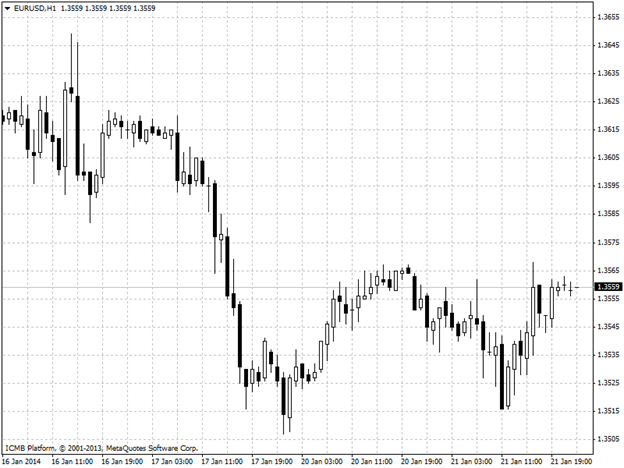

EUR/USD

The dollar strengthened against the euro earlier Tuesday after the International Monetary Fund hiked its 2014 global growth forecast, while expectations for further cuts to Federal Reserve stimulus programs this month also bolstered the greenback before profit taking wiped out its gains. In revisions to its World Economic Outlook report published on Tuesday the IMF said it expects the global economy to grow by 3.7% in 2014, up from an October forecast of 3.6% growth. The news fueled expectations for central banks to wind down stimulus programs such as bond purchases going forward, the Federal Reserve especially, as the multilateral lending institution predicted the U.S. economy to expand 2.8%, up from an October forecast of 2.6%. Many market participants expect the Fed to trim its quantitative easing program to USD65 billion from the current USD75 billion at its next policy meeting on Jan. 29. Fed bond purchases aim to prop up the economy by suppressing long-term interest rates, thus weakening the dollar as a side effect as investors flock to asset classes like stocks.

EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="474" height="242">

EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="474" height="242">

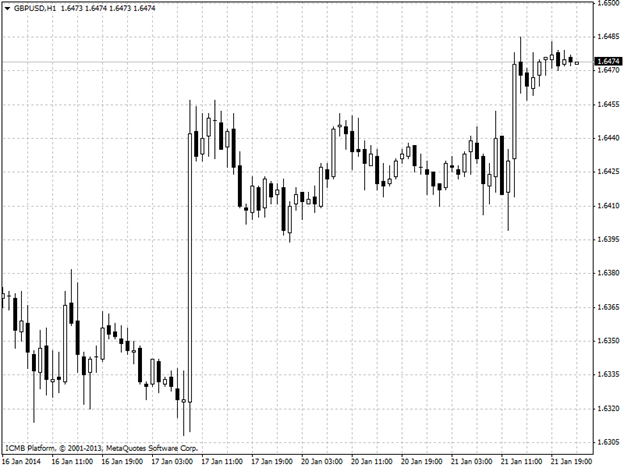

GBP/USD

The pound rose against the dollar earlier Tuesday after the International Monetary Fund said it was hiking the U.K.'s 2014 growth forecast by more percentage points than any other major European country, while mixed-but-solid British data also bolstered the pair. The pound enjoyed support after the IMF hiked Britain’s 2014 growth forecast to 2.4% from 1.9% in October, more than any other major European economy. Also in the U.K., the Confederation of British Industry said its index of industrial order expectations fell to -2 this month from 12 in December, well below expectations of a reading of 10. However, the CBI said the volume of total orders for the next three months rose to 22 from 14, the highest level since April 2012. New orders in the three months to January saw their strongest growth in nearly three years. The data also showed that the quarterly business outlook balance ticked down to 21 in the three months to January from 24 in the three months to October, which had been its highest since April 2010. In revisions to its World Economic Outlook report published on Tuesday the IMF said it expects the global economy to grow by 3.7% in 2014, up from an October forecast of 3.6% growth.

GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="474" height="242">

GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="474" height="242">

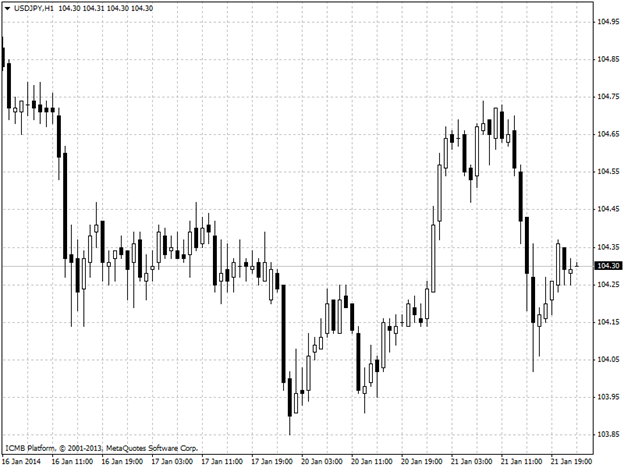

USD/JPY

The dollar moved higher against the yen on Tuesday and rose to the highest level in four years against the Canadian dollar amid expectations that the Federal Reserve will continue to unwind its stimulus program this month. Dollar rises vs. yen, hits 4-year high against Canadian dollar Dollar rises against yen, hits 4-year highs against Canadian dollar Demand for the dollar was underpinned by expectations for a reduction to the Fed’s quantitative easing program at the outcome of its next policy meeting on January 29 to USD65 billion from the current USD75 billion. Investor demand for the safe haven yen was hit after China’s central bank moved to inject liquidity into the financial system overnight, easing concerns over a possible credit crunch. The shared currency slipped after the ZEW Centre for Economic Research said its index of German economic sentiment ticked down to 61.7 this month from 62.0 in December. Analysts had expected an increase to 64.0. However, the current conditions index rose to a 20-month high of 41.2 from 32.4 in December, beating expectations for an increase to 34.1.

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="474" height="242">

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="474" height="242">

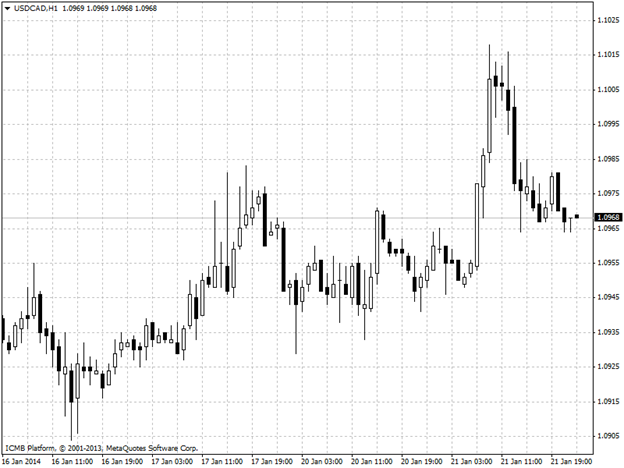

USD/CAD

The Canadian dollar weakened to C$1.10 for the first time in more than four years amid speculation the U.S. Federal Reserve will slow its monetary stimulus as the Bank of Canada signals more may be on the way. The currency sank against most major peers before a central-bank rate decision tomorrow that will follow weaker-than-forecast economic reports this month. The bank may signal in a policy statement it favors lower interest rates, only three months after dropping a bias toward higher rates. The Fed will keep reducing monthly bond purchases it makes to spur economic growth, according to economists in a Bloomberg survey.

USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="474" height="242">

USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="474" height="242">