- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Grim Outlook For Office Automation & Equipment Industry

The Zacks Office Automation and Equipment Industry comprises companies that provide products and services related to printing solutions, healthcare and industrial businesses. The industry participants are located in Japan and the United States.

Here are the industry’s three major themes:

- Companies in the industry are expected to suffer supply-chain constraints due to the coronavirus outbreak. Moreover, sluggish economic growth in China and the ongoing tariffs related to the U.S.-China trade war remain concerns. Additionally, increased product offerings from local manufacturers along with their low-cost alternatives are forcing industry participants to slash prices. This is eating into the industry participants’ bottom line.

- Soft demand for copiers and office equipment due to increasing adoption of smartphones and portable devices has been detrimental to the industry’s growth. Heavy investments in technology to innovate and customize products specific to client requirements is dragging down margins. Additionally, with product life cycles being short, investments in research and development are increasing.

- The increasing adoption of bring-your-own-device (BYOD) trend in offices is boosting demand for automated software solutions. These are required to check the reliability of devices that are connected to a company’s network and also limit or block access for users or devices, which induce a security threat.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Office Automation and Equipment industry is housed within the broader Zacks Computer And Technology sector. It carries a Zacks Industry Rank #181, which places it in the bottom 20% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bleak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions it appears that analysts are pessimistic on this group’s earnings growth potential. Since Mar 31, 2019, the industry’s earnings estimates for the current year have moved 41.1% south.

Before we present a few stocks that you may want to consider, let’s take a look at the industry’s recent stock-market performance and valuation picture.

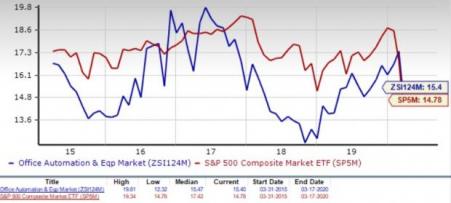

Industry Underperforms S&P 500 & Sector

The Zacks Office Automation and Equipment industry has underperformed the Zacks S&P 500 composite as well as its own sector in the past year.

The industry has decreased 30.8% over this period compared with the Zacks Computer and Technology sector’s decline of 7.6%. The S&P 500 has fallen 11.4%.

One Year Price Performance

Industry’s Current Valuation

On the basis of forward 12-month price-to-earnings (P/E), which is commonly used for valuing Office Automation and Equipment stocks, the industry is currently trading at 15.40X compared with the S&P 500’s 14.78X and the sector’s 17.11X.

Over the past five years, the industry has traded as high as 19.81X and as low as 12.32X, recording a median of 15.47X, as the chart below shows.

Forward 12-Month Price-to-Earnings (P/E) Ratio

Stocks to Watch Out For

The supply-chain disruption due to the coronavirus pandemic along with a tough operating environment and a saturated market is expected to hurt the performance of industry participants in the near term.

None of the stocks in the industry carries a Zacks Rank #1 (Strong Buy) or Rank 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Here, we present three stocks with a Zacks Rank #3 (Hold) that investors may choose to hold for the time being.

Pitney Bowes Inc (NYSE:PBI). (PBI): This Stamford, CT-based stock has lost 61.5% in the past year. The Zacks Consensus Estimate for the company’s current-year earnings has stayed flat at 65 cents per share over the past 30 days.

Price and Consensus: PBI

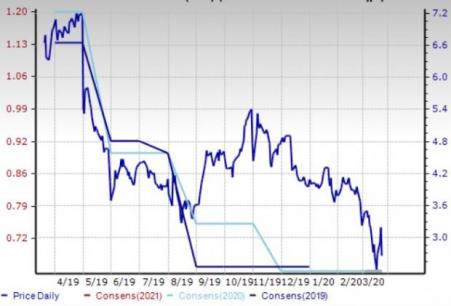

Ricoh Co. (RICOY): Tokyo, Japan-based Ricoh has lost 36% in the past year. The Zacks Consensus Estimate for fiscal 2021 has declined 12.4% to 85 cents per share over the past 30 days.

Price and Consensus: RICOY

Konica Minolta Inc. (KNCAY): Tokyo-based Konica Minolta has lost 61.9% in the past year. The consensus estimate for fiscal 2021 earnings has increased 12.1% to $1.02 per share over the past 30 days.

Price and Consensus: KNCAY

Ricoh Co. (RICOY): Free Stock Analysis Report

Pitney Bowes Inc. (PBI): Free Stock Analysis Report

Konica Minolta Inc. (KNCAY): Free Stock Analysis Report

Original post

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.