- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Buy Arrow Electronics (ARW) Stock

Arrow Electronics, Inc. (NYSE:ARW) is currently a well-performing technology stock and a rise in share price and strong fundamentals signal its bullish run. Therefore, if you haven’t taken advantage of the share price appreciation yet, it’s time you add the stock to your portfolio.

The company has performed extremely well so far this year and has the potential to carry on the momentum in the near term.

Here are a few reasons why the stock is worth considering

Share Price Appreciation

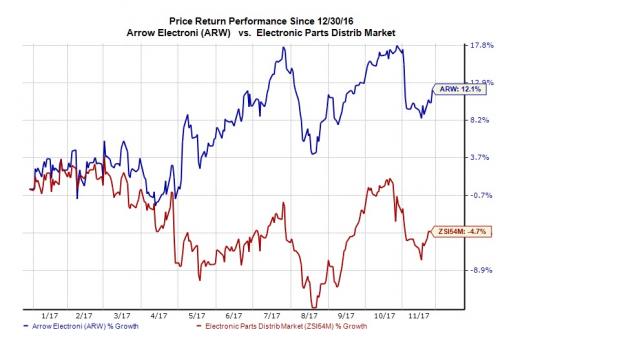

A look at the company’s price trend reveals that the stock has had an impressive run on the bourse year to date. Arrow has gained 12.1% against the industry’s loss of 4.7%.

Solid Rank & VGM Score: Arrow currently carries a Zacks Rank #2 (Buy) and has a VGM Score of B. Our research shows that stocks with a VGM Score of A or B when combined with a Zacks Rank #1 (Strong Buy) or #2 offer the best investment opportunities for investors. Thus, the company appears to be a compelling investment proposition at the moment.

Northward Estimate Revisions: Four estimates for the current year moved north over the past 30 days versus no southward revisions, reflecting analysts’ confidence in the company. Over the same period, the Zacks Consensus Estimate for the current year increased 0.5%.

Positive Earnings Surprise History: Arrow has an impressive earnings surprise history. The company outpaced the Zacks Consensus Estimate in two of the trailing four quarters, delivering a positive average earnings surprise of 0.4%.

Arrow Electronics, Inc. Price and EPS Surprise

Strong Growth Prospects: The Zacks Consensus Estimate for 2017 earnings of $7.35 per share reflects year-over-year growth of 10.9%. Moreover, earnings are expected to register 12.4% growth in 2018. The stock has long-term expected earnings per share growth rate of 11.4%.

Growth Drivers: The company’s continuous efforts to maximize consumer satisfaction have resulted in original equipment manufacturers, contract manufacturers and commercial customers selecting Arrow’s distribution channels for marketing products. Further, Arrow’s core strength in providing best-in-class services and easy-to-acquire technologies are anticipated to prove conducive to growth in the quarters ahead.

Additionally, Arrow’s persistent acquisitions enable it to enter markets, diversify and broaden product portfolio along with maintaining its leading position, thereby significantly contributing to the revenue stream. Incremental sales from strategic acquisitions such as Computerlinks are anticipated to boost the top line, going forward.

Other Stocks to Consider

Stocks worth considering in the broader technology sector include Micron Technology, Inc. (NASDAQ:MU) , Intel Corporation (NASDAQ:INTC) and Jabil Inc. (NYSE:JBL) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings per share growth rate for Micron, Intel and Jabil is projected to be 10%, 8.4% and 12%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Arrow Electronics, Inc. (ARW): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Jabil Circuit, Inc. (JBL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Pretty rough day out there—S&P 500 down about 1.8%, Nasdaq down around 2.2%, and small caps hit even harder, dropping 2.7%. However, the S&P 500 is approaching a crucial...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.