- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Market Momentum Hits Polar Extremes As Stocks Test Bull Trend

The latest stock market correction and swing lower has seen momentum drop to extreme lows (on a intermediate-term basis). This poses a bit of a conundrum because stocks have been struggling since hitting historic longer-term momentum highs.

So what do investors make of this going forward? Let’s look at a couple of four-pack charts.

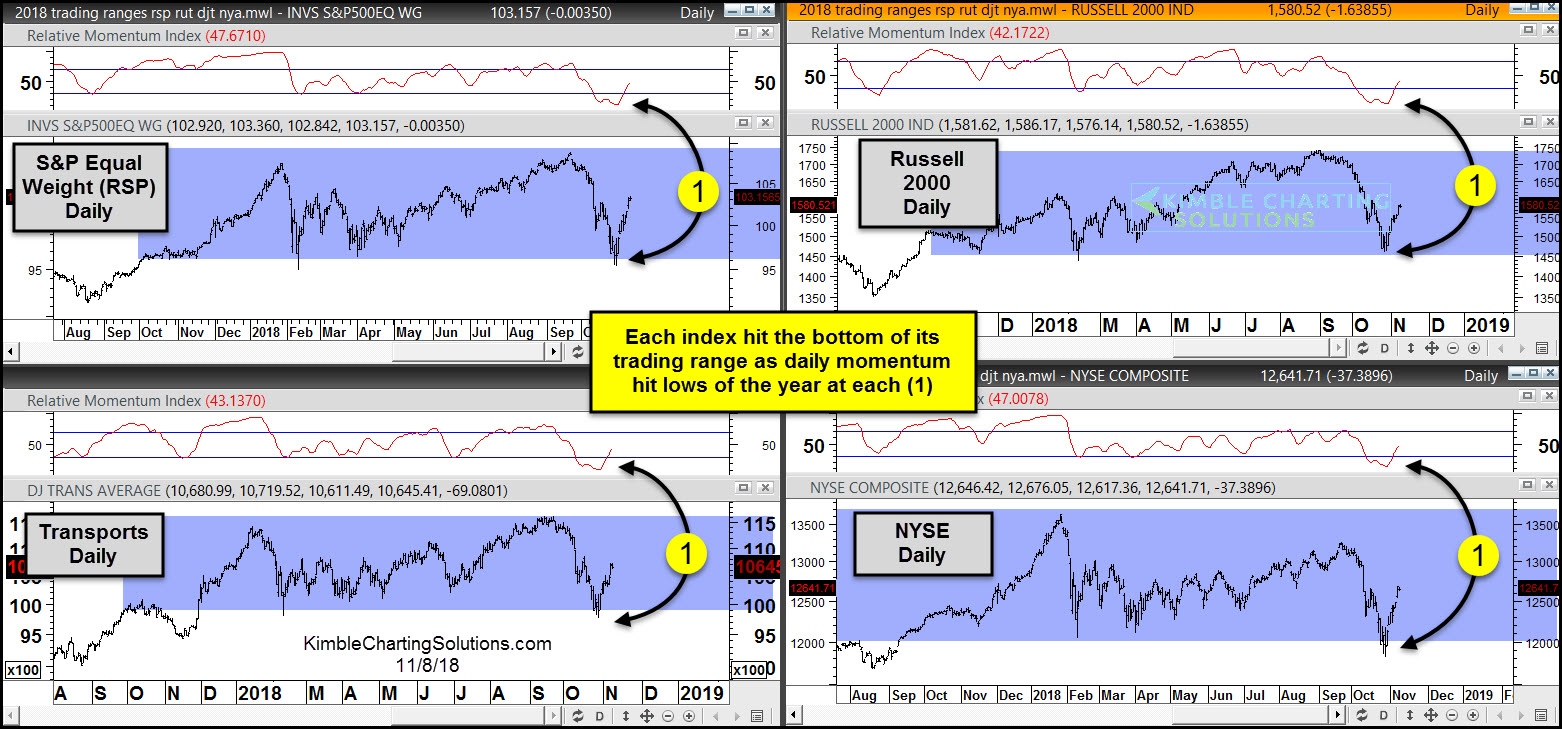

The first 4-pack of charts looks at the “daily” Equal Weight S&P 500, Russell 2000, Dow Transports and NYSE Composite. All of these important stock indexes are in horizontal trading ranges with momentum at the lowest levels in the past couple of years.

This has helped stocks bounce nearly 8 percent off the lows.

Stock Market Index “Ranges” (support at momentum lows)

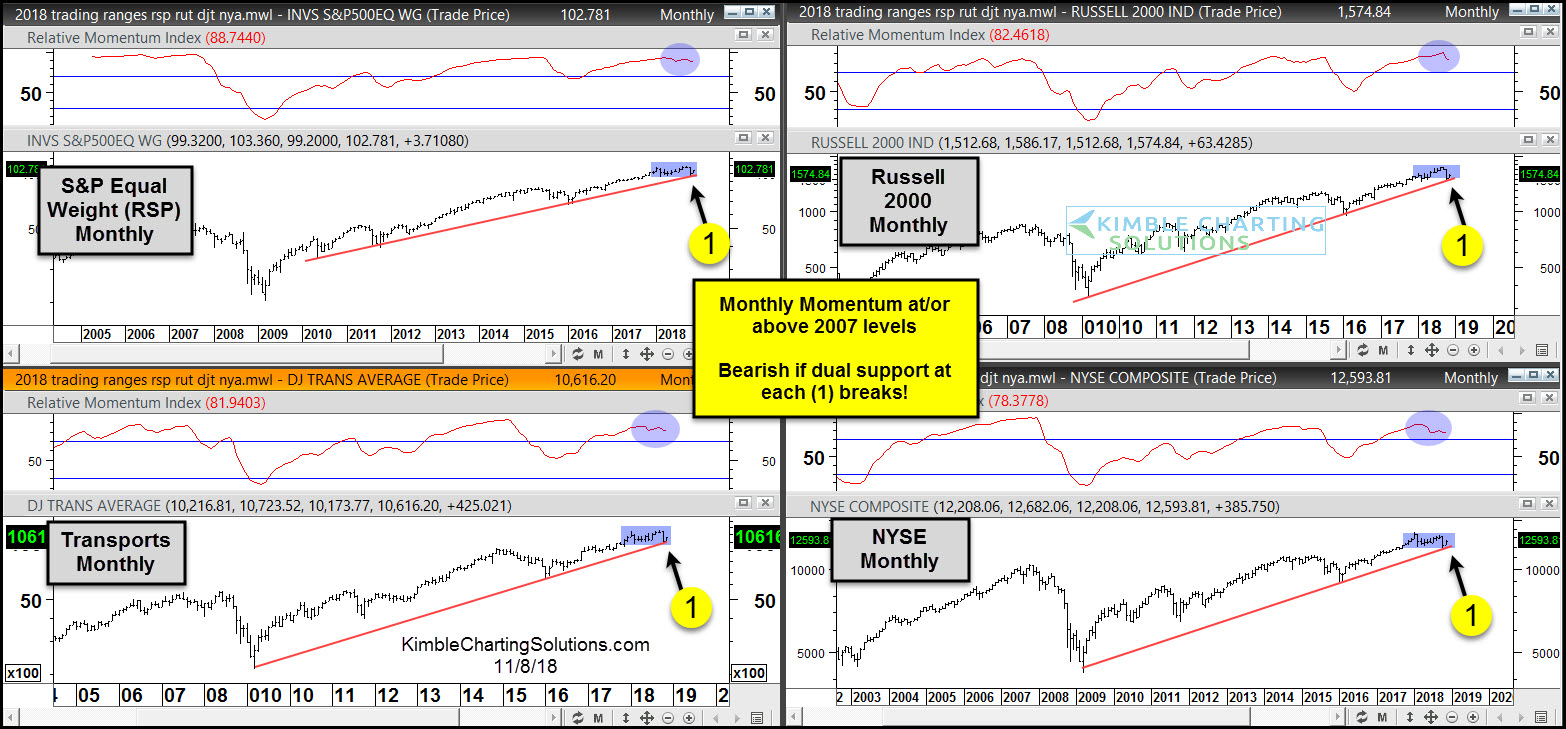

The next 4-pack of charts is a longer-term look at “monthly” bars for the Equal Weight S&P 500, Russell 2000, Dow Transports and NYSE Composite. In addition to testing the bottom of their trading ranges, the stock indexes are also testing 8-year+ rising support at each (1)… with momentum at/or above 2007 levels.

How these two timeframes reconcile will be important for investors.

If support at each (1) would give way, monthly momentum has a long way to go to get oversold. From a big picture perspective, the support test a (1) could be huge!

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.