-- “Bobby” Posted This Comment:

Both Gold and Silver it is said

Are jeered yet feared by the Fed

For if they rise it will but show

The dollar’s worth is very low

So if they rise in upward trend

The Fed then feels it must defend

The things they do we know aren’t right

But they don’t care, they have the might

To lie and cheat and say “F.U.

We have our man, we have Jack Lew

The FTC, just who are they?

They’ll do our bid, we’ll have our way”

A falling price we must endure

Until no gold they can procure

To fuel their scheme and thus prolong

Their crooked plan that will go wrong

So Gold and Silver you should collar

Not stocks, nor bonds and not the dollar

Our day will come, you wait and see

Our stacks will show what they can be.

Both Gold and Silver it is said

Are jeered yet feared by the Fed

For if they rise it will but show

The dollar’s worth is very low

So if they rise in upward trend

The Fed then feels it must defend

The things they do we know aren’t right

But they don’t care, they have the might

To lie and cheat and say “F.U.

We have our man, we have Jack Lew

The FTC, just who are they?

They’ll do our bid, we’ll have our way”

A falling price we must endure

Until no gold they can procure

To fuel their scheme and thus prolong

Their crooked plan that will go wrong

So Gold and Silver you should collar

Not stocks, nor bonds and not the dollar

Our day will come, you wait and see

Our stacks will show what they can be.

To Paraphrase Bobby’s Thoughts:

Gold is the enemy of Central Banking. A rising gold price indicates central banks are devaluing their paper currencies too rapidly. Hence they “jeer” 'gold and simultaneously “fear” it'.

The Fed must defend the “funny money” it has created. That usually means suppressing the price of gold through “leasing” or selling gold. They will until they can’t.

The “game” is over when the gold available for “leases” and sales is gone. That day is not here yet but it seems close.

Many global stock markets are down hard. Several $ Trillion in global bonds yield negative interest (crazy). Currencies have been declining in purchasing power for decades. Gold and silver remain – the last ones standing.

Stack silver and gold!

In Contrast to Bobby’s Thoughts ...

If you want a more conventional approach, then read the propaganda from central banks, too-big-to-fail bank forecasts, and Keynesian economist papers. Also Harry Dentthinks we will see gold prices perhaps as low as $250 - $400 in a few years. He believes that gold is only a commodity and that commodities peaked in 2010 – 2011 and will not peak again until about 2038 – 2040. Hence gold, according to Harry Dent, after 4.5 years of falling prices, is still over-priced and going lower. I disagree, but I suspect his view is popular, especially among central bankers.

Regarding What Harry Dent and Central Banks Think, Consider the Basics:

Politicians will spend more than their revenues and will increase debt as long as they can. There is no doubt about politicians and spending.

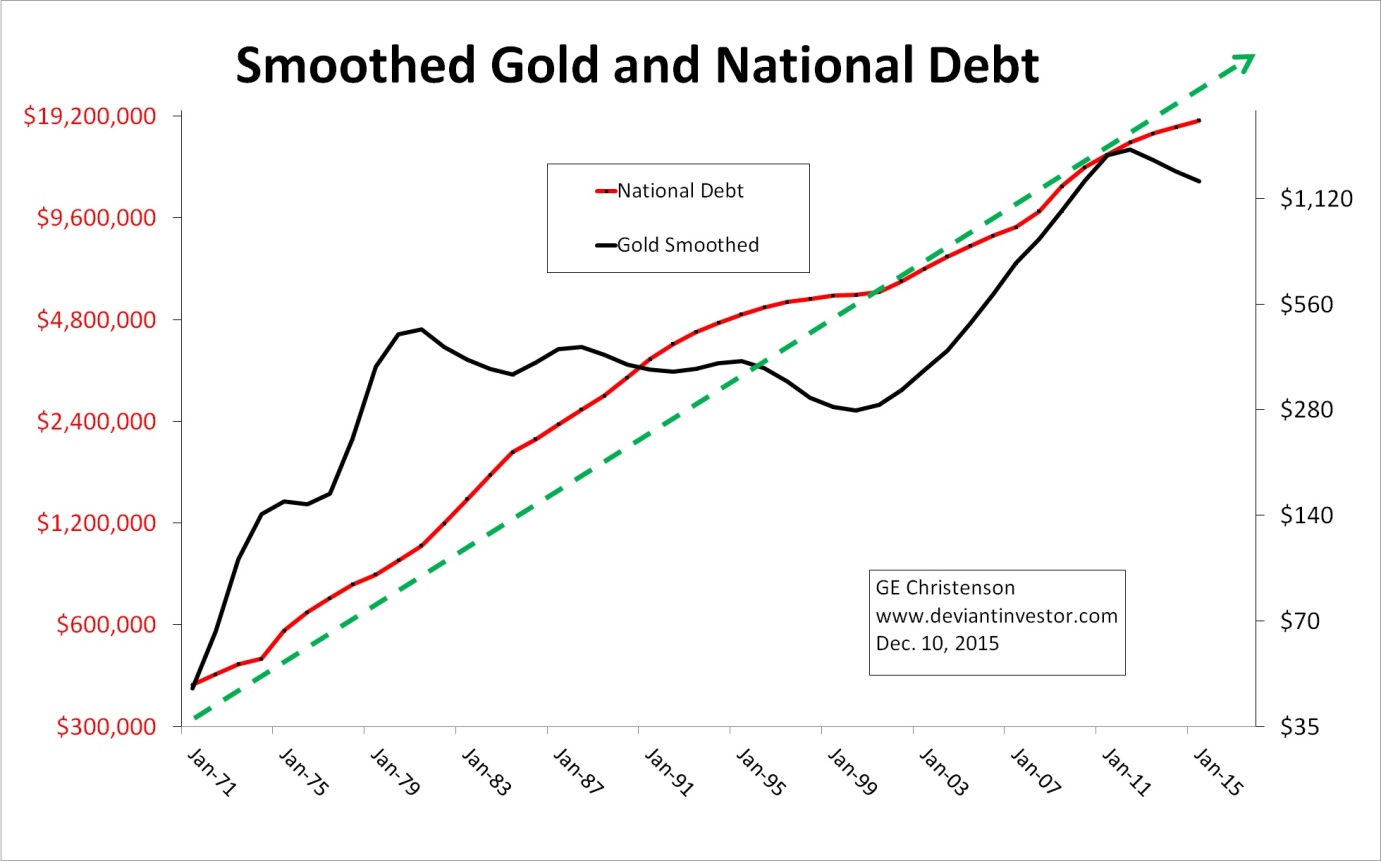

Increasing debt correlates with increasing gold prices on average. See log-scale graph below for gold prices and official US national debt since 1971.

Debt will increase and so will gold prices, regardless of suppressed or free markets, crazy or sane policies, with or without Keynesian nonsense, with or without hope and change.

The world appears closer to another world war, or at least a proxy war in Syria. War and related expenses, massively increased debt, and “money printing” will increase gold prices.

Western socialist governments spend far more on welfare and warfare programs than they can collect via taxing citizens. Hence we should expect more unpayable debt, inflation, economic nonsense, “money printing” and (unfortunately) a hot war to divert attention from failed policies. Debt, inflation, economic nonsense, welfare payments, “money printing” and wars will increase the price of gold.

CONCLUSIONS

The US official national debt has increased from under $ 2 Billion to almost $19 Trillion in the 102 years since the Federal Reserve was created. Gold has increased from $20.67 per ounce to today’s price of about $1,070. Expect more debt and higher gold prices.

Gold prices have been crushed during the past 4.5 years. Expect a reaction higher. When? If you are a stacker it matters little whether the low was this month or will occur in 2016. The inevitable reset higher should occur relatively soon, and will not be delayed until 2030 - 2040, as per Harry Dent and others.

Paper dies, gold thrives.