- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

John Laing Group: Growth In Buoyant Markets

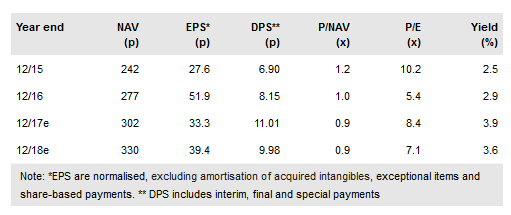

John Laing Group Plc (LON:JLG) trading update and recent disposal of a wind farm provided year-to-date figures for investment commitments and realisations. The figures confirmed the strength of the underlying infrastructure project market and highlighted the increased level of activity within the business. We have revised our forecasts and now expect a special dividend payment of 5.3p/share (6.5% of £299m), offering a yield on the final and special payments combined, of c 3.3%. We expect further NAV growth in FY17 and beyond, and believe JLG’s rating is undemanding.

Increased investment realisations and commitments

So far in FY17, JLG has completed realisations of £299m (previous guidance £200m) and made investment commitments of £340m (guidance of £200m). We have revised our financial forecasts for FY17 to reflect these updated figures and a small reduction in the pension deficit (from £30m to £22m). Due to the increased level of realisations, we have increased the ‘special’ element (based on 6.5% of £299m) of our forecast for JLG’s DPS for FY17. JLG has guided towards a ‘special’ payment of 5-10% of realisations and in previous years has paid c 7.5%. We assume, given the scale of disposals in FY17, JLG may pay a more conservative percentage of realisations, and now forecast final and special DPS payments of 3.81p and 5.30p, respectively. Our forecast for investment and realisations in FY18 is unchanged (£200m), although with an investment pipeline of c £2bn and commitments running at £350m, our assumptions for FY18 face upward pressure.

To read the entire report Please click on the pdf File Below:

Related Articles

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Shares of Etsy (NASDAQ:ETSY) are down approximately 7% since the company reported earnings on February 19. Concerns over slowing growth are overriding revenue and earnings that...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.