- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Illinois Tool (ITW) Beats Q4 Earnings & Sales, Ups '18 View

Industrial tool maker Illinois Tool Works Inc. (NYSE:ITW) kept its earnings streak alive in fourth-quarter 2017, pulling off a positive earnings surprise of 4.9%. Results were primarily driven by sales growth, benefits from enterprise initiatives and 2.4% fall in the diluted share count due to the company’s active share buyback activities.

Earnings, excluding roughly $1.92 per share of tax charge in the quarter, came in at $1.70 per share, topping the Zacks Consensus Estimate of $1.62. The bottom line increased roughly 17% from the year-ago tally of $1.45.

For 2017, the company’s earnings were $6.59 per share, lagging the Zacks Consensus Estimate of $6.70. However, the figure grew 16% year over year. As noted, the bottom-line results excluded roughly 17 cents benefit accrued from a legal settlement and $1.90 per share of tax charge.

Revenues Driven By Organic and Forex Gains

Revenues in the quarter totaled $3,629 million, reflecting growth of 7% from the year-ago tally. The improvement was driven by 3.7% organic gains and 3.2% positive impact of foreign currency movements, partially offset by 0.1% negative impact from acquisitions/divestitures.

Also, the top line surpassed the Zacks Consensus Estimate of $3.55 billion.

Illinois Tool Works reports its revenues under the segments discussed below:

In the quarter, Test & Measurement and Electronics’ revenues increased 11.7% year over year to $545 million. Revenues from Automotive OEM (Original Equipment Manufacturer) grew 7% to $828 million. Food Equipment generated revenues of $548 million, increasing 3% year over year.

Welding revenues came in at $388 million, growing 7.4% year over year. Construction Products’ revenues were up 6.7% to $412 million while revenues of $487 million from Specialty Products reflected growth of 6.9%. Polymers & Fluids’ revenues of $427 million increased 4.9% year over year.

For 2017, the company’s revenues totaled approximately $14,314 million, increasing 5.3% year over year. Also, the figure surpassed the Zacks Consensus Estimate of $14.2 billion.

Margin Profile Improves

In the quarter, Illinois Tool Works’ cost of sales increased 5.9% year over year, representing 58.5% of total revenues compared with 59% in the year-ago quarter. Selling, administrative, and research and development expenses, as a percentage of total revenues, came in at 16.7%.

Operating margin improved 160 basis points (bps) year over year to 23.4%, driven by roughly 140 bps contributions from enterprise initiatives.

Cash Position Strong, Debt Increases Slightly

Exiting the fourth quarter, Illinois Tool Works had cash and cash equivalents of approximately $3,094 million, up from $2,785 million in the previous quarter. Long-term debt was $7,478 million versus $7,439 million in the previous quarter.

The company generated net cash of $695 million from its operating activities in the quarter, up 4.7% year over year. Capital expenditure on purchase of plant and equipment totaled $78 million. Free cash flow was $617 million, reflecting a conversion rate (as a percentage of adjusted net income) of 106%.

Outlook

For 2018, Illinois Tool Works increased its GAAP earnings guidance to $7.45-$7.65 per share, reflecting 40 cents growth at mid-point. The increase reflects the positive impact of tax rate cuts to 25-26% and forex gains.

For first-quarter 2018, GAAP earnings per share are expected within $1.80-$1.90. Organic revenues are expected to be 3-4%.

In addition to these, the company declared its intention to increase the dividend payout rate from 43% to 50% of free cash in August 2018. However, this increment is still subject to the company’s board approval.

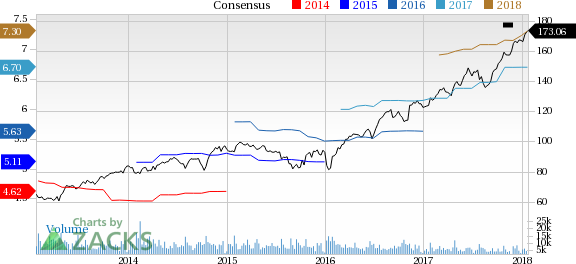

Illinois Tool Works Inc. Price and Consensus

Illinois Tool Works Inc. (ITW): Free Stock Analysis Report

Sun Hydraulics Corporation (SNHY): Free Stock Analysis Report

EnPro Industries (NPO): Free Stock Analysis Report

Colfax Corporation (CFX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.