- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Healthcare, Vertex To Drive 3D Systems (DDD) Q4 Earnings?

3D Systems Corporation (NYSE:DDD) is scheduled to report fourth-quarter and full-year 2017 results on Feb 28, after the closing bell.

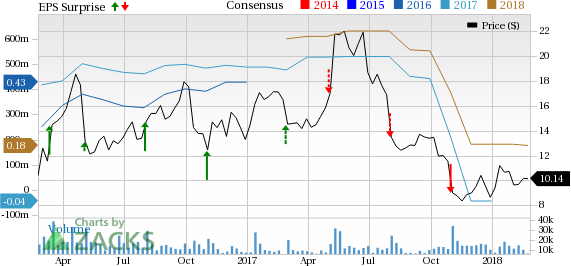

The company has a dismal earnings surprise history, with earnings missing estimates by a huge margin in three of the trailing four quarters. This resulted in an average negative surprise of 83.8%. Last quarter, the company’s earnings missed estimates by 281.8%.

Let’s see how things are shaping up prior to this announcement.

Factors to Consider

3D Systems is poised to grow on the back of its strong healthcare business, which has proved to be a profit churner in the past quarters. The company is enjoying steady demand for its healthcare solutions and industrial offerings as well as strength in the EMEA region. However, the demand remains constrained in the Americas and the Asia-Pacific region, which can hurt revenues in the upcoming quarterly results.

Nevertheless, the company continues to witness steady performance of its Software business. We expect the segment to be one of the positive growth drivers in the upcoming results.

The company’s focus on strengthening foothold on 3D printing industry foothold is expected to present a favorable long-term opportunity. As a matter of fact, majority of 3D Systems customers are shifting from prototyping to end-use production using 3D printing technology, and the company believes it is well-positioned to aid customers in their transition. This apart, demand for production printers, materials and software is expected to act as a major catalyst and support growth.

3D Systems Corporation Price, Consensus and EPS Surprise

Moreover, the company has been making acquisitions to diversify offerings, add synergistic technology and expand domain expertise in operating markets. In January 2017, it announced the acquisition of dental materials provider, Vertex-Global Holding B.V., which operates under the Vertex and NextDent brands.

Concurrent with third-quarter 2017 results, the company announced that it has conducted a deep and extensive review of inventory based on year-to-date demand, customer data and market trends. Consequently, the company recorded a significant adjustment to inventory. It implemented organizational changes to improve execution as well as increased investments as it shifts to a worldwide go-to-market structure.

In light of such major transformational initiatives, the company decided that it is not able to predict earnings and sales numbers accurately, and has thus decided to withdraw guidance.

Further, 3D Systems successfully improved cost structure and optimized supply chain through concerted restructuring efforts. We believe that such diligent restructuring efforts are likely to boost fourth-quarter financials.

However, the fact remains that the company’s financial performances have been hit by unfavorable broader market conditions. Particularly, revenues from 3D printing products and services were significantly undermined due to a widespread decline in industry demand. Other headwinds, including economic slowdown, inflation, currency fluctuations and commodity prices vagaries have also affected performance. These factors are expected to dent revenues in the upcoming quarter as well.

In addition, the company’s high operating and acquisition costs have hurt its near-term operating income performance. Further, the company also believes that investment in IT and go-to-market initiatives will result in higher expenses, consequently restricting near-term operating income growth.

Earnings Whispers

Our proven model does not show that 3D Systems is likely to beat estimates in this quarter. This is because a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. This is not the case here as you will see below:

Zacks ESP: The company’s Earnings ESP is +115.39%, as the Most Accurate Estimate is 4 cents while the Zacks Consensus Estimate is pegged at 2 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: 3D Systems has a Zacks Rank #4 (Sell). We caution against stocks with a Zacks Rank #4 or 5 (Strong Sell) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are some companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Etsy, Inc. (NASDAQ:ETSY) has an Earnings ESP of +31.34% and a Zacks Rank of 3. The company is expected to release quarterly numbers around Feb 27. You can see the complete list of today’s Zacks #1 Rank stocks here.

Inogen, Inc. (NASDAQ:INGN) , with an Earnings ESP of +25.30% and a Zacks Rank of 2, is slated to report results on Feb 27.

Dillard's, Inc. (NYSE:DDS) has an Earnings ESP of +15.83% and a Zacks Rank of 1. The company is likely to release earnings on Feb 27.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

3D Systems Corporation (DDD): Free Stock Analysis Report

Etsy, Inc. (ETSY): Free Stock Analysis Report

Inogen, Inc (INGN): Free Stock Analysis Report

Dillard's, Inc. (DDS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.