- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

MDU Resources (MDU) Announces Five Year Capex Plan

MDU Resources Group, Inc. (NYSE:MDU) recently made an announcement regarding its capital expenditure forecast for 2018 through 2022.

Breaking Down Capex

Per the capex program, the group expects to spend approximately $466 million in construction materials and services for 2018 through 2022. Toward this, it anticipates spending roughly $382 million expenditure in construction materials and contracting along with nearly $84 million in construction services. Notably, these investments will primarily include spending toward normal equipment and plant replacements. In addition to organic growth, the group's construction businesses anticipate growth through mergers and acquisitions.

The company intends to meet the growing demand of increasing customers in the eight states it operates with system upgrades and replacements to supply safe and reliable service. Notably, it intends to make investments in new electric generation and transmission along with natural gas distribution.

In the Regulated Energy delivery segment, it anticipates spending nearly $2,323 million. Of which the company intends to spend approximately $617 million, $891 million and $349 million in electric, natural gas & pipeline, and midstream operations, respectively. The company expects to fund the entire five year capital expenditure program through its operating cash flow and issuance of debts.

How These Investment will Help?

The group expects electric and natural gas utility business to grow its rate base by approximately 5% annually over the next five years on a compound basis, under the five-year capital investment program. The group is focused on growth and improving existing operations through organic projects and acquisitions in areas of its operation.

We expect organic growth projects through the capital expenditure program will aid the group to gain over the long term. This is likely to be reflected in the earnings as well.

Going Ahead

MDU Resources is also considering the plan of reorganizing into a holding company structure. The purpose of the potential reorganization would be to make Montana-Dakota Utilities Co. and Great Plains Natural Gas Co., which are currently the divisions of MDU Resources, into subsidiaries of the holding company, just as the group’s other wholly owned subsidiaries.

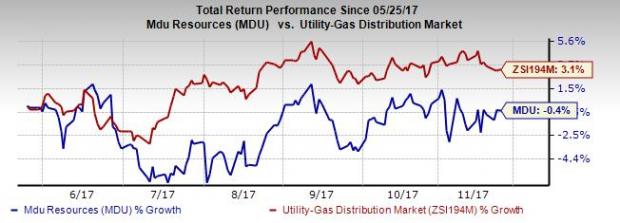

Price Movement

Shares of MDU Resources underperformed the industry in the last six months. The company’s shares lost 0.4% compared with the industry’s growth of 3.1%.

Such underperformance can be attributed to the company’s third-quarter 2017 operating earnings that missed estimates by 8%. Additionally, the results were also impacted due to high operating expenses of the group during the reported quarter.

Zacks Rank & Key Picks

MDU Resources currently carries a Zacks Rank #4 (Sell). Investors can consider better-ranked stocks from the same space such as Chesapeake Utilities Corporation (NYSE:CPK) , ONE Gas, Inc. (NYSE:OGS) and Spire Inc. (NYSE:SR) , all of which carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chesapeake Utilities posted third-quarter 2017 earnings from continuing operations of 42 cents per share, beating the Zacks Consensus Estimate of 35 cents by 20.00%. The company’s 2017 estimates increased to $2.85 per share from $2.83 per share in the last 30 days.

ONE Gas posted third-quarter 2017 earnings from continuing operations of 36 cents per share, beating the Zacks Consensus Estimate of 28 cents by 28.57 %. The company’s 2017 estimates increased to $3.01 per share from $2.99 per share in the last 30 days.

Spire Inc. posted third-quarter 2017 reported a loss of 22 cents per share, narrower the Zacks Consensus Estimate loss of 27 cents by 18.52%. The company’s 2017 estimates increased to $3.71 per share from $3.70 per share in the last 30 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Chesapeake Utilities Corporation (CPK): Free Stock Analysis Report

MDU Resources Group, Inc. (MDU): Free Stock Analysis Report

ONE Gas, Inc. (OGS): Free Stock Analysis Report

Spire Inc. (SR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The market for 3M (NYSE:MMM) stock is on fire, with shares rising by 7% in the final week of February and 65% in the preceding 12 months, and there is more upside ahead. The...

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Pretty rough day out there—S&P 500 down about 1.8%, Nasdaq down around 2.2%, and small caps hit even harder, dropping 2.7%. However, the S&P 500 is approaching a crucial...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.