- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Add Broadridge (BR) To Your Portfolio

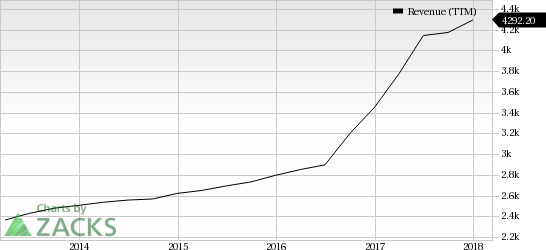

Broadridge Financial Solutions Inc. (NYSE:BR) has been investors’ favorite for quite some time as evident from its price momentum. The stock has soared 57.6% over the past year, substantially outperforming the 8.7% gain of the industry it belongs to.

Let’s delve deeper and take a look at the key aspects, aiding the company’s performance.

The stock has a stellar record of positive earnings surprises, having beaten the Zacks Consensus Estimate in three of the last four quarters, with an average positive surprise of 21.2%.

In the last quarterly results, the company reported non-GAAP earnings of 79 cents per share (excluding acquisition and amortization related expenses), surpassing the Zacks Consensus Estimate of 58 cents. Also, quarterly earnings increased over two-fold on a year-over-year basis.

A higher level of event-driven activities resulted in a 13.5% year-over-year increase of revenues to $1.013 billion, which came ahead of the Zacks Consensus Estimate of $954 million. Notably, the company’s fee revenues soared a whopping 227% to $97 million during the quarter, primarily due to higher proxy contest and mutual-fund proxy activities.

The company generates recurring revenues and a good percentage of its business comes from recurring fees, which include contributions from the Net New Business and acquisitions related synergies. We believe, higher recurring revenues, internal growth, the contribution from Net New Business, increased distribution revenues and acquisition-related synergies are also being the top-line drivers for the company.

Notably, Broadridge also positively revised its fiscal 2018 outlook. The company now projects revenue growth to be 2-4% compared with the earlier guidance of 2-3%. Adjusted earnings are now projected to surge 27-31%, up from the previous expectation of 15-19%. Management also raised free cash flow guidance range to $500-$550 million from $400-$450 million.

The rise in the guidance keeps us optimistic about the near-term results. We are also positive about the company’s product launches, share repurchase programs and dividend-paying initiatives. Moreover, its business relations with the likes of Accenture (NYSE:ACN) and Amazon (NASDAQ:AMZN) Web Services are looking promising for the long term.

Also, Broadridge has a Growth Style Score of A, which indicates that the stock is more suitable for growth investors. The stock has a long-term expected earnings per share growth rate of 10% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Keeping these positives in mind, we believe that Broadridge is one such stock that deserves a place in investors’ portfolio.

Other Key Picks

Other top-ranked stocks in the broader technology sector include Paycom Software, Inc. (NYSE:PAYC) and NVIDIA Corporation (NASDAQ:NVDA) , both sporting a Zacks Rank #1.

Long-term EPS growth rate for Paycom and NVIDIA are projected at 25.8% and 10.3%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Paycom Software, Inc. (PAYC): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Accenture PLC (ACN): Free Stock Analysis Report

Broadridge Financial Solutions, Inc. (BR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.