Corn and soybean supplies were reduced due to strong export demand, although futures dropped from six-month highs as analysts expected a larger reduction. The stocks-to-use ratio for soybeans declined to 4.4%, only a 16-day supply, due to strong demand from China. The U.S. wheat balance sheets were unchanged from last month.

Corn

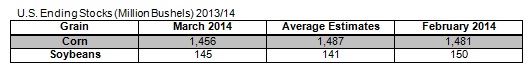

U.S. corn ending stocks for the 2013/14 marketing year were projected 25 million bushels lower to 1.456 billion bushels, due primarily to increased exports. Exports for U.S. corn in the 2013/14 marketing year were increased by 25 million bushels to 1.625 billion bushels, due to a rise in world demand and an increase in shipments in recent weeks. The season-average farm price for corn was narrowed 5 cents on both ends of the projected range to $4.25 to $4.75 per bushel.

World corn production was increased to 967.52 million tons, compared with 966.63 million forecast last month. Production in Brazil and Argentina were unchanged at 70 million tons and 24 million tons, respectively.

Soybeans

U.S. Soybean exports for 2013/14 were projected at a record 1.53 billion bushels, up 20 million bushels from last month reflecting the record pace of shipments and sales through February. Soybean imports were raised 5 million bushels to 35 million bushels.

Projected ending stocks for 2013/14 soybeans were lowered 5 million bushels to 145 million bushels and the stock-to-use ratio is now only 4.5%, although analysts were expecting a larger reduction to 141 million bushels. The 2013/14 season-average price range was projected at $12.20 to $13.70, up 25 cents on both ends.

Soybean production for Brazil was reduced to 88.5 million tons from 90 million tons, due to the late-season drought in South America. Soybean production was also reduced for Paraguay by 1.2 million tons due to the dry weather.

Wheat

U.S. wheat balance sheets were unchanged from last month. Global wheat supplies for 2013/14 were increased slightly due to a 0.8 million ton increase in world production, coming from Australia and India.

The season-average farm price for all wheat was increased 10 cents on the bottom end of the range to $6.75 to $6.95 per bushel.

Outlook

China and other grain importers have taken advantage of the low grain prices in the U.S., although the futures market was expecting a larger increase. Soybean production in South America continues to be strained by heat and drought, with some private estimates well below the USDA by over 10%.

The grain market continues to watch the unrest in Ukraine, although export markets are become more comfortable with the situation. Odessa and four other Black Sea ports, which handle 87% of Ukrainian grain exports, are not in Crimea and unlikely to be disrupted.

The next major report is the USDA's Prospective Plantings Report coming out on March 31, 2014.