We have recently issued an updated research report on Huntington Ingalls Industries, Inc. (NYSE:HII) . The company’s third-quarter 2018 earnings of $5.29 per share surpassed the Zacks Consensus Estimate by 27.8%.

Total revenues came in at $2.08 billion, which exceeded the Zacks Consensus Estimate by 8.3%. The metric also improved on a year-over-year basis. Additionally, the company received new orders worth $2.8 billion in the third quarter.

In the United States, Huntington Ingalls is the largest military shipbuilder. Its portfolio comprises high-profile products like nuclear-powered ships such as aircraft carriers and submarines as well as non-nuclear ships like surface combatants, expeditionary warfare/amphibious assault and coastal defense surface ships.

Factors Influencing the Stock

Huntington Ingalls kick started 2018 on a solid note, with 25 ships under contract for construction by first-quarter end. Coming to third-quarter updates, the company’s CVN 79 Kennedy achieved approximately 84% structural and 53% overhaul completion. Moreover, it delivered NSC 7 Kimball in September, and is striving to complete test and deliver NSE 8 Midget in early 2019.

Huntington Ingalls’ SSN 791 Delaware was launched in November 2018 and is expected to be delivered in the first half of 2019. Such notable programs should boost the company’s top line, on successful completion.

Furthermore, the shipbuilding business outlook remains strong, given the fiscal 2019 defense budget’s plan to spend $18.3 billion on Shipbuilding. No doubt, such an expansionary spending proposal will prove beneficial to Huntington Ingalls.

On the flip side, uncertain and unpredictable U.S. defense spending levels as well as any reduction in shipbuilding activity by the U.S. Navy may result in fewer contracts to the same fixed number of shipyards.

Notably, fleet size has been reduced from 566 ships in 1989 to 280 ships as of Dec 31, 2017. Consequently, putting pressure on employment in the shipbuilding industry and hurting Huntington Ingalls’ top line.

As of Sep 30, 2018, Huntington Ingalls had $1.3 billion debt. Such debt levels expose the company to the risk of higher interest rates on borrowings under its Credit Facility, which are subject to variable rates of interest. The current market situation in the United States being in favor of increasing interest rates might prove detrimental to the company.

Zacks Rank & Key Picks

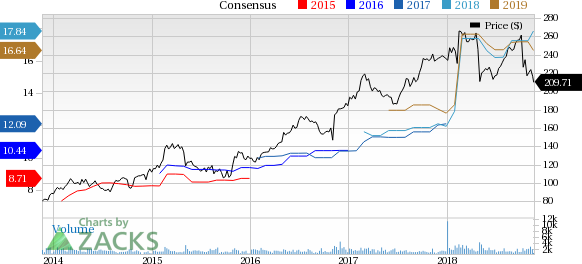

Huntington Ingalls currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks from the same industry are Boeing (NYSE:BA) , Lockheed Martin (NYSE:LMT) and Engility Holdings (NYSE:EGL) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Boeing delivered an average positive earnings surprise of 28.01% in the last four quarters. The Zacks Consensus Estimate for 2018 earnings climbed 3% to $15.05 over the past 90 days.

Lockheed Martin delivered an average positive earnings surprise of 13.92% in the trailing four quarters. The Zacks Consensus Estimate for 2018 earnings moved 2.9% north to $17.51 over the past 90 days.

Engility Holdings delivered an average positive earnings surprise of 19.98% in the preceding four quarters. The Zacks Consensus Estimate for 2018 earnings moved up 4% to $2.10 over the past 90 days.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

The Boeing Company (BA): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Engility Holdings, Inc. (EGL): Free Stock Analysis Report

Original post

Zacks Investment Research