- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's How Hibbett (HIBB) Looks Just Ahead Of Q4 Earnings

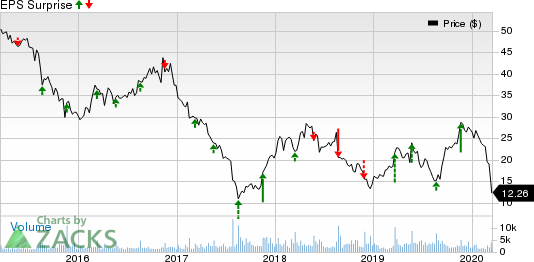

Hibbett Sports, Inc. (NASDAQ:HIBB) is slated to release fourth-quarter fiscal 2020 results on Mar 20, before market open.

Notably, the company delivered a positive earnings surprise of 153.9% in the last reported quarter. Moreover, its bottom line outpaced estimates by 57.2%, on average, over the trailing four quarters.

The Zacks Consensus Estimate for fiscal fourth-quarter earnings is pegged at 62 cents, which suggests an increase of 8.8% from the year-ago period’s reported figure. The consensus estimate has been unchanged in the past 30 days. Moreover, the consensus mark for sales is pegged at $299 million, indicating a decline of 2.3% from the year-ago reported figure.

Key Factors to Note

Hibbett’s fiscal fourth-quarter sales are expected to reflect gains from solid omni-channel initiatives, including store rationalization, e-commerce and loyalty program. Notably, its focus on increasing customer base through e-commerce and selective store expansion has been supporting its strong position in the industry.

The company has enhanced omni-channel experience for customers, with six ways to shop. These include shopping at physical stores, traditional e-commerce with home delivery, buy online and pick up in store, reserve online and pick up in store, same-day delivery, and using app to win the right to purchase coveted launch shoes. Gains from these endeavors are likely to get reflected in the company’s top-line results for the to-be-reported quarter.

In addition, Hibbett’s comparable store sales (comps) are expected to gain from the aforementioned efforts. Strong brick-and-mortar and e-commerce businesses have been the key contributors to comps growth over the past few quarters. Innovative launches in categories like footwear, activewear and accessories have also been growth drivers.

However, Hibbett has been witnessing higher SG&A expenses for a while now. In the last earnings call, management predicted the addition of expenses related to the City Gear acquisition to deleverage SG&A expenses, on a GAAP basis, in fiscal 2020. The company expects the SG&A expense rate to increase 60-80 bps in fiscal 2020 compared with 50-70 bps rise mentioned earlier. This is also likely to have increased SG&A expenses in the fiscal fourth quarter.

Zacks Model

Our proven model does not conclusively predict an earnings beat for Hibbett this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Although Hibbett carries a Zacks Rank #3, its Earnings ESP of 0.00% makes surprise prediction difficult.

Stocks Poised to Beat Earnings Estimates

Here are some companies that you may want to consider as our model shows that these have the right combination of elements to post an earnings beat.

Five Below, Inc. (NASDAQ:FIVE) has an Earnings ESP of +0.32% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Children's Place, Inc. (NASDAQ:PLCE) currently has an Earnings ESP of +1.16% and a Zacks Rank #3.

CarMax, Inc. (NYSE:KMX) presently has an Earnings ESP of +2.18% and a Zacks Rank #3.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Hibbett Sports, Inc. (HIBB): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

CarMax, Inc. (KMX): Free Stock Analysis Report

The Children's Place, Inc. (PLCE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.