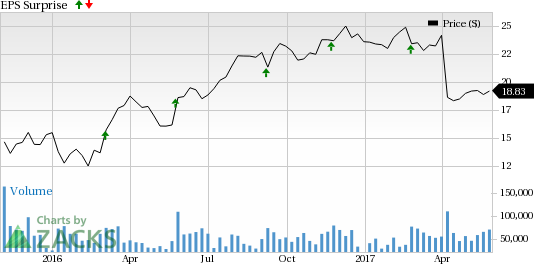

Hewlett Packard Enterprise Company (NYSE:HPE) is set to report second-quarter fiscal 2017 results on May 31. The company posted a positive earnings surprise of 2.3% last quarter.

Factors to Consider

Hewlett Packard Enterprise is witnessing a negative trend in its earnings growth rate. In April, management lowered its earnings guidance to the range of $1.46–$1.56 per share from $1.88–$1.98 for fiscal 2017.

Furthermore, we remain increasingly cautious about the company’s near-term prospects due to the three main challenges which it highlighted in the last quarterly report. The company mentioned three major challenges, heightened pressure from unfavorable currency exchange movements, increased commodities pricing and some near-term execution issues, which are likely to affect its overall performance in the near term.

Also, macroeconomic challenges and tepid IT spending remain near-term concerns. Competition from peers adds to its woes.

Earnings Whispers

Our proven model does not conclusively show that Hewlett Packard Enterprise will beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. This is not the case here, as you will see below.

Zacks ESP: Earnings ESP for Hewlett Packard Enterprise is 0.00% since the Most Accurate estimate of 35 cents comes in line with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Hewlett Packard Enterprise’s carries a Zacks Rank #5 (Strong Sell). Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are a couple of companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Teradyne, Inc. (NYSE:TER) , with an Earnings ESP of +2.38% and Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Lam Research Corporation (NASDAQ:LRCX) , with an Earnings ESP of +1.66% and a Zacks Rank #1.

DST Systems, Inc. (NYSE:DST) , with an Earnings ESP of +0.64% and a Zacks Rank #2.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more.

Click here for a peek at this private information >>

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

DST Systems, Inc. (DST): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Teradyne, Inc. (TER): Free Stock Analysis Report

Original post

Zacks Investment Research