- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Add Garmin (GRMN) To Your Portfolio

Garmin Ltd. (NASDAQ:GRMN) is currently one of the top-performing stocks in the technology sector and an increase in share price and strong fundamentals signal its bullish run. Therefore, if you haven’t taken advantage of the share price appreciation yet, it’s time you add the stock to your portfolio.

The company has performed well this year and has the potential to carry on the momentum in the near term.

Why an Attractive Pick?

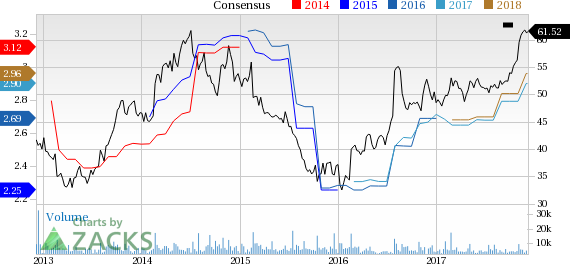

Share Price Appreciation: A glimpse of the company’s price trend shows that the stock has had an impressive run on the bourses year to date. Garmin has returned 62.7% compared with the industry’s rally of 47.6%.

Solid Rank: Garmin sports a Zacks Rank #1 (Strong Buy). Thus, the company appears to be a compelling investment proposition at the moment.

Northward Estimate Revisions: Nine estimates for the current year have moved north over the past 60 days against no southward revisions, reflecting analysts’ confidence in the company. Over the same period, the Zacks Consensus Estimate for the current year has increased 4.0%. Also, for 2019, the Zacks Consensus Estimate has inched up 5.0% to $2.96.

Positive Earnings Surprise History: Garmin has an impressive earnings surprise history. The company outpaced the Zacks Consensus Estimate in each of the trailing four quarters, with an average positive earnings surprise of 15.9%.

Strong Growth Prospects: The company’s Zacks Consensus Estimate for fiscal 2018 earnings of $2.90 reflects year-over-year growth of 2.47%. Moreover, earnings are expected to register 2.11% growth in 2019. The stock has long-term expected earnings per share growth rate of 8.4%.

Growth Drivers

Accelerated adoption of Garmin’s wearable products has been a huge positive for the company.

During the third quarter, the company launched Descent dive watch, Impact bat swing sensor and TXi series of touchscreen flight displays with engine-monitoring solutions. The company also unveiled new wearables including vívoactive 3, vívomove HR, vívosport and vívofit jr, all of which are expected to contribute to the company’s top-line growth.

Moreover, its partnership with Amazon (NASDAQ:AMZN) to launch Garmin Speak, a device that brings full range of Alexa skills inside cars, is also a key driver. The deal will equip Alexa with mapping capabilities, which is absent in other in-car Alexa solutions (such as those from Ford).

During the earnings call, Garmin raised its guidance for full-year 2017, which indicates strong growth in the near future. Management expects revenues of $3.07 billion compared with the prior expectation of $3.04 billion. Also, it expects pro forma earnings of $2.90 per share compared with $2.80 per share expected earlier. Currently, the Zacks Consensus Estimate for revenues and earnings for 2017 is pegged at $3.07 billion and $2.90 per share, respectively.

We believe that increasing investments in wearable gadgets such as outdoor watches and marine cameras will help Garmin to counter the decline in sales of its traditional automobile navigation devices.

Other Stocks to Consider

A few other top-ranked stocks in the broader technology sector are Groupon Inc. (NASDAQ:GRPN) , PetMed Express, Inc. (NASDAQ:PETS) and SMART Global Holdings, Inc. (NASDAQ:SGH) , each carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings per share growth rate for Groupon, PetMed Express and SMART Global is projected at 10%, 10% and 15%, respectively.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Groupon, Inc. (GRPN): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

SMART Global Holdings, Inc. (SGH): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.