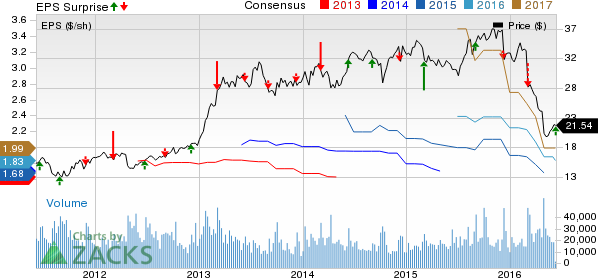

H&R Block Inc. (NYSE:HRB) reported income from continuing operations of $3.16 per share for fiscal fourth-quarter 2016, ended Apr 30, beating than the Zacks Consensus Estimate of $3.09. Earnings however decreased 18% due to lower revenues and higher expenses.

Shares gained 2.6% in after-market trading hours, reflecting investor optimism over the outperformance and a 10% hike in dividend.

Earnings for fiscal 2016 came at $1.59 per share, missing the Zacks Consensus Estimate of $1.65 and decreasing from $1.75 in fiscal 2015.

Operational Performance

H&R Block’s revenues came at $3 million in fiscal 2016, down 1.3% year over year due to lower client volumes, the adverse impact of the divestiture of H&R Block Bank and unfavorable foreign currency translation. However, increased pricing and an improved business mix limited the downside. Tax preparation fees remained almost flat year over year.

Total operating expenses increased 5.3% year over year to $10.2 million due to higher occupancy costs and amortization expense.

Earnings before interest, tax, depreciation and amortization (EBITDA) were $839 million, which compares unfavorably with $951 million reported in the year-ago period.

Financial Position

H&R Block exited the quarter with cash and cash equivalents of $896.8 million, down 55% year over year. The decline was primarily due to cash payments made for the transfer of deposit liabilities owing to bank divestiture, changes in capital structure and share buyback.

Total outstanding long-term debt at the end of the fiscal year was $1.5 billion, higher than the year-ago level of $0.5 million due to the issuance of $650 million of 4.125% Senior Notes and $350 million of 5.250% Senior Notes.

Net cash from operating activities was $329.5 million in fiscal 2016, comparing favorably with $148.9 million cash used in the the prior fiscal year.

Dividend and Share Repurchase

The board of directors approved a 10% increase in dividend to 22 cents per share. On Jul 1, 2016, H&R Block will pay this dividend oto investors of record as of Jun 20. The dividend will mark the 215th consecutive payout to shareholders since the company went public in 1962.

The company bought back 3.9 million shares in the reported quarter, taking the fiscal year tally to 56.4 million shares repurchased.

Peer Performance

Intuit Inc. (NASDAQ:INTU) reported adjusted earnings per share of $3.27, beating the Zacks Consensus Estimate of $3.03.

Zacks Rank

H&R Block presently carries a Zacks Rank #4 (Sell). A couple of better-ranked business service providers are Care.com, Inc. (NYSE:CRCM) and Weight Watchers International, Inc (NYSE:WTW) , both carrying a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.Click to get this free report >>

INTUIT INC (INTU): Free Stock Analysis Report

BLOCK H & R (HRB): Free Stock Analysis Report

WEIGHT WATCHERS (WTW): Free Stock Analysis Report

CARE.COM INC (CRCM): Free Stock Analysis Report

Original post