- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

MarketAxess (MKTX) Q4 Earnings Beat Estimates, Improve Y/Y

MarketAxess Holdings Inc.’s (NASDAQ:MKTX) fourth-quarter 2017 earnings per share of 89 cents beat the Zacks Consensus Estimate by 1.14% and grew by the same magnitude year over year.

However, including the effects of 31 cents on account of a one-time charge relating to the Tax Cuts and Jobs Act and 30 cents of excess tax benefits related to a new share-based compensation accounting standard (ASU 2016-09) adopted on Jan 1, 2017, net income came in at 88 cents per share in the fourth quarter.

Operational Update

MarketAxess posted total revenues of $99.6 million, up 5.4% year over year. The improvement can be primarily attributed to a 60% surge in investment income. Commission revenues increased 2.9% while information and post-trade services increased 20% and 36% respectively, and other revenues increased 589% year over year.

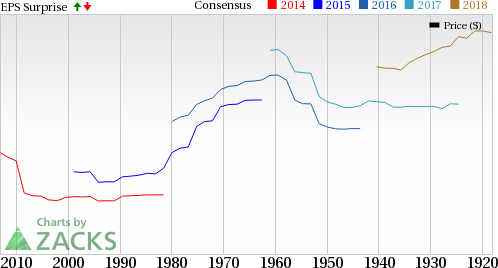

MarketAxess Holdings, Inc. Price, Consensus and EPS Surprise

Total trading volume increased 5.1% in the reported quarter to $355.6 billion year over year, driven by record trading volume in U.S. high-grade and other credit products.

Total expenses at MarketAxess increased 13.8% from the prior-year quarter to $50.2 million. This rise was due to higher employee compensation and benefit cost, technology and communication costs plus general administrative and occupancy costs.

The effective tax rate for the fourth quarter of 2017 was 32.2% compared with 34.1% for the fourth quarter of 2016.

Financial Update

Total assets were $581.2 million as of Dec 31, 2017, up 10.1% from year-end 2016.

Total cash and cash equivalents were $167 million, down 0.7% from year-end 2016.

Total stockholder’s equity was $514.8 million, up 10% from the end of last year.

Free cash flow totaled $63.5 million, up 23.4% year over year.

Share Repurchase Update and Dividend Hike

MarketAxess made share buyback of $6.1 million in the fourth quarter.

The company's board of directors declared a 27% increase in its quarterly cash dividend to 42 cents per share. The same will be paid on Feb 28, 2018 to stockholders of record as of the close of business on Feb 14, 2018.

Zacks Rank

MarketAxess carries a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Companies in the Finance Sector

Among the other firms in the same space that have reported their fourth-quarter earnings so far, American Express Company (NYSE:AXP) , Nasdaq, Inc. (NASDAQ:NDAQ) and Discover Financial Services (NYSE:DFS) beat their respective Zacks Consensus Estimate by 2.6% 1.31% and 3.96%, respectively.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Discover Financial Services (DFS): Free Stock Analysis Report

American Express Company (AXP): Free Stock Analysis Report

Nasdaq, Inc. (NDAQ): Free Stock Analysis Report

MarketAxess Holdings, Inc. (MKTX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.