Gold has posted slight gains on Wednesday, as the base metal trades at $1065.03 per ounce in the European session. In economic news, the Federal Reserve is expected to announce a historic rate hike for the first time since June 2006. The US will also release Building Permits, a key event.

After a dismal November, when gold prices dropped about 8 percent, the metal has leveled off in the month of December. Investors have been content to sit on the sidelines, waiting for the upcoming crucial Fed meeting which could prove to be the economic release of the year. The Fed will conclude a two-day policy meeting on later on Wednesday and all indications are that the Fed will raise rates by 0.25%, to be followed by further rate hikes in 2016. The Fed last raised rates back in June 2006, and Fed chief Janet Yellen and other policymakers have sent broad signals to the markets that the US central bank if finally ready to press the rate trigger. The US economy is close to full employment, and Yellen recently stated that she was not concerned about persistently low inflation. How the commodity markets will react to a rate hike is of course, the million dollar question. Given that the markets have had ample time to price in this event, volatility in gold prices could be limited. At the same time, even a small rate increase represents a huge shift in the Fed’s monetary policy, which could help boost the US dollar.

There were no surprises from US consumer inflation numbers on Tuesday. Core CPI, which is carefully monitored by the Federal Reserve, remained at 0.2% for a third straight month. CPI dipped to 0.0%, down from 0.2% in November. Both indicators matched their forecasts, so these readings are unlikely to make any waves in the markets. More importantly, these numbers, although pointing to a weak inflation picture in the US, are unlikely to deter the Fed from a widely expected rate hike later on Wednesday.

XAU/USD Fundamentals

Wednesday (Dec. 16)

- 13:30 US Building Permits. Estimate 1.16M

- 19:00 US FOMC Economic Projections

- 19:00 US FOMC Statement

- 19:00 US Federal Funds Rate. Estimate

- 19:30 US FOMC Press Conference

*Key releases are highlighted in bold

*All release times are GMT

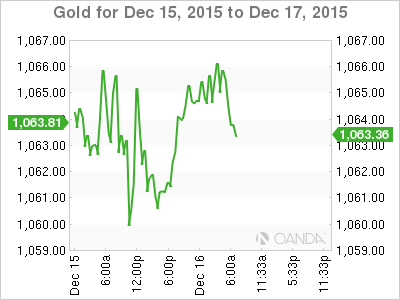

XAU/USD for Wednesday, December 16, 2015

XAU/USD December 16 at 10:25 GMT

XAU/USD 1065.03 H: 1066 L: 1061

XAU/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 980 | 1024 | 1043 | 1080 | 1098 | 1134 |

- XAU/USD posted slight gains in the Asian session and has leveled off in European trade.

- 1080 is providing resistance

- 1043 is the next support level

- Current range: 1043 to 1080

Further levels in both directions:

- Below: 1043, 1024 and 980

- Above: 1080, 1098, 1134 and 1151

OANDA’s Open Positions Ratio

XAU/USD ratio is showing little movement, reflective of the lack of activity from the pair. Long positions continue to command a solid majority (71%), indicative of strong trader bias towards gold prices reversing directions and moving to higher levels.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.