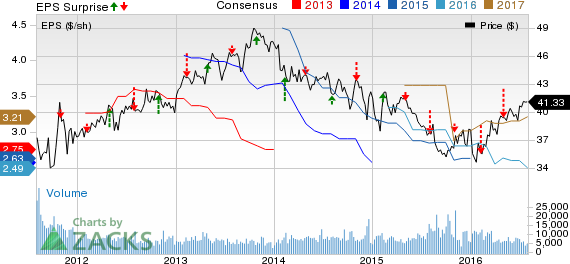

Loews Corporation (NYSE:L) reported second-quarter 2016 operating earnings of 60 cents per share, which beat the Zacks Consensus Estimate by 3 cents.

Including asset impairment charges at Diamond Offshore (NYSE:DO) , net loss came in at 19 cents per share. In the prior-year quarter, Diamond Offshore had reported earnings of 46 cents per share.

The quarter nonetheless witnessed better performance at CNA Financial (NYSE:CNA) and improved results from the parent company investment portfolio owing to higher income from equity securities.

Revenues

Loews’ total revenue of $3.3 billion declined 2.9% year over year. Lower insurance and contract drilling revenues led to the decline.

Behind the Headlines

Total expenses increased 16% year over year to $3.6 billion due to higher other expenses incurred during the quarter.

CNA Financial’s revenues increased 0.3% over the prior-year quarter to $2.3 billion. It reported net income attributable to Loews Corp. of $183 million, up 51% year over year. The improvement was attributable to increased favorable net prior-year development and the absence of any charge in the reported quarter.

Boardwalk Pipeline Partners’ (NYSE:BWP) revenues increased 3% year over year to $308 million. Its reported net income attributable to Loews Corp. increased 42% year over year to $17 million. The improvement was fueled by new rates coming into effect as a result of the Gulf South rate case and proceeds received from a one-time legal settlement. Moreover, earnings benefited from the Evangeline pipeline that was placed into service in mid-2015 as well as new growth projects.

Loews Hotels’ revenues improved about 13.2% year over year to $189 million. Income attributable to Loews was $1 million, while the year-ago quarter income was $8 million. Earnings were also affected by an impairment charge related to a joint venture property.

Diamond Offshore’s revenues declined 38% year over year to $390 million. Net loss attributable to Loews was $290 million. In the year-ago quarter, Diamond Offshore had contributed $45 million in income. The deterioration was due to asset impairment charges of $267 million in the reported quarter. Moreover, earnings were affected by a reduction in the number of rigs operating.

Book value as of Jun 30, 2016 was $52.84 per share, up about 0.2% from $50.72 as of Dec 31, 2015.

Share Repurchase

During the second quarter of 2016, Loews spent $65 million on buying back 1.6 million shares.

Zacks Rank

Loews currently carries a Zacks Rank #3 (Hold).

BOARDWALK PIPLN (BWP): Free Stock Analysis Report

LOEWS CORP (L): Free Stock Analysis Report

CNA FINL CORP (CNA): Free Stock Analysis Report

DIAMOND OFFSHOR (DO): Free Stock Analysis Report

Original post

Zacks Investment Research