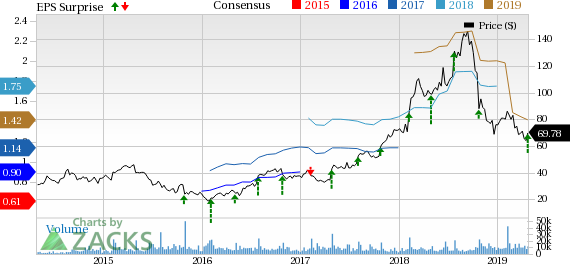

Grubhub (NYSE:GRUB) reported first-quarter 2019 earnings of 30 cents per share, which beat the Zacks Consensus Estimate by a nickel. However, the figure plunged 42.3% on a year-over-year basis.

The decline can be attributed to higher investments in marketing and advertisements that fully offset strong top-line growth.

Revenues surged 39% year over year to $323.8 million, which also beat the consensus mark of $323 million.

Total costs & expenses jumped 56.7% year over year to $314.9 million. Operations & support, sales & marketing, technology, and general & administrative expenses increased 67.6%, 60.9%, 57.2% and 28.8%, respectively.

Revenue per order less operations and support costs was $3.46, up from $3.34 in the previous quarter.

Adjusted EBITDA decreased 20.6% from the year-ago quarter to $50.9 million. Adjusted EBITDA per order was $1.09, up from 98 cents in the previous quarter.

Gross Food Sales & Active Diners Increase

Gross food sales rallied 21% year over year to $1.5 billion.

Active Diners were 19.3 million, up 28% year over year. Daily Average Grubs (DAGs) were 521,000 compared with 436,900 reported in the year-ago quarter.

The Taco Bell advertising campaign that promoted partnership with GrubHub contributed an incremental few hundred thousand new diners and 100-150 basis points (bps) of incremental DAGs in the reported quarter.

Grubhub delivery accounted for slightly more than 30% of the company’s first-quarter 2019 DAGs.

During the reported quarter, the company added 5,000 enterprise locations by expanding its relationships with Dunkin' Brands, Pizza Hut, NTNs and Jersey Mike's, among others. The company also inked new partnerships with Smoothie King, Halal Guys, Golden Corral and Smokey Bones.

Guidance

For second-quarter 2019, GrubHub forecasts revenues between $305 million and $325 million. Adjusted EBITDA is anticipated to be $49-$59 million.

For 2019, GrubHub reiterated revenue guidance between $1.315 billion and $1.415 billion. Adjusted EBITDA is still expected to be $235-$265 million.

Zacks Rank & Stocks to Consider

GrubHub currently has a Zacks Rank #3 (Hold).

Synopsis (NASDAQ:SNPS) , Intuit (NASDAQ:INTU) and Sapiens International (NASDAQ:SPNS) are some better-ranked stocks in the broader computer and technology sector. All three stocks have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

While Synopsis is expected to report quarterly results on May 22, Sapiens and Intuit are set to report on May 6 and 23, respectively.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

Grubhub Inc. (GRUB): Free Stock Analysis Report

Sapiens International Corporation N.V. (SPNS): Free Stock Analysis Report

Synopsys, Inc. (SNPS): Free Stock Analysis Report

Intuit Inc. (INTU): Free Stock Analysis Report

Original post