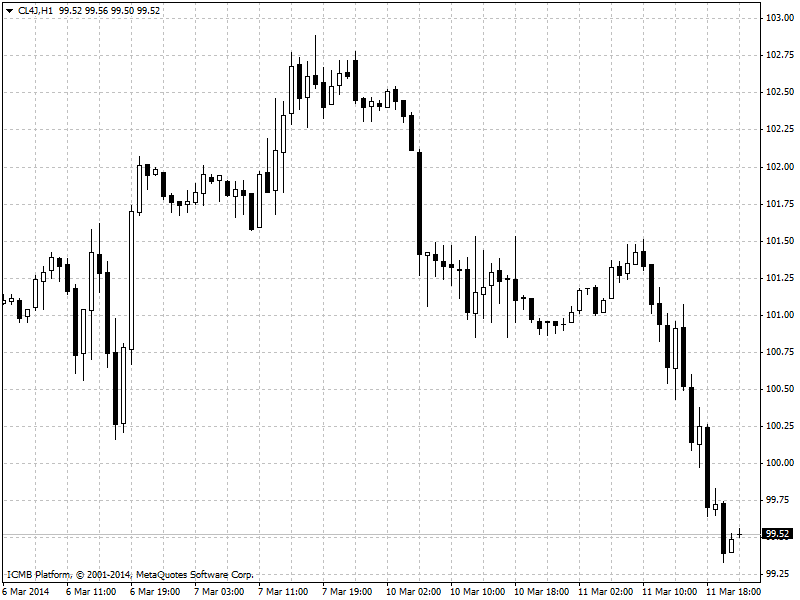

CL

Crude prices edged lower on Tuesday, as soft Chinese trade data continued to spook investors with fears emerging-market economies are cooling while concerns that U.S. weekly inventory data may disappoint also watered down prices. Crude dips on Chinese trade data, U.S. stockpile concerns Weak Chinese trade continued to bruise oil prices on Tuesday. Data released over the weekend showed that Chinese exports fell 18.1% on-year in February, defying expectations for a 6.8% increase, following a rise of 10.6% in January. A separate report showed that the annual rate of inflation in China slowed to 2.0% in February, from 2.5% in January. The numbers confirmed market concerns that emerging markets are cooling. China is the world's second-largest consumer of crude oil. The numbers also sparked concerns that U.S. demand for Chinese-made goods may have taken a hit due to a string of harsh winter storms, which may reflect in Wednesday's supply data as well as Thursday's data on U.S. retail sales.

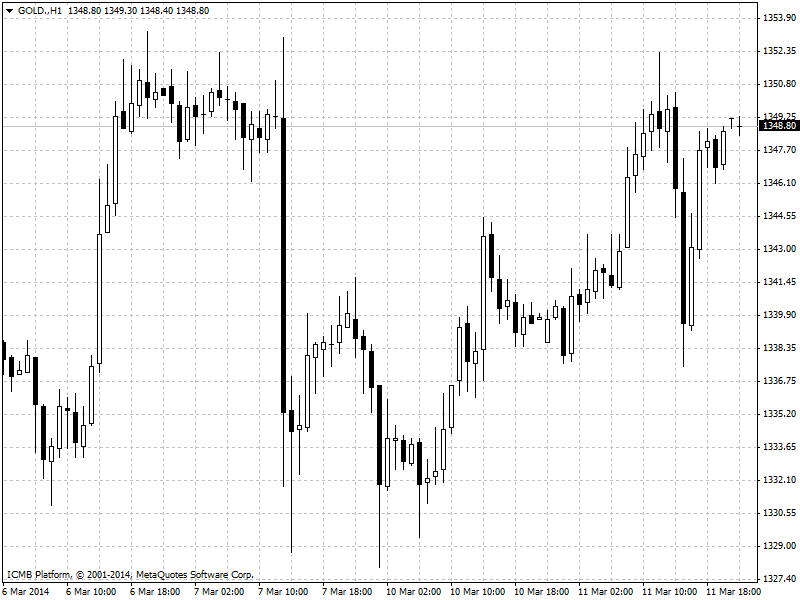

GOLD

Gold prices edged higher on Tuesday as the ongoing Russian standoff in Ukraine bolstered the yellow metal's appeal as a hedge. Ongoing geopolitical tensions in Ukraine bolstered gold's appeal as a hedge on Tuesday. Russia remained at odds with the West on how to end the standoff in Ukraine, while U.S. Secretary of State John Kerry declined an invitation to visit Russia for further discussions, which boosted gold prices. Meanwhile, silver for May delivery was down 0.26% at US$20.855 a troy ounce, while copper futures for May delivery were down 2.60% at US$2.983 a pound. Weak Chinese trade data bruised copper prices. Data released over the weekend showed that Chinese exports fell 18.1% on-year in February, defying expectations for a 6.8% increase, following a rise of 10.6% in January. A separate report showed that the annual rate of inflation in China slowed to 2.0% in February, from 2.5% in January.