- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Lindsay's (LNN) Q1 Earnings Miss, Revenues Beat Estimates

Lindsay Corporation (NYSE:LNN) reported first-quarter fiscal 2018 (ended Nov 30, 2017) earnings of 30 cents per share, surging a whopping 275% from 8 cents per share recorded in the prior-year quarter. Earnings, however, missed the Zacks Consensus Estimate of 36 cents.

The irrigation equipment manufacturer reported revenues of $124.5 million, up 13% year over year. Revenues also beat the Zacks Consensus Estimate of $118 million.

Irrigation segment revenues climbed 15% year over year to $103.4 million. Domestic irrigation revenues recorded growth of 28% from the year-ago quarter, driven by an increase in irrigation system sales volume. However, International irrigation revenues decreased 4% due to lower project sales.

Infrastructure segment revenues were up 3% year over year to $21.2 million led by increased sales volume in road safety products and higher Road Zipper System lease revenues, partly offset by lower revenues in other product lines.

Operational Update

Cost of operating revenues went up 12.3% year over year to $92 million. Gross profit improved 14% to $32.4 million from $28.4 million in the year-earlier quarter. Gross margin also expanded 30 basis points (bps) to 26%. Infrastructure margins improved due to a favorable product mix within road safety products and higher margin lease revenues.

Operating expenses flared up 2% year over year to $26.2 million in the reported quarter. The company posted an operating profit of $6.2 million, up significantly from $2.7 million recorded in the comparable period last year. Operating margin ascended 250 bps to 5% in the fiscal first quarter compared to the prior-year quarter.

Financial Position

Lindsay had cash and cash equivalents of $109.5 million at the end of the fiscal first quarter compared with $103.1 million recorded at the end of the comparable quarter last fiscal. The company recorded cash usage of $5 million from operating activities for the three-month period ended Nov 30, 2017, compared with positive cash flow of $8 million recorded in the prior-year period. Lindsay had long-term debt of $116.7 million during the reported quarter compared with $116.8 million recorded in the year-earlier period.

There were no share repurchases during the fiscal first quarter. As of Nov 30, 2017, shares worth around $63.7 million remained under the company’s buyback program.

Lindsay’s backlog as of Nov 30, 2017, was $80.3 million compared with $55.9 million as of Nov 30, 2016.

Outlook

Lindsay saw a significant year over year improvement in order flow and irrigation system sales in North America irrigation in the first quarter. The company noted that it will remain focused on providing innovative technology solutions and improving operating performance. However, volatile commodity prices remain a matter of concern.

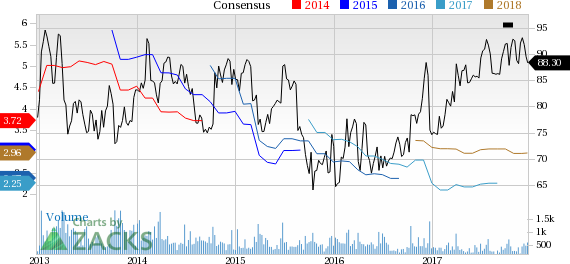

Share Price Performance

In the past year, Lindsay has underperformed the industry it belongs to. The company’s shares have gained around 17% compared with 44.4% growth recorded by the industry.

Zacks Rank & Key Picks

Lindsay currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the same sector include Deere & Company (NYSE:DE) , Caterpillar Inc. (NYSE:CAT) and Kubota Corporation (OTC:KUBTY) . While Deere and Caterpillar sport a Zacks Rank #1 (Strong Buy), Kubota carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Deere has a long-term earnings growth rate of 8.2%. Its shares have rallied 51.3%, year to date.

Caterpillar has a long-term earnings growth rate of 10.3%. So far this year, shares of the company have gained 66.8%.

Kubota has a long-term earnings growth rate of 10.7%. The company’s shares have been up 36.1% during the same time frame.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Lindsay Corporation (LNN): Free Stock Analysis Report

Kubota Corp. (KUBTY): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.