Gold is steady on Thursday, as the spot price stands at $1075.97 per ounce in the North American session. On the release front, it’s a very quiet day ahead of the Christmas holiday. US Unemployment Claims edged down to 267 thousand, beating the estimate of 270 thousand.

There hasn’t been much to cheer about when it comes to gold, as the metal is on track to record another negative year in 2015. Gold took a hit in the aftermath of the Federal Reserve’s rate hike, and briefly dropped below the $1050 level, marking its lowest level since February 2010. However, gold has rallied since then, posting gains of about 2 percent. This strong performance stands in marked contrast to oil as well as the major currencies. Will gold continue to push upwards?

There were a host of US releases on Wednesday, with mixed results. Durable Goods reports were unimpressive, underscoring weakness in the US manufacturing sector. Core Durable Goods slipped by 0.1%, short of the forecast of a 0.1% gain. Durable Goods came in at 0.0%, but this beat the estimate of -0.6%. Housing numbers also disappointed, as New Home Sales dipped to 490 thousand, well off the estimate of 507 thousand. This reading comes on the heels of Existing Home Sales, which posted a weak reading of 4.76 million, its worst performance since April 2014. There was some good news from consumer indicators, as the UoM Consumer Sentiment improved to 92.6 points, above the forecast of 92.1 points and marking a 4-month high.

In one of the most important economic events in 2015, the US Federal Reserve raised interest rates by 0.25 percent, the first rate hike since June 2006. The Fed got the rate ball rolling back in October, when it surprised the markets when it released a statement that it was seriously considering raising rates. Predictably, this caused a buzz in the markets about the Fed’s plans, as speculation earlier in the year about a rate hike failed to materialize. To the credit of Fed chief Janet Yellen and her colleagues, the Fed put into place a carefully-crafted strategy, sending a steady of stream of signals that it was intending to tighten monetary policy, if economic conditions remained positive. This gave the markets ample time to price in a rate hike, and currency market volatility was not excessive after the US rate hike, the first in almost 10 years. Although a hike of 0.25 percent is expected to have limited economic impact, the Fed move has given the US economy a critical vote of confidence, and this will be duly noted by the global markets. As well, this move is expected to be the first in a series of incremental rate hikes over the course of 2016, and higher interest rates means that the US dollar will become even more attractive to investors, which could spell even more trouble for commodities such as gold.

XAU/USD Fundamentals

Thursday (Dec. 24)

- 13:30 US Unemployment Claims. Estimate 270K. Actual 267K

- 15:30 US Natural Gas Storage. Estimate -26B. Actual -32B

*Key Events are in Bold

*All release times are GMT

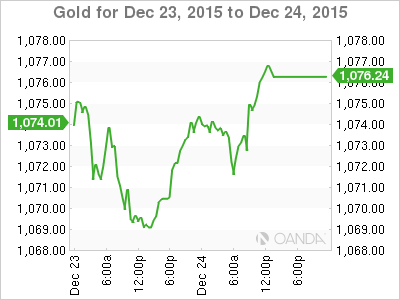

XAU/USD for Thursday, December 24, 2015

XAU/USD December 24 at 19:30 GMT

XAU/USD 1075.97 H: 1077 L: 1071

XAU/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 980 | 1024 | 1043 | 1080 | 1098 | 1134 |

- 1080 is a weak resistance line

- 1043 is providing support

- Current range: 1043 to 1080

Further levels in both directions:

- Below: 1043, 1024 and 980

- Above: 1080, 1098, 1134 and 1151

OANDA’s Open Positions Ratio

XAU/USD ratio is showing little movement, reflecting the lack of significant movement from the pair. Long positions continue to command a solid majority (72%), indicative of strong trader bias towards gold prices reversing directions and moving higher.