- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Magellan (MMP) & Plains All To Increase BridgeTex Capacity

Magellan Midstream Partners, L.P. (NYSE:MMP) along with Plains All American Pipeline, L.P. (NYSE:PAA) , its joint venture partner in BridgeTex Pipeline Company, LLC, announced plans to increase the capacity of the BridgeTex pipeline by 40,000 barrels per day (bpd). The joint venture also announced an additional open season to evaluate the demand for increased capacity, which will give potential customers an opportunity to come out with binding commitments by Dec 30, 2017.

The open season activities in the region are primarily driven by a rise in drilling activities in the Permian Basin. Active rig count in the region has been on the rise for quite some time now, which triggered the interest of pipeline manufacturers in the area. The latest expansion decision on BridgeTex comes on the heels of a long-term deal signed in July between a Singapore-based commodity trading company, Trafigura Pte Ltd and Plains All American Pipeline. Per the deal, Trafigura demanded 100,000 bpd of Permian crude and condensate delivered to the Gulf Coast.

About BridgeTex Pipeline

BridgeTex Pipeline is a 50/50 joint venture between Magellan Midstream and Plains All American. The pipeline’s transportation capacity was increased to 400,000 bpd from 300,000 bpd in July. After the latest capacity expansion, the Permian Basin crude oil will be delivered from Colorado City, TX to the Houston Gulf Coast area with new capacity of around 440,000 bpd.

About the BridgeTex JV Partners

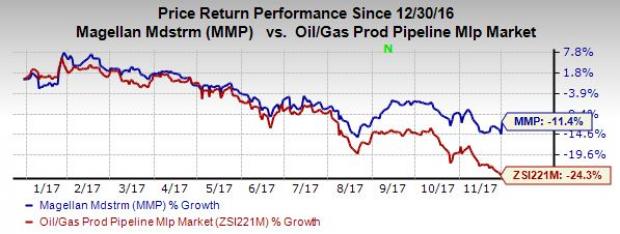

Magellan Midstream is a master limited partnership that owns and operates a diversified portfolio of energy infrastructure assets. This Tulsa, OK-based partnership primarily transports, stores, and distributes refined petroleum products and, to a lesser extent, ammonia. Currently, the partnership performs its operations via three segments — Refined Products, Crude Oil and Marine Storage. Units of Magellan Midstream have lost 11.4% year to date compared with 24.3% decline of the industry it belongs to.

Houston, TX-based Plains All American, a master limited partnership, is involved in the transportation, storage, terminalling and marketing of crude oil, natural gas, natural gas liquids (NGL) and refined products in the United States and Canada. The partnership has operations in the Permian Basin, South Texas/Eagle Ford area, Rocky Mountain and Gulf Coast in the United States, and Manito, South Saskatchewan, Rainbow in Canada. Plains All American operates through three segments -Transportation, Facilities, and Supply and Logistics. Units of Plains All American have lost 39.6% year to date compared with 24.3% decline of the industry it belongs to.

Zacks Rank & Stock to Consider

Both Magellan Midstream and Plains All American carry Zacks Rank #3 (Hold).

Some better-ranked stocks in the oil and energy sector include ConocoPhillips (NYSE:COP) and Northern Oil and Gas, Inc. (NYSE:NOG) . Both the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Houston, TX-based ConocoPhillips is a major global exploration and production company. The company’s sales for 2017 are expected to increase 24.4% year over year. The company delivered an average positive earnings surprise of 152.3% in the last four quarters.

Minnetonka, MN -based Northern Oil and Gas is an independent energy company. The company’s sales for the fourth quarter of 2017 are expected to increase 51.9% year over year. The company delivered an average positive earnings surprise of 175% in the last four quarters.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Plains All American Pipeline, L.P. (PAA): Free Stock Analysis Report

Magellan Midstream Partners L.P. (MMP): Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG): Free Stock Analysis Report

ConocoPhillips (COP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.