Huntsman Corporation (NYSE:) announced a deal to acquire CVC Thermoset Specialties, a North American specialty chemical producer that serves the industrial composites, adhesives and coatings markets.

CVC Thermoset Specialties is part of Emerald Performance Materials LLC and has annual revenues of roughly $115 million, with two production facilities located in Akron, OH, and Maple Shade, NJ.

Per the terms of the deal, Huntsman is expected to pay $300 million in the all-cash transaction financed from available liquidity, subject to customary closing adjustments.

The purchase price reflects an adjusted EBITDA multiple of around 10 times or between roughly 7-8 times pro forma for synergies based on 2019. Notably, the transaction is slated to close in the middle of 2020.

Per Huntsman, the CVC Thermoset Specialties acquisition adds an important complementary technology breadth to its portfolio of Advanced Materials and the latter’s unique products can make systems, using Huntsman’s class-leading epoxy-based material, even tougher, stronger, and more robust. The buyout will also improve Huntsman’s ability to generate differentiation in customers' applications, especially through its strong formulation business. Notably, Huntsman anticipates generating substantial synergies within two years.

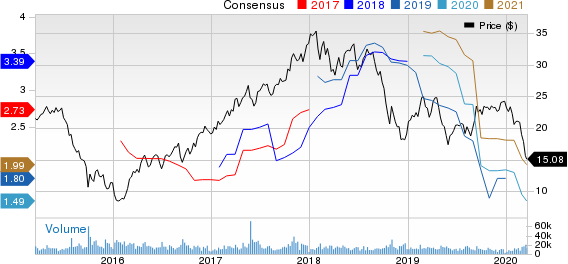

The company's shares have lost 32.5% in the past year compared with the

industry’s 46.5% decline.

On the fourth-quarter earnings call, Huntsman stated that it will remain focused on investing in its downstream and specialty platforms in 2020 through acquisitions and organically. It will also remain balanced in its capital allocation, including opportunistic share repurchases and maintaining a competitive dividend payout.

For the Polyurethanes unit, the company expects demand headwinds in several major markets and regions in 2020. It also anticipates differentiated MDI (methylene diphenyl diisocyanate) margins to be stable.

For Performance Products, Huntsman sees growth in performance amines. It also expects weak maleic anhydride demand, with stable margins.

For Advanced Materials, the company expects stable overall margins amid

weakness in industrial markets and demand headwind in aerospace.

For the Textile Effects unit, Huntsman expects growth in specialty products. It also expects stable volumes and improved margins.

Huntsman Corporation Price and Consensus

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are Franco-Nevada Corporation (TSX:) , Barrick Gold Corporation (NYSE:) and NovaGold Resources Inc. (NYSE:) .

Barrick Gold currently has a Zacks Rank #2 (Buy) and a projected earnings growth rate of 43.1% for 2020. The company’s shares have rallied 21% in a year.

NovaGold has a projected earnings growth rate of 11.1% for 2020. It currently carries a Zacks Rank #2. The company’s shares have gained 86% in a year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

See these 7 breakthrough stocks now>>

See these 7 breakthrough stocks now>>Huntsman Corporation (HUN) announced a deal to acquire CVC Thermoset Specialties, a North American specialty chemical producer that serves the industrial composites, adhesives and coatings markets.

CVC Thermoset Specialties is part of Emerald Performance Materials LLC and has annual revenues of roughly $115 million, with two production facilities located in Akron, OH, and Maple Shade, NJ.

Per the terms of the deal, Huntsman is expected to pay $300 million in the all-cash transaction financed from available liquidity, subject to customary closing adjustments.

The purchase price reflects an adjusted EBITDA multiple of around 10 times or between roughly 7-8 times pro forma for synergies based on 2019. Notably, the transaction is slated to close in the middle of 2020.

Per Huntsman, the CVC Thermoset Specialties acquisition adds an important complementary technology breadth to its portfolio of Advanced Materials and the latter’s unique products can make systems, using Huntsman’s class-leading epoxy-based material, even tougher, stronger, and more robust. The buyout will also improve Huntsman’s ability to generate differentiation in customers' applications, especially through its strong formulation business. Notably, Huntsman anticipates generating substantial synergies within two years.

The company's shares have lost 32.5% in the past year compared with the industry’s 52% decline.

On the fourth-quarter earnings call, Huntsman stated that it will remain focused on investing in its downstream and specialty platforms in 2020 through acquisitions and organically. It will also remain balanced in its capital allocation, including opportunistic share repurchases and maintaining a competitive dividend payout.

For the Polyurethanes unit, the company expects demand headwinds in several major markets and regions in 2020. It also anticipates differentiated MDI (methylene diphenyl diisocyanate) margins to be stable.

For Performance Products, Huntsman sees growth in performance amines. It also expects weak maleic anhydride demand, with stable margins.

For Advanced Materials, the company expects stable overall margins amid weakness in industrial markets and demand headwind in aerospace.

For the Textile Effects unit, Huntsman expects growth in specialty products. It also expects stable volumes and improved margins.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are Franco-Nevada Corporation (FNV), Barrick Gold Corporation (GOLD) and NovaGold Resources Inc. (NG).

Franco-Nevada has a projected earnings growth rate of 24.2% for 2020. The company’s shares have rallied 40% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Barrick Gold currently has a Zacks Rank #2 (Buy) and a projected earnings growth rate of 43.1% for 2020. The company’s shares have rallied 21% in a year.

NovaGold has a projected earnings growth rate of 11.1% for 2020. It currently carries a Zacks Rank #2. The company’s shares have gained 86% in a year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Franco-Nevada Corporation (FNV): Free Stock Analysis ReportBarrick Gold Corporation (GOLD): Free Stock Analysis ReportHuntsman Corporation (HUN): Free Stock Analysis ReportNovagold Resources Inc. (NG): Free Stock Analysis ReportOriginal post

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.