- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Innophos (IPHS) Q4 Earnings Lag Estimates, Sales Up Y/Y

Innophos Holdings, Inc. (NASDAQ:IPHS) posted a loss of $11.3 million or 58 cents per share in fourth-quarter 2017, compared with a profit of $9.4 million or 47 cents a year ago. The bottom line in the reported quarter was hit by tax reform charges of $17 million.

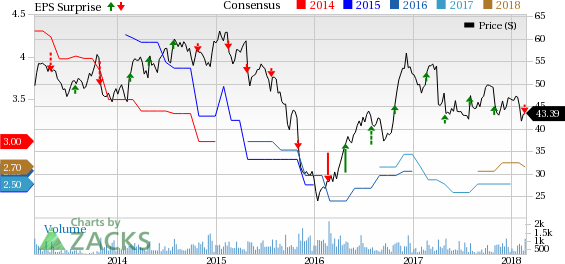

Barring one-time items, the company’s adjusted earnings were 52 cents per share in the quarter, which trailed the Zacks Consensus Estimate of 56 cents.

The company raked in net sales of $193.1 million in the reported quarter, up around 15% year over year. Sales were driven by strong gains in the Food, Health and Nutrition (FHN) segment on the back of Novel Ingredients and NutraGenesis acquisitions.

FY17 Results

For 2017, profit was $22.4 million or $1.13 per share, down 53% from around $48 million or $2.44 per share recorded a year ago.

Net sales for the full year edged down roughly 1% year over year to $722 million.

Segment Highlights

Revenues from the FHN segment climbed 29% year over year to $116 million in the fourth quarter, driven by contribution from acquisitions.

The Industrial Specialties (IS) division recorded revenues of $64 million in the quarter, up 4% year over year. Sales were supported by higher volumes that more than offset pricing pressure in technical grade products.

Other sales fell 16% year over year to $13 million on lower volumes to low-value fertilizer markets.

Financials

Innophos ended 2017 with cash and cash equivalents of $28.8 million, down 46% year over year. Long-term debt was $310 million, up 68% year over year. Net cash provided by operating activities for 2017 was $80.6 million, a roughly 42% year over year decline.

Outlook

Moving ahead, Innophos expects revenues to grow 12-14% in 2018 on contributions from Novel Ingredients and NutraGenesis acquisitions, favorable growth in the nutrition end-markets and stabilization in the base business.

The company expects earnings per share (on a reported basis) to more than double in 2018. It also envisions adjusted earnings per share and adjusted EBITDA to grow 10-14% and 15-17%, respectively. The guidance includes an improvement in earnings per share of roughly 16 cents in full-year 2018 due to lower effective tax rate.

Moreover, the company is progressing with its proactive selling price increase program (implemented in fourth-quarter 2017) which is expected to offset the impact of anticipated increases in input cost in 2018. Innophos also remains on track to achieve $4 million of expected acquisition cost synergies this year, which is expected to enhance the adjusted EBITDA margin profile of its FHN unit.

Price Performance

Innophos’ shares are down 17.7% over a year, underperforming the gain of roughly 19.7% recorded by the industry over the same time frame.

Zacks Rank and Stocks to Consider

Innophos currently carries a Zacks Rank #4 (Sell).

Better-ranked companies in the basic materials space include Olympic Steel, Inc. (NASDAQ:ZEUS) , Methanex Corporation (NASDAQ:MEOH) and The Mosaic Company (NYSE:MOS) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Olympic Steel has an expected long-term earnings growth rate of 7.5%. Its shares rallied around 39% over the past six months.

Methanex has an expected long-term earnings growth rate of 15%. Its shares have gained roughly 28% over the past six months.

Mosaic has an expected long-term earnings growth rate of 9.5%. Its shares have rallied around 43% over the past six months.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Methanex Corporation (MEOH): Free Stock Analysis Report

Innophos Holdings, Inc. (IPHS): Free Stock Analysis Report

The Mosaic Company (MOS): Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.