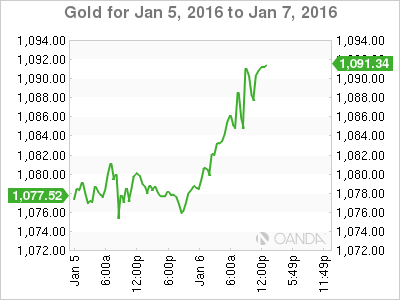

Gold has pushed higher on Wednesday, extending gains for a third straight session. In the North American session, gold is trading just shy of the $1090 level. On the release front, ADP Nonfarm Payrolls was outstanding, posting a gain of 257 thousand. There was more good news from the US Trade Balance, which beat the estimate. However, the ISM Non-Manufacturing PMI missed the estimate. Later in the day, the Federal Reserve releases the minutes of its December policy meeting.

It’s been a golden start for 2016, as the metal has jumped some 2.5% in value since the start of the week. Why are investors snapping up gold, considered a safe-haven? Firstly, the appetite for risk by investors has decreased, following the release of weak Chinese manufacturing data, which has underscored the slowdown affecting the world’s second largest economy. Chinese Caixin Manufacturing PMI softened in December, as the key indicator slipped to 48.2 points in December, short of the forecast of 48.9 points. The PMI broke above the 50-point level only once in all of 2015, pointing to ongoing contraction in the Chinese manufacturing sector, another indication that the slowdown in China continues. Gold has also benefited from a growing crisis in the volatile Middle East between two major oil producers, as Saudi Arabia abruptly cut off relations with Iran following a violent protest which damaged the Saudi Arabian embassy in Tehran.

The markets are keeping a close eye on the Federal Reserve, gearing for the release of the minutes of the momentous December policy meeting. At that meeting, the Fed opted to raise interest rates for the first time in over nine years, by 0.25 percent. The Fed has hinted that the December move will kick-off a series of incremental hikes in 2016, and the markets will be looking for confirmation, or at least a hint that this is the Fed’s monetary strategy. Meanwhile, employment data started off 2016 in style, jumping to 257 thousand in December. This crushed the forecast of 193 thousand, and was the strongest gain since June 2014. The markets will thus have plenty of data to sift through during the day, so we could see some further movement in the currency markets during the North American session.

XAU/USD Fundamentals

- 13:15 US ADP Non-Farm Employment Change. Estimate 193K. Actual 257K

- 13:30 US Trade Balance. Estimate -44.0B. Actual -42.4B

- 14:45 US Final Services PMI. Estimate 55.1 points. Actual 54.3 points

- 15:00 US ISM Non-Manufacturing PMI. Estimate 56.0 points. Actual 55.3 points

- 15:00 US Factory Orders. Estimate -0.2%. Actual -0.2%

- 15:30 US Crude Oil Inventories. Estimate 0.7M. Actual -5.1M

- 19:00 US FOMC Meeting Minutes

*All release times are GMT

*Key events are in bold

XAU/USD for Wednesday, January 6, 2016

XAU/USD January 6 at 16:05 GMT

- XAU/USD 1090.10 H: 1092.59 L: 1074.40

XAU/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1024 | 1043 | 1080 | 1098 | 1134 | 1151 |

- 1080 has switched to a support role as gold continues to move higher

- There is resistance at 1098

- Current range: 1080 to 1098

Further levels in both directions:

- Below: 1080, 1043, 1024 and 980

- Above: 1098, 1134 and 1151

OANDA’s Open Positions Ratio

XAU/USD ratio remains unchanged, despite gains by the pair. Long positions continue to command a solid majority (74%), indicative of strong trader bias towards gold prices continuing to move higher.