- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Luminex (LMNX) At 52-Week High: What's Driving The Stock?

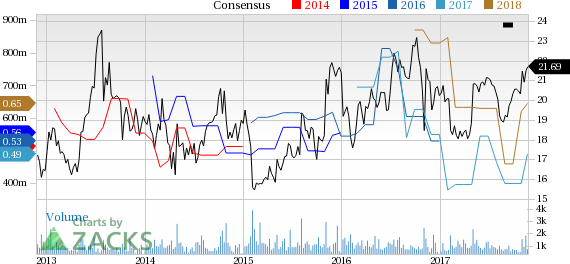

Share price of Luminex Corporation (NASDAQ:LMNX) scaled a new 52-week high of $22.42 on Nov 22, closing nominally lower at $21.69. The company has gained 14.8% in the last three months, much higher than the S&P 500’s gain of 6.6%. Luminex has also surpassed the broader industry’s 7.1% gain. The stock has a market cap of $955.54 million.

Further, Luminex’s estimate revision trend for the current year is favorable. In the past 30 days, four estimates moved up while one moved down. Estimates were up from 40 cents per share to 49 cents.

The company also has a trailing four-quarter average positive earnings surprise of 87.9%. Its long-term growth of 16.3% holds promise.

The company’s current-year earnings growth is projected to be 43.4%, higher than 16.2% for the broader industry and 22.7% for the S&P 500.

Growth Drivers

Luminex exited the third quarter of 2017 on a solid note. Earnings increased 216.7% year over year and revenues rose almost 4.1%. The third quarter saw solid cash flow as well as profits. Further, the expansion in operating margin buoys optimism. Also, Luminex’s reiterated 2017 annual revenue guidance is encouraging.

The company also witnessed favorable tidings at the regulatory front. In this regard,the ARIES Group A Strep Assay — a moderate complexity, sample-to-answer test for the direct detection of Streptococcus pyogenes from throat swab specimen using the ARIES System — recently received FDA clearance.

.jpg)

Zacks Rank & Other Key Picks

Luminex carries a Zacks Rank #2 (Buy).

A few other top-ranked medical stocks are PetMed Express, Inc. (NASDAQ:PETS) , Align Technology, Inc. (NASDAQ:ALGN) and Myriad Genetics, Inc. (NASDAQ:MYGN) . Notably, PetMed, Align Technology and Myriad Genetics sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed has a long-term expected earnings growth rate of 10%. The stock has rallied roughly 79.4% over a year.

Align Technology has a long-term expected earnings growth rate of 28.9%. The stock has gained 164.5% in a year.

Myriad Genetics has a long-term expected earnings growth rate of 15%. The stock has gained 88.3% in a year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Luminex Corporation (LMNX): Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Related Articles

New tariffs stoke inflation fears and rattle markets. With recession risks rising, defensive stocks look more appealing. InvestingPro spots three undervalued picks with...

The market for 3M (NYSE:MMM) stock is on fire, with shares rising by 7% in the final week of February and 65% in the preceding 12 months, and there is more upside ahead. The...

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.