- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Is TOTAL S.A. (TOT) A Great Stock For Value Investors?

Value investing is easily one of the most popular ways to find great stocks in any market environment. After all, who wouldn’t want to find stocks that are either flying under the radar and are compelling buys, or offer up tantalizing discounts when compared to fair value?

One way to find these companies is by looking at several key metrics and financial ratios, many of which are crucial in the value stock selection process. Let’s put TOTAL S.A. (NYSE:TOT) stock into this equation and find out if it is a good choice for value-oriented investors right now, or if investors subscribing to this methodology should look elsewhere for top picks:

PE Ratio

A key metric that value investors always look at is the Price to Earnings Ratio, or PE for short. This shows us how much investors are willing to pay for each dollar of earnings in a given stock, and is easily one of the most popular financial ratios in the world. The best use of the PE ratio is to compare the stock’s current PE ratio with: a) where this ratio has been in the past; b) how it compares to the average for the industry/sector; and c) how it compares to the market as a whole.

On this front, TOTAL S.A. has a trailing twelve months PE ratio of 14.2, as you can see in the chart below:

This level actually compares pretty favorably with the market at large, as the PE for the S&P 500 stands at about 21.1. If we focus on the long-term PE trend, TOTAL S.A.’s current PE level puts it above its midpoint over the past five years.

Further, the stock’s PE also compares favorably with the Zacks Oil and Gas - Integrated - International industry’s trailing twelve months PE ratio, which stands at 22.3. At the very least, this indicates that the stock is relatively undervalued right now, compared to its peers.

We should also point out that TOTAL S.A. has a forward PE ratio (price relative to this year’s earnings) of just 13.8, so it is fair to say that a slightly more value-oriented path may be ahead for TOTAL S.A. stock in the near term too.

P/CF Ratio

An often overlooked ratio that can still be a great indicator of value is the price/cash flow metric. This ratio doesn’t take amortization and depreciation into account, so can give a more accurate picture of the financial health in a business. This is a preferred metric to some valuation investors because cash flows are (a) generally less prone to manipulation by the company’s management, and (b) are less affected by variation in accounting policies between different companies.

The ratio is generally applied to find out whether a company’s stock is overpriced or underpriced with reference to its cash flows generation potential compared with its competitors. However, it is not commonly used for cross-industry comparison, as the average price to cash flow ratio varies from industry to industry.

In this case, TOTAL S.A.’s P/CF ratio of 6 is lower than the Zacks Computer-Mini industry average of 7.1, which indicates that the stock is undervalued in this respect.

Broad Value Outlook

In aggregate, TOTAL S.A. currently has a Value Score of A, putting it into the top 20% of all stocks we cover from this look. This makes TOTAL S.A. a solid choice for value investors, and some of its other key metrics make this pretty clear too.

For example, its P/CF ratio (another great indicator of value) comes in at 6, which is slightly better than the industry average of 6.8. Clearly, TOT is a solid choice on the value front from multiple angles.

What About the Stock Overall?

Though TOTAL S.A. might be a good choice for value investors, there are plenty of other factors to consider before investing in this name. In particular, it is worth noting that the company has a Growth Score of C and a Momentum Score of C. This gives TOT a Zacks VGM score — or its overarching fundamental grade — of B. (You can read more about the Zacks Style Scores here >>)

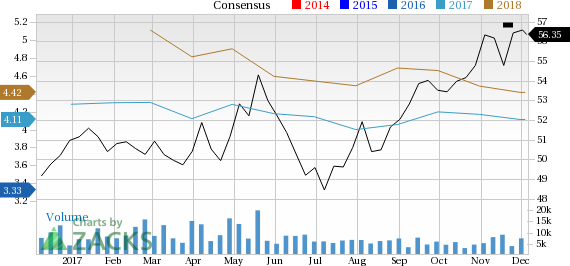

Meanwhile, the company’s recent earnings estimates have been little discouraging. The current year has seen one estimate going higher in the past sixty days compared to four lower. This has had a significant impact on the consensus estimate as the current year consensus estimate has declined by 2.1% in the past two months. You can see the consensus estimate trend and recent price action for the stock in the chart below:

TOTAL S.A. Price and Consensus

This bearish trend is why the stock has just a Zacks Rank #3 (Hold) and why we are looking for in-line performance from the company in the near term.

Bottom Line

TOTAL S.A. is an inspired choice for value investors, as it is hard to beat its incredible lineup of statistics on this front. Moreover, a strong industry rank (Top 12% out of more than 250 industries) further strengthens its growth potential. In fact, over the past six months, the industry has clearly outperformed the broader market, as you can see below:

So, value investors might want to wait for estimates and analyst sentiment to turn around in this name first, but once that happens, this stock could be a compelling pick.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

TotalFinaElf, S.A. (TOT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.