- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

KBR's Energy Solutions Unit Wins Consultancy Services Work

KBR, Inc. (NYSE:KBR) has won a Heating Systems Energy Efficiency Study work from the National Environment Agency (“NEA”) of Singapore to provide consultancy services on energy efficiency.

Per the contract, KBR, via its Energy Solutions unit, will help energy intensive industrial facilities to study the energy performance of heating systems. Also, it will develop a best practice guide for the oil refining, petrochemical and chemical sub-sectors. Notably, the project will be primarily executed from its consulting hub, located in Singapore.

Energy Solutions’ Prospects Look Good

The company’s recurring revenue services business — contributing nearly 24% to 2019 revenues — is experiencing solid top-line growth. The company’s consulting business is also experiencing increased activity since the past few quarters on the back of more efficient reutilization and strong pricing environment.

Recently, the company got certified as an Energy Service Company or ESCO in Singapore to serve industrial facilities with energy optimization services. This will enhance KBR’s strengths in feasibility studies and detailed engineering designs.

In 2019, Energy Solutions segment’s revenues increased 16% courtesy of the ramp up of cost-reimbursable projects that include a brownfield revamp refinery project in the U.S. Gulf Coast, a crude terminal expansion project in the Permian Basin and a Greenfield methanol project in Louisiana.

For 2020, the company expects healthy balance between energy and government projects. However, the recent coronavirus outbreak has put pressure on overall economy. The company anticipates lower LNG activity due to Covid-19 woes.

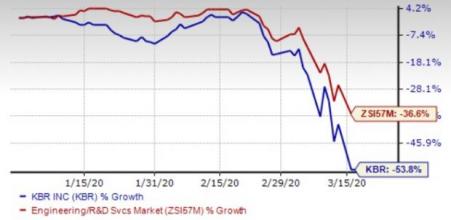

Shares of the company have also witnessed a downfall in the year to date period. The stock has plunged 53.8% so far this year compared with the industry’s 36.6% fall. Estimates for 2020 have also moved south in the past 30 days, reflecting analysts’ concern over the company’s earnings growth potential.

Zacks Rank

KBR — which shares space with Gates Industrial Corporation plc (NYSE:GTES) , Quanta Services, Inc. (NYSE:PWR) and AECOM (NYSE:ACM) in the same industry — currently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Quanta Services, Inc. (PWR): Free Stock Analysis Report

AECOM (ACM): Free Stock Analysis Report

KBR, Inc. (KBR): Free Stock Analysis Report

Gates Industrial Corporation PLC (GTES): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.