- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Hibbett (HIBB) Surges 46.7% In 3 Months: What Lies Ahead?

Hibbett Sports Inc. (NASDAQ:HIBB) has been putting up a good show lately driven by robust earnings trend, growth of omni-channel capabilities, improved Rewards members, small market strategy and inventory management initiatives.

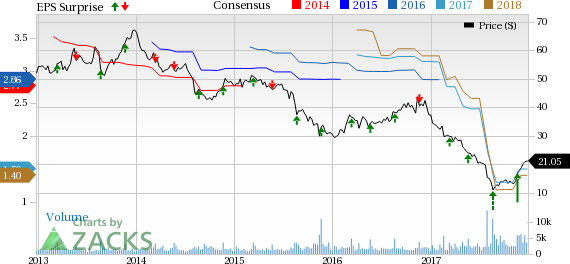

The cumulative effect of the company’s strategies and strong third-quarter fiscal 2018 is visible in its stock performance. Notably, the stock has gained 46.7% in the past three months, outperforming the industry’s growth of 4.7%. Additionally, the stock has improved 41.8% since reporting third-quarter fiscal 2018 results on Nov 17.

This has helped the stock improve significantly, and attain a Zacks Rank #1 (Strong Buy) and a VGM Score of A. That said, let’s find out the reasons behind the stock’s upsurge.

Robust Surprise Trend

Much of the recent momentum in Hibbett’s stock price can be attributed to robust earnings trend in recent quarters and a splendid performance in third-quarter fiscal 2018. The company retained positive earnings momentum in the fiscal third quarter, which marked its third straight bottom-line beat. Moreover, the company reversed its trend of having missed sales estimates in nine of the past 10 quarters. Results were driven by improvement in the company’s footwear and apparel businesses, alongside strong e-commerce sales, which now accounts for nearly 5% of total sales.

Encouraging Outlook Drives Estimates

Following the robust quarter, the company substantially raised guidance for fiscal 2018. The company now envisions earnings for fiscal 2018 in the range of $1.42-$1.50 per share, up significantly from the previous forecast of $1.25-$1.35.

Consequently, the company’s estimates witnessed an uptrend in the last 30 days. The Zacks Consensus Estimate for fourth quarter and fiscal 2018 moved up by 2 cents each to 27 cents per share and $1.44 per share, respectively.

Growth Initiatives Bode Well

While the external environment remains challenging, Hibbett is encouraged by the progress it is making on internal initiatives, including the launch of new e-commerce site and re-launch of loyalty program. The company observes that initial results from the website launch have exceeded expectations, while the new loyalty program has been well received by customers. E-commerce contributed 5% to net sales in fiscal third-quarter benefiting from the company’s early marketing plan and strong conversion from online traffic.

Additionally, its ongoing marketing initiatives boosted sales by improving traffic and increased loyalty members, while also enhancing site navigation strength and product assortments. Rewards jumped to 57% of net sales in fiscal third-quarter, compared with 47% last year. Further, revenues from Rewards members improved 24% year over year. Going forward, the company anticipates its small market strategy along with the growth of omni-channel capabilities to enrich customers' experience, consequently positioning Hibbett well for long-term growth.

Store Expansion & Inventory Management Strategies

Hibbett is gaining from small market strategy as it continues to strengthen presence across the country. The company targets expansion in markets where it is needed and which offer increased potential for future growth. The company reiterated target of growing to over 1,500 stores in undeserved markets. In third-quarter fiscal 2018, Hibbett introduced 13 new stores, expanded one high-performing store and shut down 11 underperforming ones. With this, the company operated 1,082 stores in 35 states as of Oct 28, 2017.

Additionally, the company is stringently working on inventory management initiatives despite a challenging environment. Overall, total inventory declined 9.2% from last year and 10.5% on per store basis at the end of fiscal third-quarter.

Possible Deterrents – Strained Margins

Though the company’s fundamentals look strong, it has been witnessing strained margins for quite a while now. The company’s margins continue to be under pressure due to increased promotions and markdowns to maintain lower inventory levels, along with higher freight and SG&A expenses. In third-quarter fiscal 2018, the company’s gross margin marked the fifth straight decline, while operating margins contracted for the fourth quarter in a row.

Looking ahead, we expect the margins to remain under pressure given the persistence of a highly promotion retail environment during the holiday season.

Looking for Some Trending Picks? Look at These

Tractor Supply Company (NASDAQ:TSCO) has a long-term earnings growth rate of 14% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Five Below, Inc. (NASDAQ:FIVE) has a long-term earnings growth rate of 26.5% and a superb earnings surprise history. Further, the company carries a Zacks Rank #2.

KAR Auction Services, Inc (NYSE:KAR) , which carries a Zacks Rank #2, has delivered positive earnings surprises in the past three quarters. It has a long-term earnings growth rate of 13.5%.

Zacks Editor-in-Chief Goes ""All In"" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Tractor Supply Company (TSCO): Free Stock Analysis Report

Hibbett Sports, Inc. (HIBB): Free Stock Analysis Report

KAR Auction Services, Inc (KAR): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.