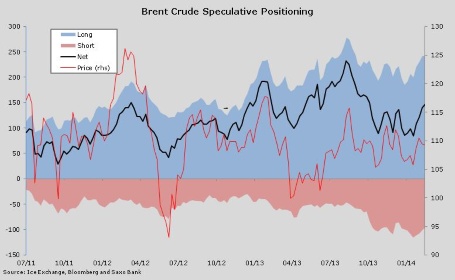

Hedge funds and other money managers raised their bullish bets on Brent crude oil by 5 percent during the week of March 4, according to data from the ICE Europe Futures Exchange. Gas oil net long was cut by 6 percent.

In Brent crude only a small amount of new longs were added despite the concerns related to Ukraine with the bulk of the rise in net-long coming from some additional short-covering. The net-long position remains much less elevated than the one currently seen in WTI crude which leaves the US variety more exposed to weakness.