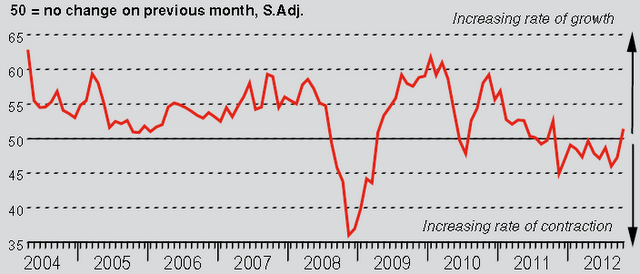

Continuing with the theme of economic stabilization in China (see discussion), the final manufacturing PMI number for November is showing that manufacturing contraction has been halted. In particular, the PMI component exhibiting some promise is the change in new orders.

Clearly growth is still anemic, but for the first time in months China's manufacturing activity is showing some signs of life.

HSBC: The volume of new orders received by Chinese manufacturers increased during October, and for the first time in a year. The seasonally adjusted index indicated the growth rate of new orders was only marginal. However, it was the second-highest index reading in the past 17 months. Nearly 20% of panelists noted an increased amount of new orders, whereas just over 18% reported a fall. A number of firms that recorded an increase in new orders attributed growth to a rising number of new clients.

Much of the growth however seems to be emanating from the public sector - particularly infrastructure projects.

Fox Business: The HSBC China flash PMI - which gathers more data from smaller, privately-held firms with a strong export focus - signaled that November growth in the manufacturing sector quickened for the first time in 13 months, with a reading of 50.4 when it was published last week, reflecting a steady uptick in the economy. A PMI reading below 50 suggests growth slowed, while a number above 50 indicates an acceleration.

But analysts caution that growth has been revived through top-down easy credit to state-owned firms and infrastructure projects that lack the dynamism of China's private economy, which is struggling with credit curbs and a policy-induced slowdown in the speculative real estate sector.

"The improving numbers are mostly because of government investment," said Dong Xian'an, an economist with Peking First Advisory. "From the second quarter, the government has unleashed a lot of projects, and that has started to be felt in the economy, but it's not a very healthy recovery yet."

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Green Shoots In Chinese Manufacturing; Is The Public Sector Driving?

Published 12/03/2012, 01:02 AM

Updated 07/09/2023, 06:31 AM

Green Shoots In Chinese Manufacturing; Is The Public Sector Driving?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.