the Spine, Brain Therapies, Specialty Therapies and Pain Therapies segments, while the Diabetes Group incorporates the Intensive Insulin Management (IIM), Non-Intensive Diabetes Therapies (NDT), and Diabetes Service & Solutions (DSS) divisions.

CVG revenues improved 7% at CER (up 7.4% as reported) to $2.77 billion, driven by strong, balanced growth across all three divisions.

CRHF sales totaled $1.47 billion, up 4% year over year at CER (up 5% as reported). This came on the back of growth in Arrhythmia Management led by high-teens growth in atrial fibrillation Solutions and low-double digit rise in Diagnostics at CER, amplified penetration of the Micra transcatheter pacing system, and strong uptake of the TYRX absorbable antibacterial envelope. This apart, strong demand for the company's suite of quadripolar cardiac resynchronization therapy-pacemakers (CRT-P) along with growth in Mechanical Circulatory Support drove Heart Failure division revenues.

CSH revenues were up 12% at CER (13% as reported) to $854 million on the back of high-30s constant currency growth in transcatheter aortic valves as a result of strong customer uptake of the CoreValve Evolut PRO platform. Moreover, the company's recent launch of the Resolute Onyx drug-eluting stent in the United States and Japan revived the Coronary business.

APV revenues registered 4% growth at CER (up 5% as reported) to $452 million, driven by continued adoption of the Valiant Captiviathoracic stent graft systems and strength in the Heli-FX EndoAnchor System. Peripheral was driven by double-digit growth in percutaneous transluminal angioplasty and drug-coated balloons. Moreover, the recently-launched Concerto 3D detachable coil system drove mid-single digit growth in endoVenous.

In MITG, worldwide sales reached $1.95 billion, marking a 2% year-over-year increase at CER (down 21% on a reported basis) on mid-single digit growth in SI, which was affected by Hurricane Maria, and partially offset by low-single digit decline in RGR.

In RTG, worldwide revenues of $1.86 billion were up 2% year over year at CER (same as reported) on low double-digit growth in Brain Therapies, offsetting declines in Spine, Specialty Therapies and Pain Therapies. Moreover, the Spine and Pain Therapies divisions along with the Pelvic Health business in the Specialty Therapies division in the United States were affected by Hurricane Maria.

However, revenues at the Diabetes group declined 2% at CER (flat as reported) to $462 million.

Margins

Gross margin in the reported quarter expanded 160 basis points (bps) to 69.9% despite a 1.8% decline in gross profit to $4.93 billion. Adjusted operating margin contracted 40 bps year over year to 27.5% owing to a 0.2% rise in research and development expenses (to $555 million) along with a 0.8% uptick in selling, general and administrative expenses (to $2.44 billion). Other expenses in the reported quarter totaled $111 million as compared with $89 million in the year-ago quarter.

Guidance

Medtronic reiterated its fiscal 2018 constant-currency revenue and EPS guidance. The company maintains full-year revenue growth projection in the range of 4-5% at CER. However, the company revised its foreign currency fluctuation estimation, which is now projected to have a positive $275-$375 million impact on fiscal results compared with $380-$480 million estimated earlier. The Zacks Consensus Estimate for 2018 revenues remains at $29.36 billion.

Fiscal 2018 adjusted earnings per share growth is still expected in the range of 9-10% at CER. Currency translation is expected to have an adverse impact of two cents compared with the earlier expectation of a negative effect of 3 cents to a positive impact of $0.01. The Zacks Consensus Estimate for fiscal 2018 earnings is pegged at $4.7.

For the third quarter of fiscal 2018, Medtronic expects currency translation to have a favorable impact of $155-$175 million on revenues. Currency translation is expected to contribute $0.01 to third-quarter earnings per share.

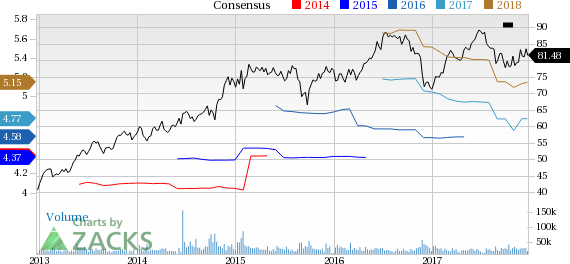

How Have Estimates Been Moving Since Then?

It turns out, fresh estimate flatlined during the past month. There have been two revisions higher for the current quarter compared to two lower.

VGM Scores

At this time, the stock has a poor Growth Score of F, however its Momentum is doing a bit better with a D. The stock was allocated also a grade of B on the value side, putting it in the top 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is solely suitable for value investors.

Outlook

The stock has a Zacks Rank #3 (Hold). We are looking for an inline return from the stock in the next few months.

Medtronic PLC (MDT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.