Gold shrugged off early Monday declines to climb higher, trading above the 1,341 resistance at one moment. Prices didn't manage to hold onto the space above 1,341, but it is nonetheless impressive especially since prices were looking bearish earlier on, and in our analysis yesterday we were also expecting price to at the very least hold onto the losses if not continuing lower. What is even more interesting is that part of the basis for the belief that Gold prices would remain bearish was due to expectation that risk appetite will recover in the short-term, and that prediction did turn out correct as US stocks managed to stay flat while Nasdaq 100 even etched out slight gains.

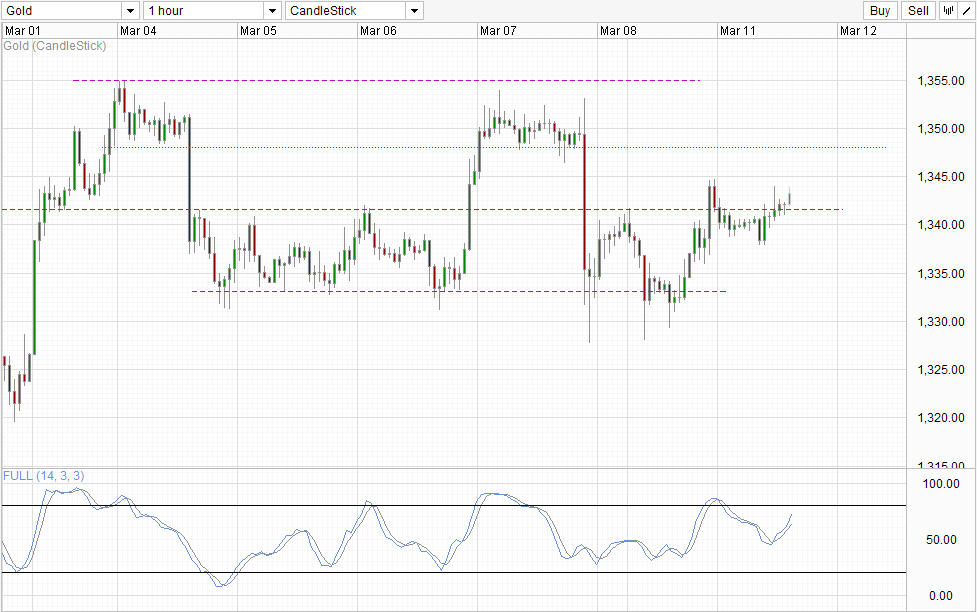

Hourly Chart

Hence, it is an understatement to say that the rally in Gold was unexpected, and borderline on unreasonable. However, from a technical perspective it does make sense - speculators are seeking bargain buys and seeing that prices rebounded off 1,333 support lends credence to this assertion. This also implies that market may be focusing more on technicals in the short-run. If indeed true, then the likelihood of further bullish extension from here may be possible as we are currently trading above 1,341 once again. That being said, preferably price should clear yesterday's swing high in order to demonstrate strong bullish convictions that will increase the likelihood of prices reaching soft support turned resistance of 1,348. Trading beyond 1,348 may be difficult as bullish momentum appears to be close to Overbought according to Stochastic, and given that risk appetite continues to recover in the short-term (Slide in Asian stocks has stopped while European futures are mostly positive for now), fundamentals are not favourable.

Daily Chart

Looking at Daily Chart, we can see that market may be placing more relevance on the smaller rising Channel compared to the wider one. If this is true, then a move towards Channel Top will be possible. Stochastic indicator may be signalling a bearish cycle right now but it should be Stoch curve has flattened close to "support levels". Hence it should not be a surprise if Stoch curve does manage to reverse moving forward.

Fundamentally, traders need to remember that the Ukrainian crisis is emerging to be an important narrative moving together with risk appetite. Hence, even though current risk appetite appears to be bullish which should drag Gold prices lower, we may still find investors buying Gold for insurance purposes just in case war does break out. As such, whenever there's strong movement expect the other camp to buy or sell to counter respectively. As such the possibility of a sideways trend cannot be ignored and trend traders will need extra confirmation to prevent getting caught in whipsaws.