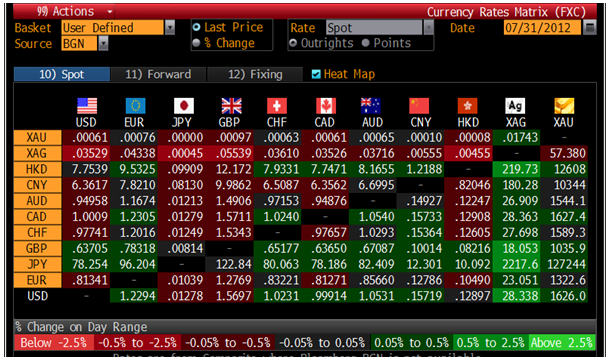

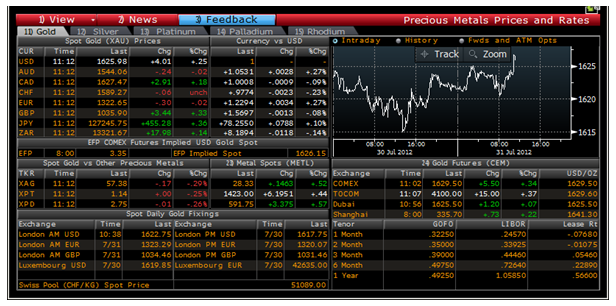

Today's AM fix was USD 1,622.75, EUR 1,323.29, and GBP 1,034.46 per ounce.

Yesterday’s AM fix was USD 1,616.50, EUR 1,317.87 and GBP 1,029.75 per ounce.

Gold fell $1.30 or 0.08% in New York yesterday and closed at $1,622.10/oz. Silver pulled back to $27.53 in Asia, but then it hit a high of $28.23 in New York and ended with a gain of 1.55%.

Gold is flat on Tuesday ahead of the US Federal Reserve's policy meeting later today where investors hope to receive some hints on the bank’s position on quantitative easing. Many analysts are not expecting large policy moves.

The US Federal Reserve Bank of Kansas City has its Jackson Hole Economic Symposium scheduled at the end of August, which will be significant for determining policy expectations ahead of the September 13th FOMC meeting. Attendees include prominent central bankers, finance ministers, academics, and financial market participants from around the world.

The European Central Bank has its policy meeting this Thursday, and because of Mario Draghi’s comments last week, some action is expected. Draghi is set to come out with a plan that involves employing the SMP (securities market program) bond-buying program coupled with EFSF/ESM purchases of Spanish and Italian bonds on primary markets. The main plan, was also confirmed by Eurogroup president Jean-Claude Juncker according to Spanish daily El Pais.

Today UBS analyst, Edel Tully, increased her short term gold bullion price targets. One month target $1,550 increases to $1,700 and three month target from $1,600 to $1,750. Factors for the increase include hints of action from Fed post the August Economic symposium, the next 3 months are historically the strongest for gold over the last 36 years and finally a boost from the ECB policy statement could lift the price as recently gold has been tracking the euro.

Spot silver surged to $28.28, its highest in nearly 4 weeks, before easing to $28.12. Spot palladium hit $590.75, also its highest price since the 5th of July.

In Greece, politicians in their ruling coalition are not able to reach agreement over the austerity plan and they will seek an extension of the bailout hoping to spread the cuts over a longer period. Troika officials signalled this is not acceptable. Therefore officials from the troika (European Commission, the International Monetary Fund, and the European Central Bank will stay on later than expected until a deal is finalized.

In a piece from the daily Gartman Letter, editor Dennis Gartman says, The Fed “must act at this meeting or it cannot act at all.” He mentions that this week is basically it before the looming November election in the US.

The Wall Street Journal quoted the following from Gartman’s Letter:

...We fear that no matter what the Fed does at the next two-day meeting its effect will be non-existent upon the economy. That is, even aggressive easing…and we do not think that likely…share have the most marginal of effects excepts perhaps upon equities prices, but we do fear that doing nothing at all shall have a detrimental effect. Thus, the Fed likely shall err upon further monetary stimulus and shall comment openly upon that fact, but it knows in its heart-of-monetary hearts that very little shall come of it.

In an uncertain world where central banks are grappling with a massive global economic contraction, the value of money is in question. Quantitative easing is having less and less effect, soon inflation will take hold and when it undermines the real economy and alters consumer behaviour the only solution will be a rapid rise in interest rates.

Gold has shown time and time again that it is an essential element in an investor’s arsenal. The men in dark suits and their spin doctors will, no doubt, conjure up a series of statements exuding their confidence in the system, reasserting that their unorthodox monetary policies will deliver. The market grows weary, banks are consolidating back to their home countries, and credit is again being tightened.

Until a new order in global monetary policy is agreed upon, say a Bretton Woods II, we will continue to treat the symptoms of this imbalanced global trade model and not its causes. Gold remains a solid and independent hedge against the devaluation of fiat (paper) money and its effects.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Trades Flat, Draghi Set To Unleash SMP Program, Market Awaits Fed

Published 07/31/2012, 08:28 AM

Updated 07/09/2023, 06:31 AM

Gold Trades Flat, Draghi Set To Unleash SMP Program, Market Awaits Fed

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.